A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

District of Columbia Articles of Incorporation for Non-Profit Organization, with Tax Provisions

Description

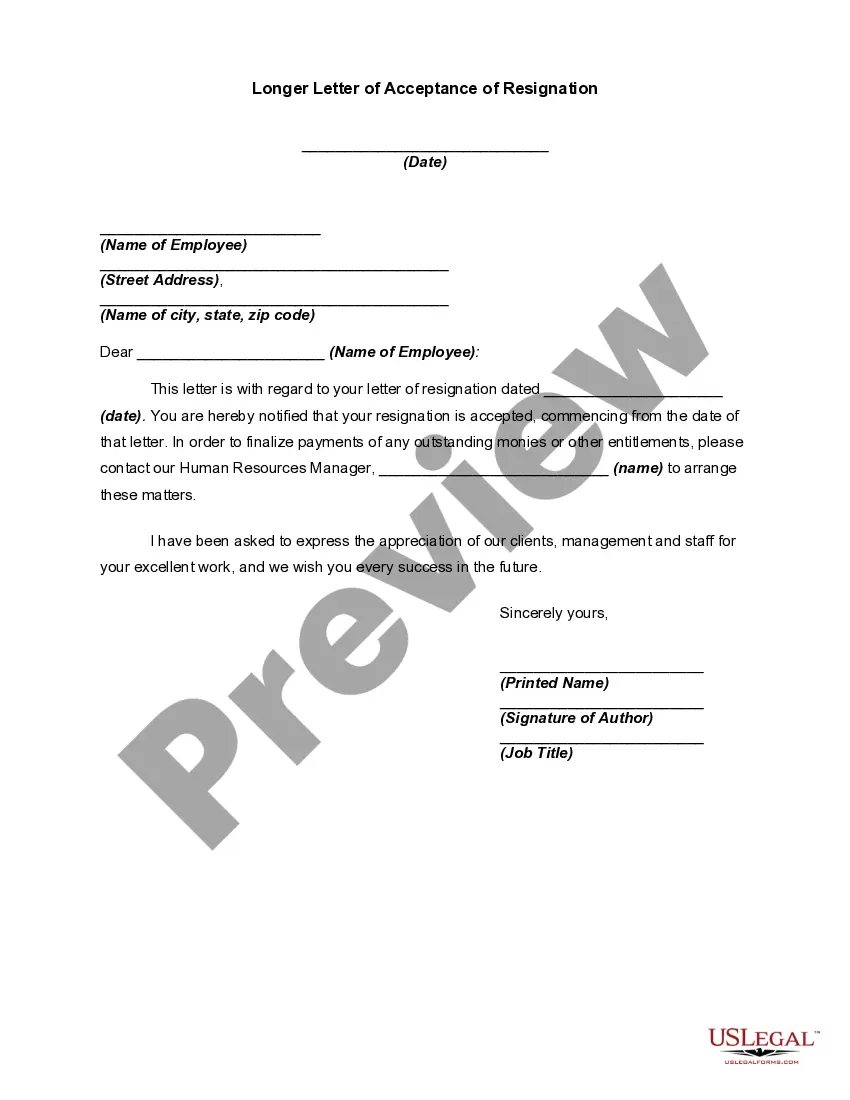

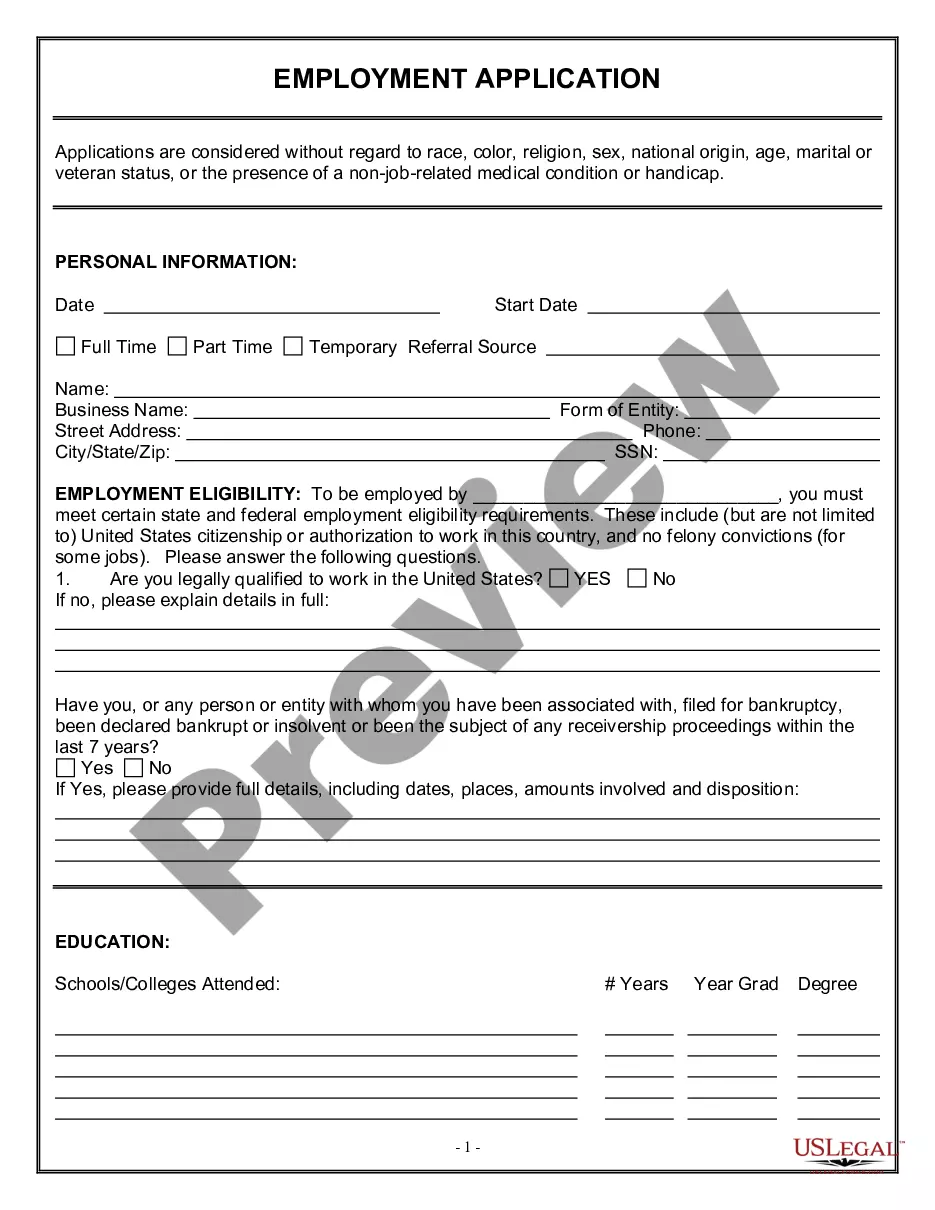

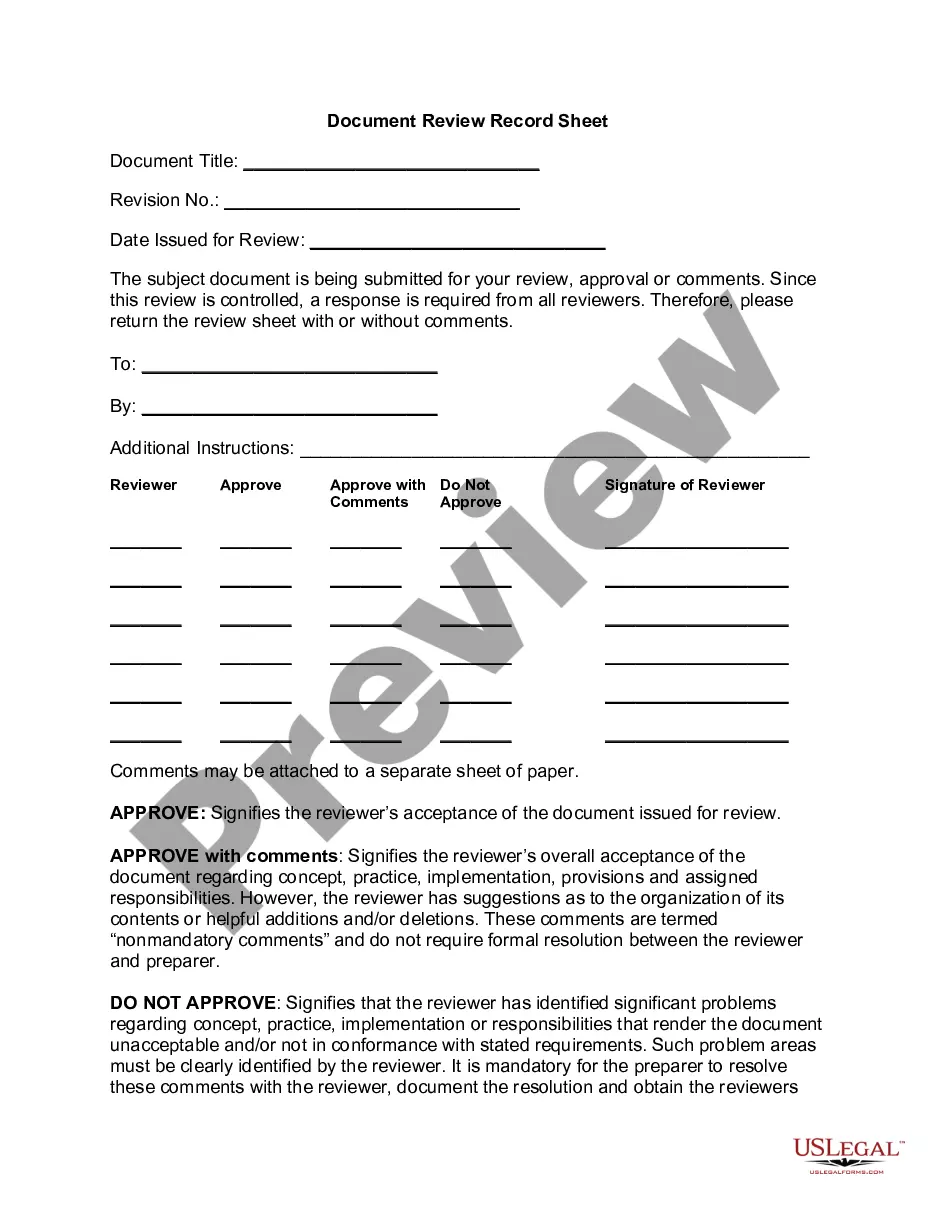

How to fill out Articles Of Incorporation For Non-Profit Organization, With Tax Provisions?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

On the website, you will find thousands of forms for business and personal uses, categorized by types, states, or keywords.

You can access the most recent versions of forms such as the District of Columbia Articles of Incorporation for Non-Profit Organization with Tax Provisions within seconds.

If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does.

Once you are happy with the form, confirm your choice by clicking the Get now button. Then, choose the pricing plan you prefer and provide your details to register for the account.

- If you possess a membership, Log In and obtain District of Columbia Articles of Incorporation for Non-Profit Organization with Tax Provisions from your US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- To begin using US Legal Forms for the first time, here are simple instructions to assist you.

- Ensure you have selected the correct form for your region/area. Select the Review button to examine the form’s content.

- Check the form outline to ensure that you have chosen the appropriate form.

