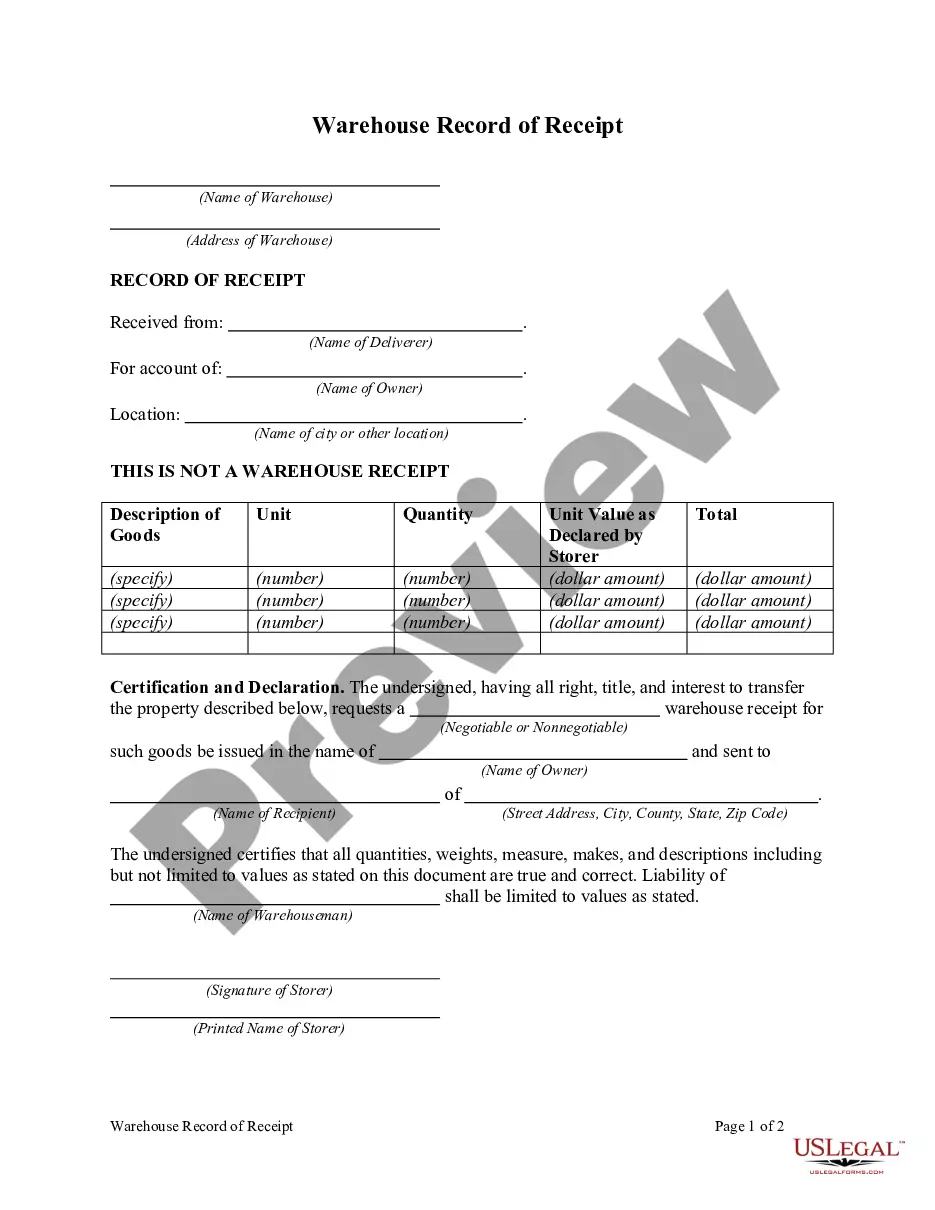

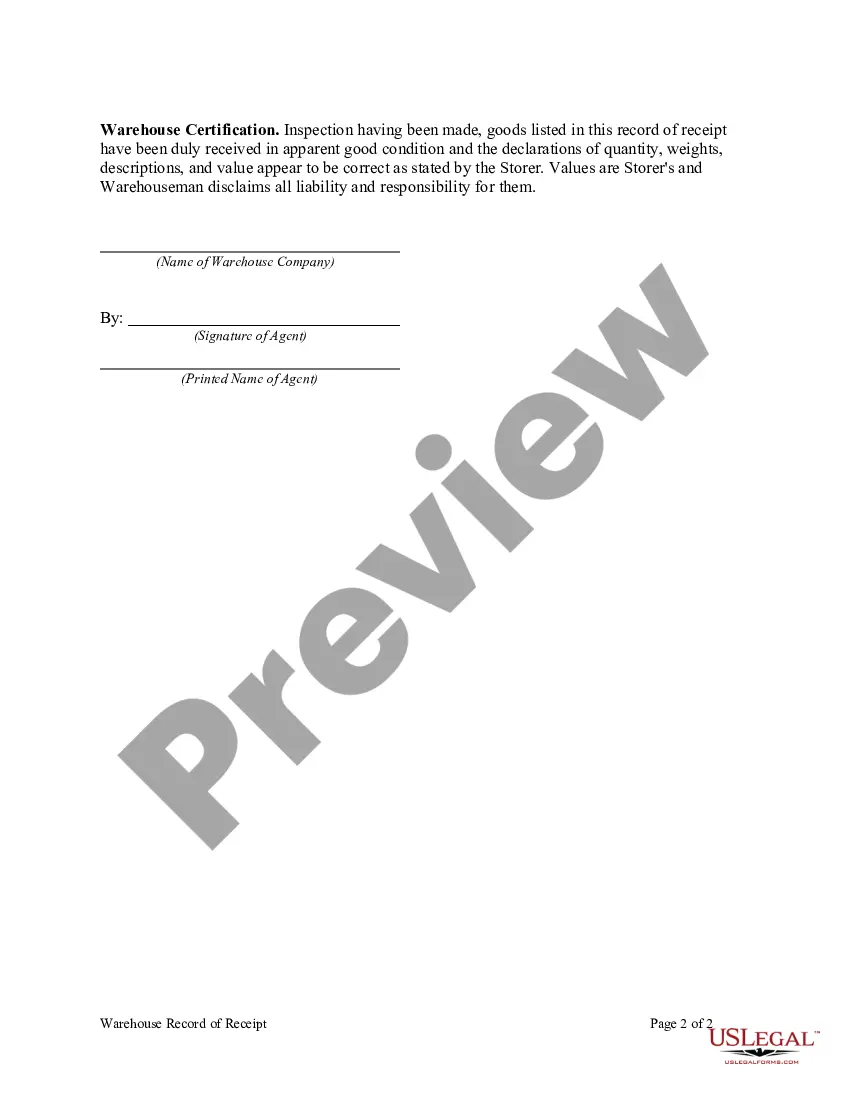

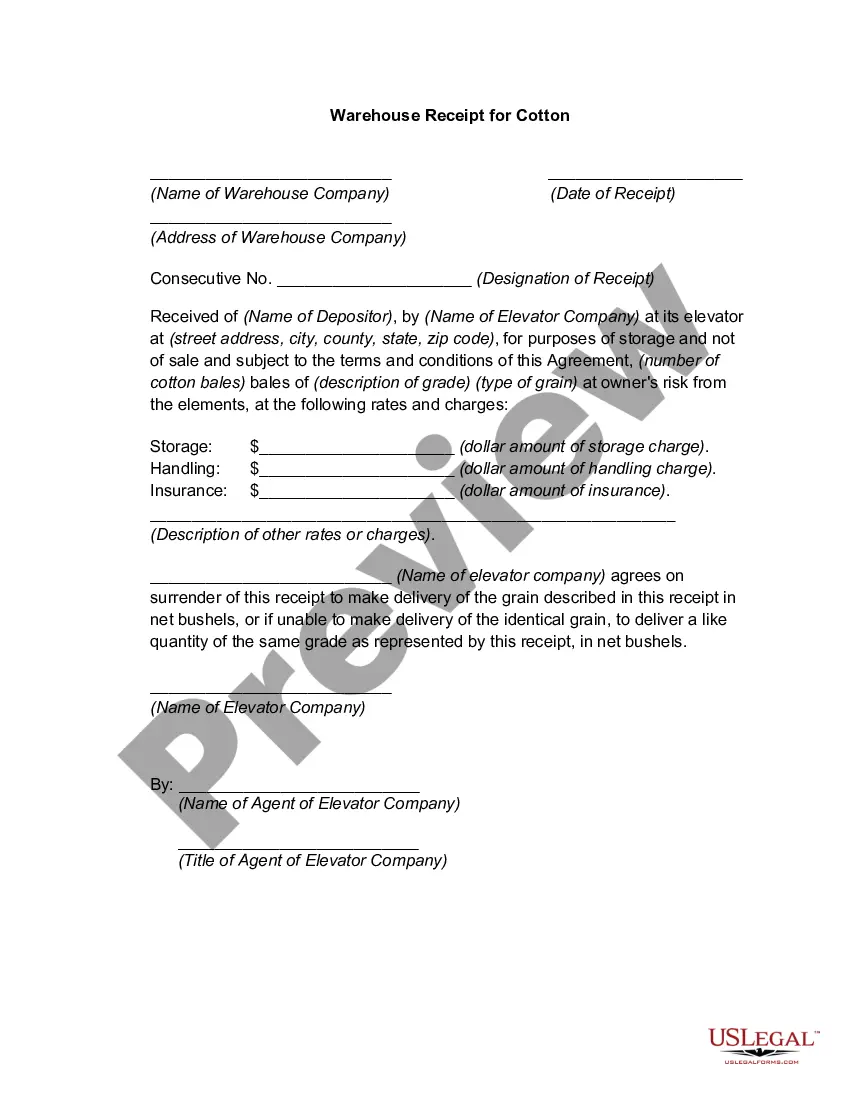

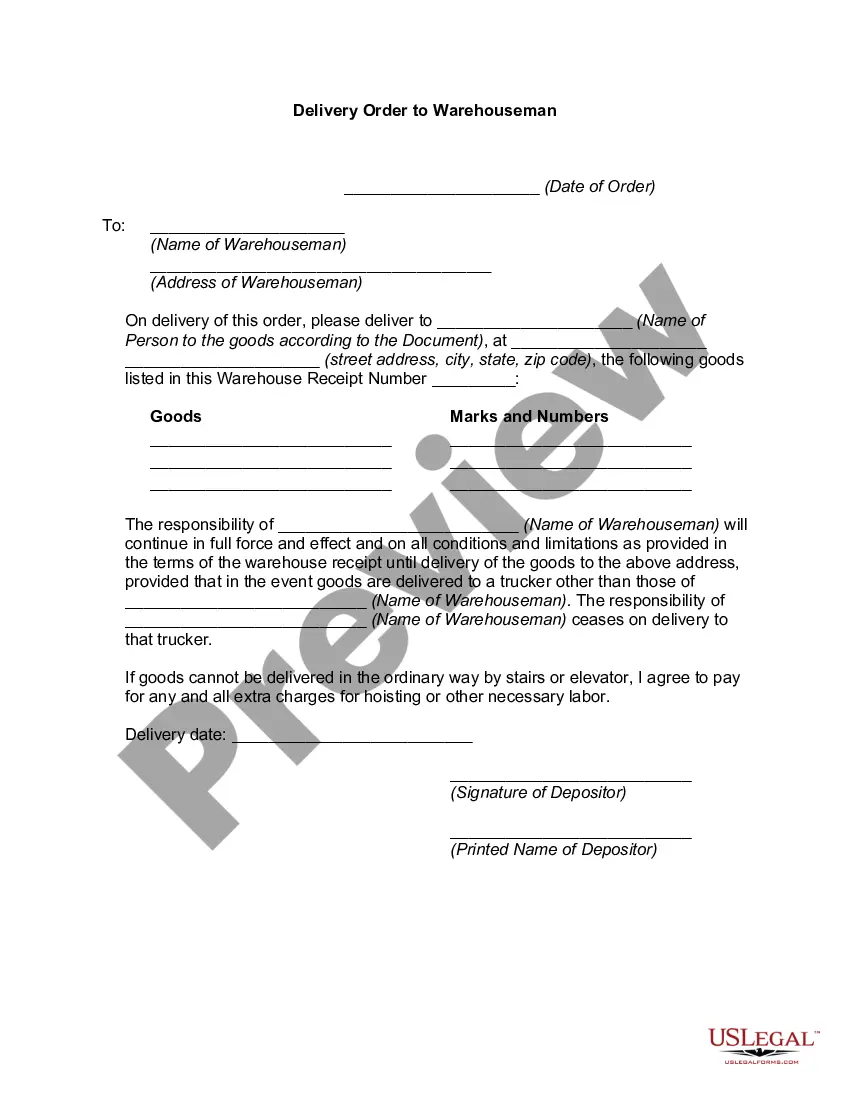

District of Columbia Warehouse Record of Receipt

Description

How to fill out Warehouse Record Of Receipt?

Selecting the appropriate valid file format can be somewhat challenging.

Certainly, there are numerous templates accessible on the web, but how do you find the correct type you require.

Utilize the US Legal Forms website. The platform provides a vast array of templates, such as the District of Columbia Warehouse Record of Receipt, suitable for business and personal purposes.

If the form does not address your needs, utilize the Search field to find the appropriate type. Once you are certain the form is suitable, click the Purchase now button to obtain the form. Choose the pricing plan you desire and enter the required information. Create your account