Subject: Division of Plan Proceeds per Court Order — District of Columbia Pension Plan Administrator Dear [Pension Plan Administrator's Name], I hope this letter finds you well. I am writing to request your assistance in complying with a court order regarding the division of pension plan proceeds in the District of Columbia. The court order pertains to [specific case information]. As per the court's decision, it is necessary to divide the plan proceeds between two parties [Provide Names] in accordance with the specific guidelines outlined in the court order. In order to ensure a smooth transfer and accurate implementation of the court's decree, I kindly request your cooperation. To fully comply with the court order, we require the following information and documentation: 1. Detailed Account Information: Please provide a detailed breakdown of the pension plan account, including the current balance, contribution history, and any applicable earnings or interest accrued. 2. Plan Administrator's Acknowledgment: Kindly confirm your acknowledgment of the court order and commitment to fulfill the division of plan proceeds as required without delay. 3. Identification of the Divisible Portion: Assist in identifying the portion of the plan proceeds subject to division as per the court order, ensuring that it is supported by the plan's terms and provisions. 4. Calculations and Allocation Method: Please provide a clear explanation of the methodology used and calculations applied in determining the allocation of plan proceeds between the involved parties. Additionally, indicate any deductions or fees that will be incurred during the division process. 5. Execution of the Court-Approved Division: Ensure that the court-approved division is executed precisely as detailed in the court order. This includes the setup of separate accounts for each party and the transfer of their respective portions promptly. 6. Communication with Involved Parties: Maintain open communication with both parties involved in the division process, keeping them informed of any progress and addressing any concerns or questions that may arise. I kindly request your prompt attention to this matter to adhere to the court's prescribed timeline. Should you require any additional information or documentation, please do not hesitate to contact me at [your contact information]. Thank you for your cooperation and support in facilitating the division of plan proceeds in compliance with the court order. I trust that together we can ensure a seamless process for all stakeholders involved. Looking forward to your prompt response. Sincerely, [Your Name] [Your Contact Information] Other variations of District of Columbia Sample Letter to Pension Plan Administrator regarding Division of Plan Proceeds per Court Order: — District of Columbia Pension Plan Division Request Letter — District of Columbia Pension Plan Proceeds Division — CompliancRequestes— - Court Order Compliance — Division of Pension Plan Proceeds in District of Columbia — District of Columbia Pension Plan Administrator — Division Request per Court Decree

District of Columbia Sample Letter to Pension Plan Administrator regarding Division of Plan Proceeds per Court Order