Form popularity

FAQ

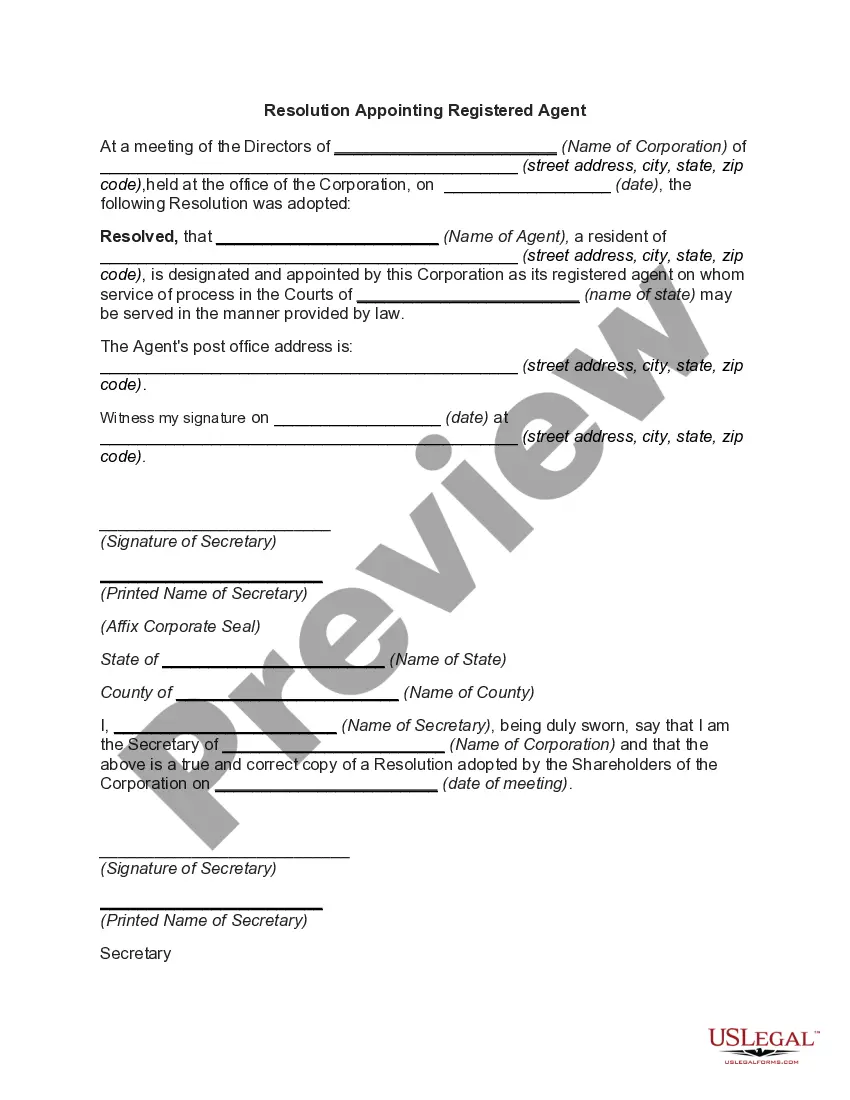

Creating District of Columbia Articles of Incorporation for a Non-Profit Organization, with Tax Provisions, involves several essential steps. First, you need to choose a unique name for your organization that complies with state regulations. After that, prepare your articles which must include key information such as your organization’s purpose, registered agent, and members. Finally, you can file these documents with the appropriate state office, and for added support in this process, consider using USLegalForms for easy access to templates and guidance.

The 33% rule for nonprofits states that organizations should allocate at least one-third of their total expenditures to charitable programs. This guideline ensures that nonprofits focus on their mission and use resources in a way that benefits the community. Understanding this rule can help you maintain compliance and effectively structure your District of Columbia Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

The DC code for nonprofits can be found in Title 29 of the District of Columbia Official Code. This title outlines the regulations and requirements for forming and operating nonprofit organizations within the district. Familiarizing yourself with these codes can facilitate the process of preparing District of Columbia Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

Yes, nonprofits must file articles of incorporation to establish formal recognition in the District of Columbia. This process provides legal protection and allows the organization to operate under state law. Filing these documents is essential for obtaining tax-exempt status, making it crucial to understand the requirements for District of Columbia Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

Writing articles of incorporation for a nonprofit involves providing essential information about the organization, including its name, purpose, and governance structure. You should prepare a list of your board members and define how the organization will operate. Utilizing templates can simplify this process, and platforms like UsLegalForms can provide the necessary resources to help you draft compliant District of Columbia Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

A 501c3 is a specific type of nonprofit organization that is recognized by the IRS as tax-exempt. All 501c3 organizations are nonprofits, but not all nonprofits qualify for 501c3 status. To be classified as a 501c3, an organization must meet certain requirements, including having a charitable purpose. Understanding the difference is crucial for ensuring compliance when filing District of Columbia Articles of Incorporation for Non-Profit Organization, with Tax Provisions.

DC CorpOnline is an online portal created by the Department of Consumer and Regulatory Affairs for managing business filings in the District of Columbia. Through DC CorpOnline, you can submit Articles of Incorporation and access other business services conveniently. It provides resources that can be valuable for non-profit organizations filing for tax provisions.

If you need a copy of your Articles of Incorporation, contact the DCRA directly. They maintain records of all incorporated non-profit organizations. You can also use uslegalforms to find forms and guidance which simplify the request process.

To obtain a copy of Articles of Incorporation in DC, you can visit the DCRA website or their office. They provide services to request copies of filed documents, including those for non-profit organizations. Utilizing platforms like uslegalforms can also assist you in navigating the process of obtaining these important documents.

Yes, many non-profit organizations can obtain tax-exempt status in the District of Columbia. Nonprofits, such as 501(c)(3) entities, must file the correct Articles of Incorporation and comply with tax regulations. By following the guidelines for District of Columbia Articles of Incorporation for Non-Profit Organization, with Tax Provisions, organizations can secure their tax-exempt benefits.