District of Columbia Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren

Description

A lactation consultant is a healthcare provider recognized as having expertise in the fields of human lactation and breastfeeding

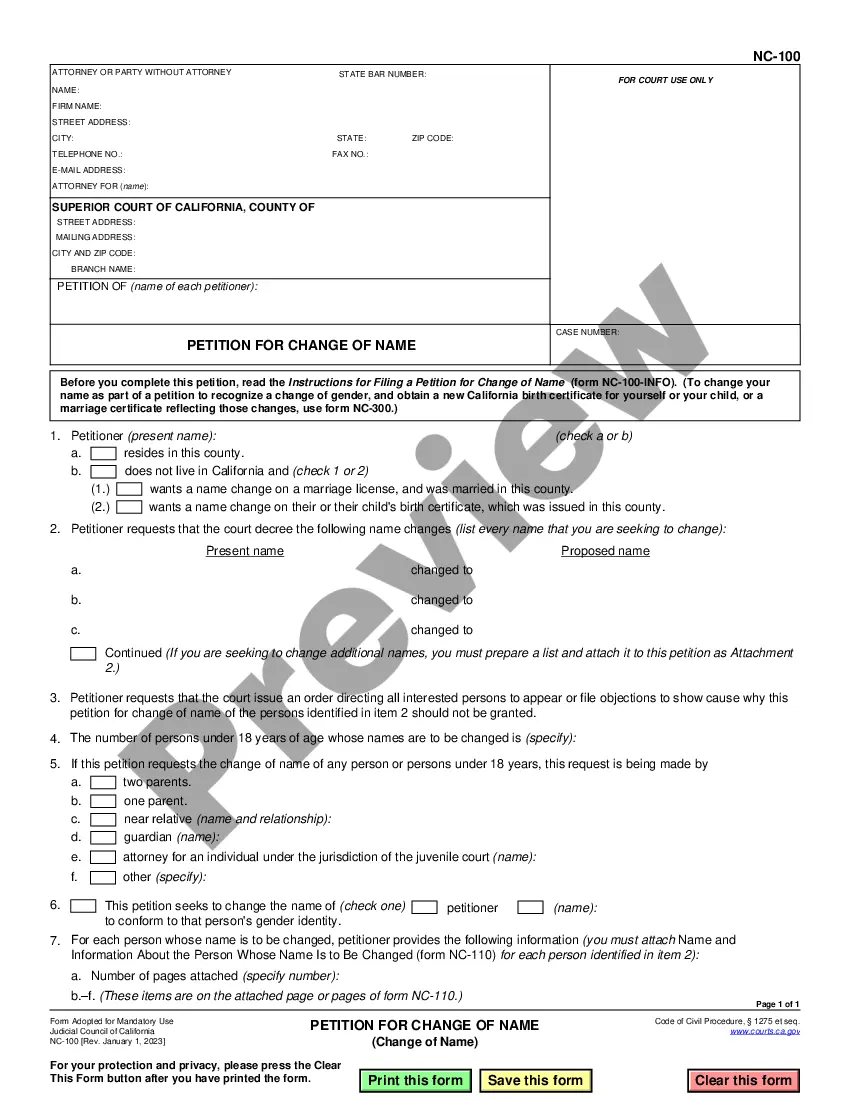

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

How to fill out Irrevocable Trust Agreement For The Benefit Of Spouse, Children And Grandchildren?

US Legal Forms - one of the largest repositories of official templates in the USA - provides a diverse selection of legal document templates that you can obtain or create.

By using the website, you will receive thousands of forms for commercial and personal purposes, organized by categories, types, or keywords. You can quickly find the latest editions of forms such as the District of Columbia Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren.

If you have a monthly subscription, Log In and retrieve the District of Columbia Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren from your US Legal Forms account. The Acquire button will appear on every form you view. You can access all previously obtained forms from the My documents section of your profile.

If you are satisfied with the form, confirm your selection by clicking on the Purchase now button. Then, select the payment plan you prefer and provide your details to register for an account.

Complete the transaction by using a credit card or PayPal account. Choose the format and obtain the form on your device. Make modifications as necessary. Fill out, edit, and print and sign the acquired District of Columbia Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren. Each template you add to your purchase has no expiration date and belongs to you permanently. Therefore, to obtain or create another copy, simply visit the My documents section and click on the form you need. Access the District of Columbia Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren with US Legal Forms, the largest collection of legal document templates. Use thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you wish to use US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you have selected the correct form for your region/area.

- Click the Preview button to review the content of the form.

- Check the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search area at the top of the screen to find an alternative that does.

