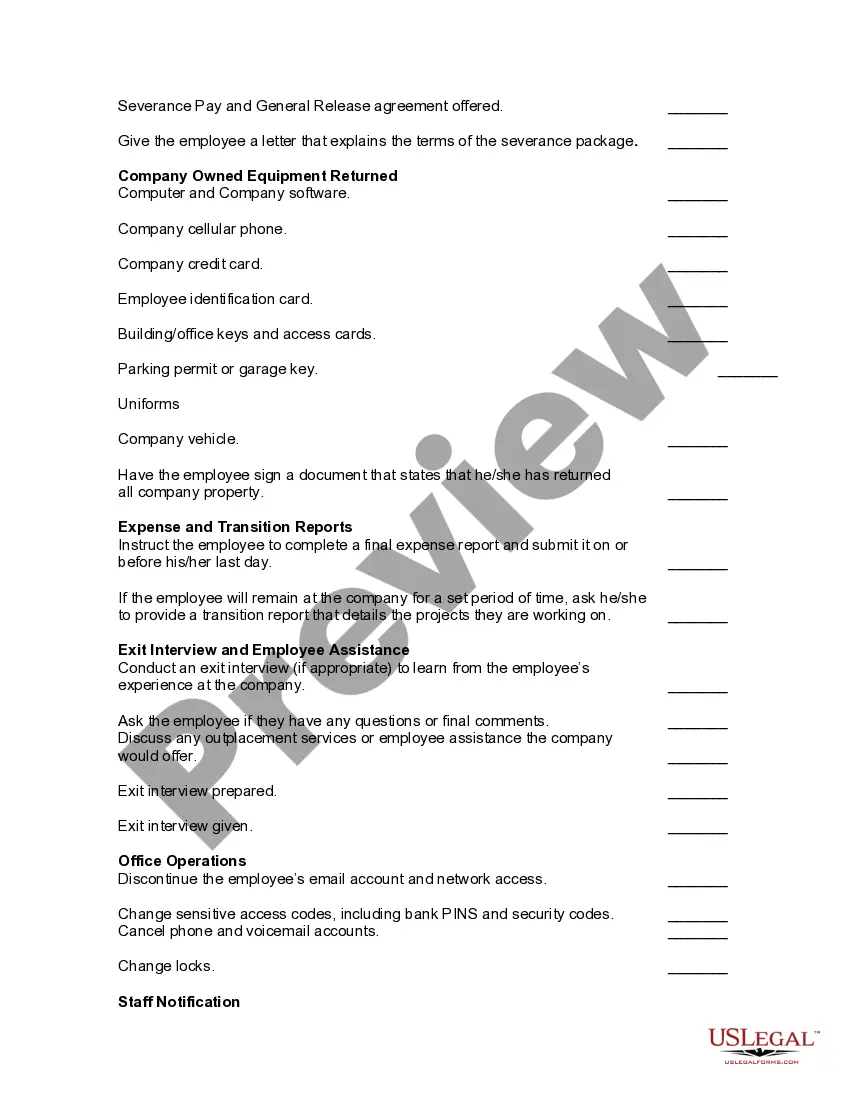

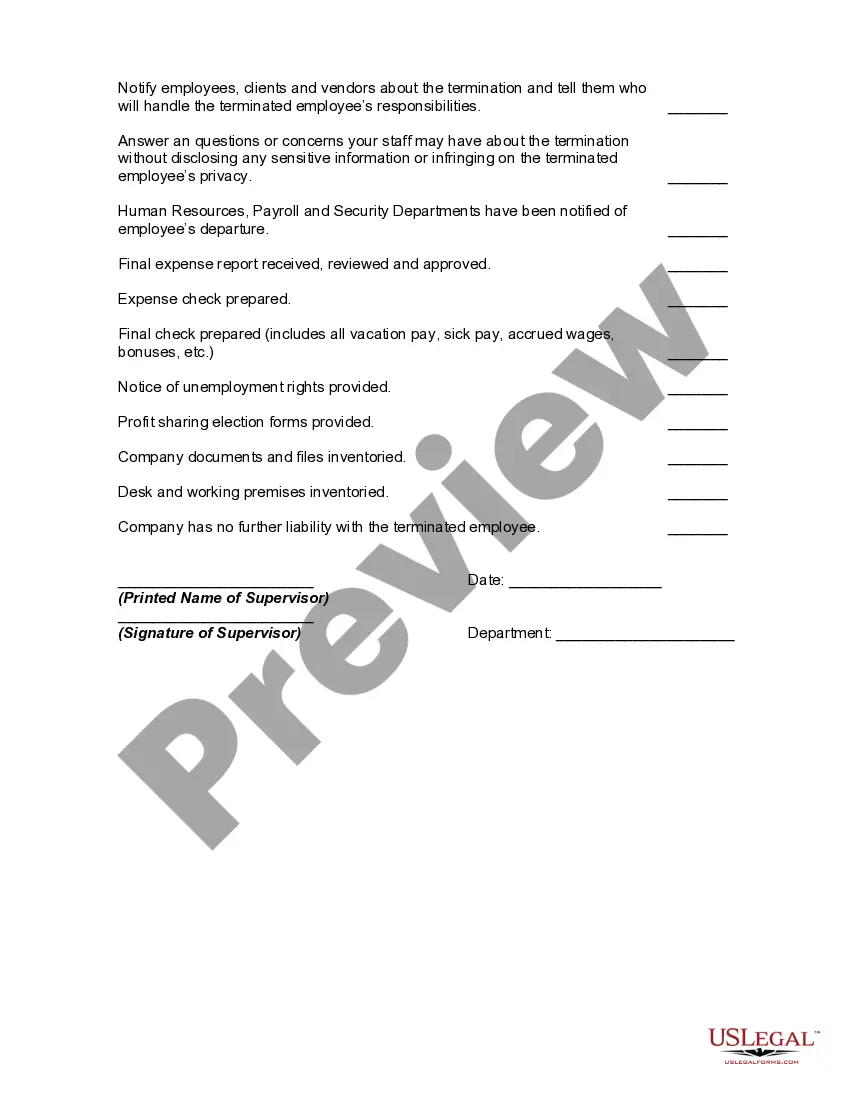

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

The District of Columbia Worksheet — Termination of Employment is a comprehensive document that outlines the necessary information and steps involved when an employee's job is terminated in the District of Columbia. This worksheet serves as a guide for both employers and employees to ensure compliance with the applicable laws and regulations in the District of Columbia. One type of District of Columbia worksheet specifically focuses on the termination of employment and provides a detailed checklist of tasks and responsibilities for both employers and employees during the termination process. This worksheet covers a range of topics including notice requirements, final payment of wages, benefits, and any related paperwork or documentation that needs to be completed. Another type of District of Columbia worksheet pertaining to termination of employment may specifically address issues related to unemployment compensation. This worksheet would cover eligibility criteria for unemployment benefits, the process for filing a claim, and the various factors that may affect the calculation of benefits, such as the reason for termination and the employee's prior earnings. In addition to these specific types, there may be variations of District of Columbia termination of employment worksheets that cater to different industries or job categories, providing tailored information and guidelines for specific professions. The District of Columbia Worksheet — Termination of Employment is designed to assist employers and employees in navigating the complexities of terminating employment relationships in compliance with the District of Columbia labor laws and regulations. It serves as a valuable resource to ensure that both parties are aware of their rights and obligations, preventing any potential legal disputes or misunderstandings. Keywords: District of Columbia, worksheet, termination of employment, checklist, notice requirements, final payment of wages, benefits, documentation, unemployment compensation, eligibility criteria, unemployment benefits, filing a claim, calculation of benefits, labor laws, compliance, legal disputes.