and complete your order using your PayPal account or credit card. Select the submission file format and download the legal format to your device. Complete, modify, and print and sign the acquired District of Columbia Warehouse Record of Receipt. US Legal Forms is the largest repository of legal forms where you can find various document templates. Leverage the service to download professionally prepared documents that comply with state regulations.

- All the forms are reviewed by experts and comply with state and federal laws.

- If you are already registered, Log In to your account and click on the Download button to access the District of Columbia Warehouse Record of Receipt.

- Use your account to view the legal forms you have previously acquired.

- Navigate to the My documents section of your account to download another copy of the document you need.

- If you are a new US Legal Forms user, here are simple steps to follow.

- First, ensure you have selected the correct type for your area/region. You can review the form using the Review button and read the form description to confirm this is the right one for you.

Form popularity

FAQ

DC does not allow NOL carry backs. Therefore, you may not claim a NOL carry back for DC tax purposes.

Who does not have to file Form D-30? You do not have to file if Total gross income (Line 10) is $12,000 or less. You are an organization recognized as exempt from DC taxes.

The DC franchise tax, also known as the DC unincorporated business franchise tax, is a tax imposed on some businesses operating in the District of Columbia that have gross receipts of $12,000 or more.

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Taxicab/Limo Drivers Any non-resident taxicab/limo driver who operates a motor vehicle for hire in the District must file a Form D-30. The filing of the D-30 is a requirement for operating or continuing to operate a motor vehicle for hire in the District by a non-resident.

SPECIFIC INSTRUCTIONS A separate Form D-40B must be filed for each taxable year for which a refund or a ruling is requested. 3. After the close of the calendar year, file Form D-40B with the Office of Tax and Revenue, P.O. Box 7861, Washington, D.C. 20044-7861.

The filing of the D-30 is a requirement for operating or continuing to operate a motor vehicle for hire in the District by a non-resident. Minimum Tax. The minimum tax is $250 if DC gross receipts are $1M or less. Minimum tax is $1,000 if DC gross receipts are greater than $1M.

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

Credit for Taxes Paid to Another State The District of Columbia allows taxpayers to claim a credit for individual income tax paid to other state(s) if the income taxed by that state is derived from that state and is of a kind taxed by DC.