Form popularity

FAQ

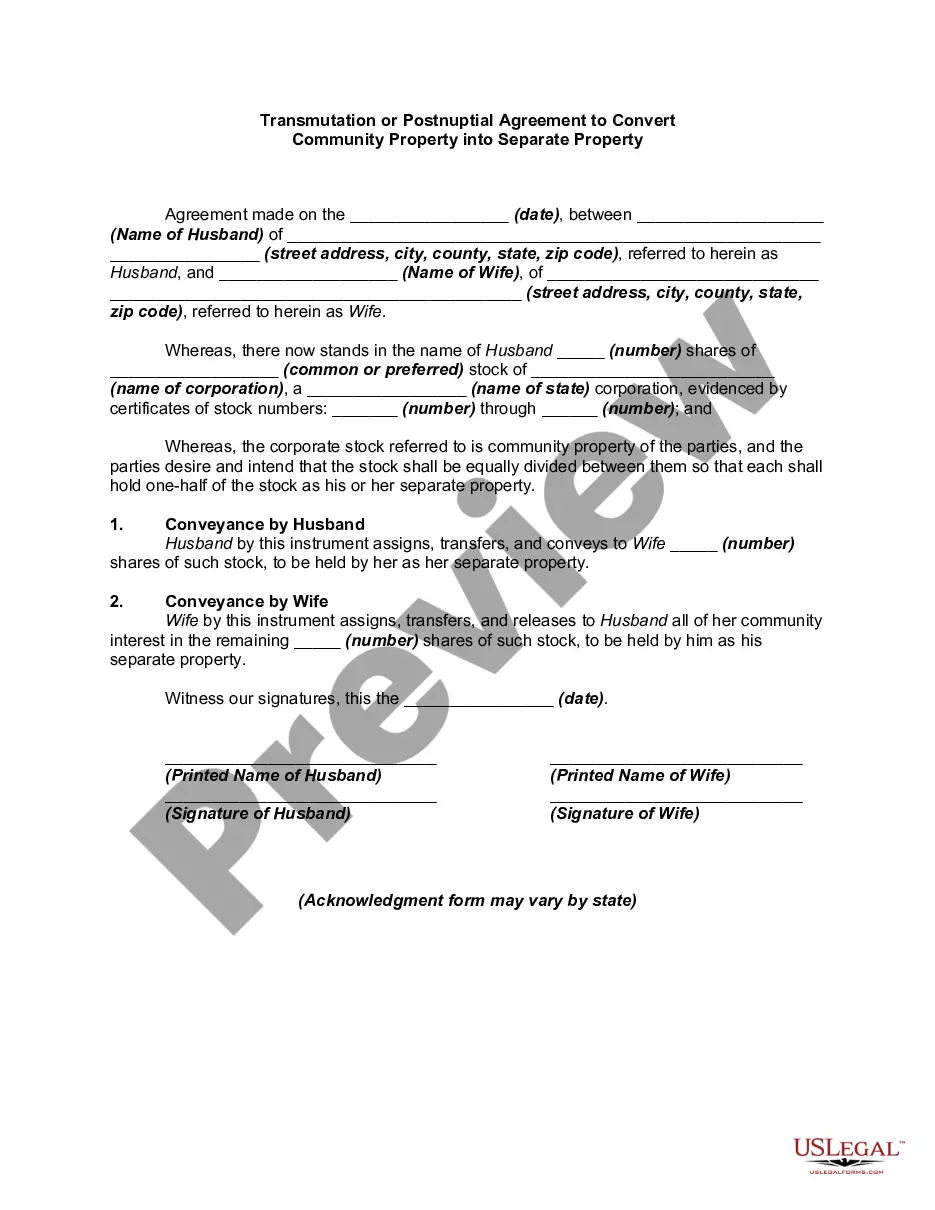

Often there is someone the grantor knows who the grantor suggests to be the trustee. Typical choices are the grantor's spouse, sibling, child, or friend. Any of these may be an acceptable choice from a legal perspective, but may be a poor choice for other reasons.

The key features of irrevocable trusts are reflected below: No Modifications: Once you create the trust, it can't be changed or modified. Personal Tax Benefits: When appreciated assets, such as stock and real estate, are transferred into the trust, the grantor will save on capital gains taxes.

Irrevocable trusts can also protect assets from being used in determining Medicare eligibility. Once an irrevocable trust is funded, the trust property cannot be taken back by the grantor without the consent of the beneficiary. It is legal to name a beneficiary as trustee, such as a spouse.

A Trust (or Marital Trust)The surviving spouse must be the only beneficiary of the trust during his/her lifetime, however, at the time of the second spouse's death, the trust can pass to any other named beneficiaries like children, grandchildren, etc.

An irrevocable trust reports income on Form 1041, the IRS's trust and estate tax return. Even if a trust is a separate taxpayer, it may not have to pay taxes. If it makes distributions to a beneficiary, the trust will take a distribution deduction on its tax return and the beneficiary will receive IRS Schedule K-1.

Individual trusts for each grandchild. Most grandparents choose to put equal amounts of money into each grandchild's individual trust. The trustee can then decide when and how much money to distribute to each grandchild from their individual trust based on the standards written into the trust.

Beneficiaries of a trust typically pay taxes on the distributions they receive from the trust's income, rather than the trust itself paying the tax. However, such beneficiaries are not subject to taxes on distributions from the trust's principal.

Irrevocable trust distributions can vary from being completely tax free to being taxable at the highest marginal tax rates, and in some cases, can be even higher. Therefore, understanding the tax implications is critically importantwhich is why we focus on irrevocable trusts in the discussion below.

No Modifications: Once you create the trust, it can't be changed or modified. Personal Tax Benefits: When appreciated assets, such as stock and real estate, are transferred into the trust, the grantor will save on capital gains taxes. An irrevocable trust doesn't avoid taxes entirely.

A SLAT allows the donor spouse to transfer up to the donor spouse's available exemption amount without a gift tax. When the donor spouse dies, the value of the assets in the SLAT is excluded from the donor spouse's gross estate and are not subjected to the federal estate tax.