Description

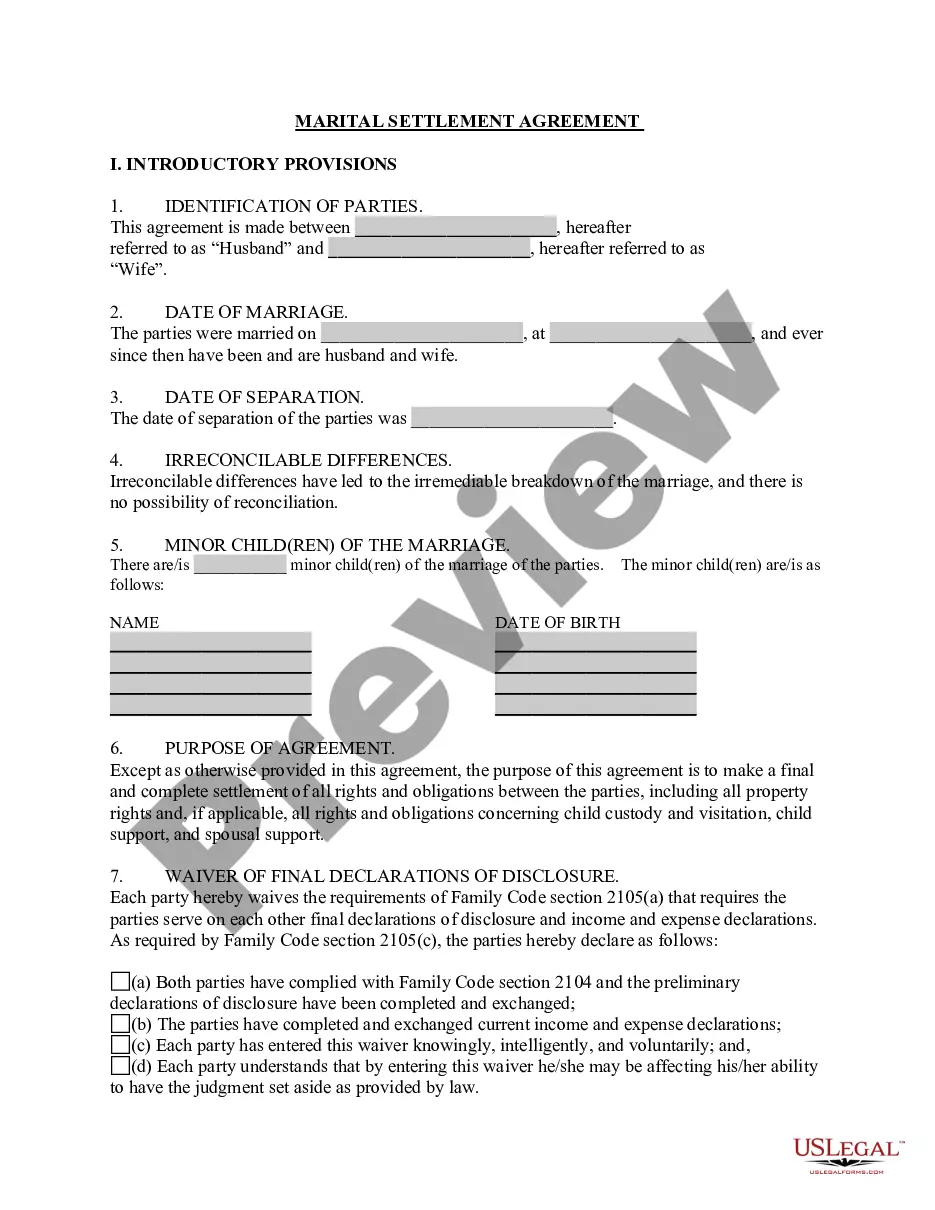

How to fill out District Of Columbia Sample Letter To Pension Plan Administrator Regarding Division Of Plan Proceeds Per Court Order?

If you want to total, acquire, or produce legal document web templates, use US Legal Forms, the biggest variety of legal kinds, which can be found on the web. Use the site`s easy and practical research to discover the documents you want. Numerous web templates for enterprise and specific purposes are sorted by categories and claims, or keywords. Use US Legal Forms to discover the District of Columbia Sample Letter to Pension Plan Administrator regarding Division of Plan Proceeds per Court Order in just a couple of clicks.

When you are presently a US Legal Forms buyer, log in in your bank account and click the Down load key to find the District of Columbia Sample Letter to Pension Plan Administrator regarding Division of Plan Proceeds per Court Order. You can also gain access to kinds you earlier downloaded within the My Forms tab of your bank account.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the form for that appropriate town/land.

- Step 2. Make use of the Review option to check out the form`s articles. Never forget to learn the explanation.

- Step 3. When you are not satisfied together with the kind, utilize the Search discipline on top of the display to find other models of your legal kind template.

- Step 4. Once you have discovered the form you want, click on the Acquire now key. Choose the prices strategy you favor and add your qualifications to sign up for an bank account.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Pick the format of your legal kind and acquire it on your own system.

- Step 7. Comprehensive, change and produce or sign the District of Columbia Sample Letter to Pension Plan Administrator regarding Division of Plan Proceeds per Court Order.

Every single legal document template you get is your own property for a long time. You have acces to each and every kind you downloaded in your acccount. Go through the My Forms segment and pick a kind to produce or acquire yet again.

Contend and acquire, and produce the District of Columbia Sample Letter to Pension Plan Administrator regarding Division of Plan Proceeds per Court Order with US Legal Forms. There are thousands of professional and express-distinct kinds you may use for your enterprise or specific needs.

Form popularity

FAQ

Once your pension benefits are locked in, you generally cannot withdraw funds from the plan as a cash payment. Contributions that your employer makes to a DC plan are deductible to the employer and are not considered a taxable benefit to you.

How to create a retirement letter Address the right people. Address your retirement letter to your supervisor. ... Specify the date of your retirement. ... Express appreciation for your experience. ... Offer to assist with the transition. ... Discuss consulting if you're interested. ... Detail your needs regarding retirement.

Up to 25% of your pot can be withdrawn tax-free ? this is called the pension tax-free lump sum. However, if you take anything more it will count towards your income for the year and be taxed as earnings at your marginal rate of 20%, 40% or 45%, depending on your total annual income.

Defined benefit pensions usually let you take a 25% tax-free cash lump sum in exchange for getting a lower income, and the conversion rate of pension to cash is dependent on the scheme's rules. However, you may have to give up a large amount of your income compared to the amount of tax-free cash you'll get.

Pension plan administrators are fiduciaries responsible for prudently managing risks in their pension plans, making decisions in the best interest of pension plan beneficiaries, and administering the plan in ance with the filed plan documents and applicable laws, including the Pension Benefits Act.

The IRS lists current contribution limits for various plans. You can then choose how you want your money invested. Most plans offer several investment choices, and each has its own fee structure and risk profile. You can start withdrawing funds from your account at age 59½.

Your traditional pension plan is designed to provide you with a steady stream of income once you retire. That's why your pension benefits are normally paid in the form of lifetime monthly payments. Increasingly, employers are making available to their employees a one-time payment for all or a portion of their pension.

If you have ended your New Jersey public employment, are not planning to return, and are not eligible to retire, you may withdraw your pension contributions. To withdraw the balance in a lump sum, you must no longer be working in any covered position.