Title: District of Columbia Sample Letter to Foreclosure Attorney: Request Verification of Debt and Cease Foreclosure Introduction: This article provides a detailed description of a District of Columbia Sample Letter to a Foreclosure Attorney. This letter serves as a formal request to the attorney representing the lender or creditor, asking for verification of the debt and a halt to the foreclosure process. By using the relevant keywords, homeowners in the District of Columbia facing foreclosure can better understand the process and take necessary actions. Keywords: District of Columbia, sample letter, foreclosure attorney, verification of debt, cease foreclosure, formal request, lender, creditor, homeowners, process, actions Sample District of Columbia Sample Letter to Foreclosure Attorney: [Your Name] [Your Address] [City, State, ZIP] [Date] [Foreclosure Attorney's Name] [Attorney's Firm Name] [Address] [City, State, ZIP] Subject: Verification of Debt and Cease Foreclosure — Urgent Request Dear [Foreclosure Attorney's Name], I am writing this letter as a concerned homeowner facing foreclosure on the property located at [Property Address], within the District of Columbia. I kindly request your assistance in providing verification of the debt related to the foreclosure proceedings, as well as an immediate cessation of all foreclosure activities. As per the Fair Debt Collection Practices Act (FD CPA), it is my right as a debtor to seek proper verification of the alleged debt. Therefore, I kindly request that you provide me with the following documents and information within [reasonable timeframe, e.g., 30 days] to comply with this legal requirement: 1. Complete mortgage loan documentation that includes the original promissory note, loan agreement, and any subsequent modifications or assignments. 2. Proof of the creditor's legal standing and ownership of the debt, including all relevant chain of title documents and assignments. 3. Itemized statement of the outstanding balance, including any fees, penalties, or interest applied. 4. Verification of compliance with all applicable federal, state, and local foreclosure laws, regulations, and procedures. 5. Confirmation of adherence to any loan modification agreements or foreclosure prevention programs that may have been previously established. I would like to emphasize the importance of your prompt response and compliance with this request. Failing to provide the requested documentation and verification of the debt, or proceeding with foreclosure without proper justification, may result in legal consequences and violations of both state and federal laws. It is crucial to note that I am not disputing my responsibility to repay outstanding debts. However, I believe it is necessary to ensure the accurate and lawful handling of foreclosure proceedings. I am open to exploring viable alternatives such as loan modification or repayment plans to resolve the outstanding debt, provided the appropriate verification is provided. I kindly request that you acknowledge the receipt of this letter and provide me with a timeline for your response. Failure to do so may result in further legal actions to protect my rights as a homeowner. Thank you for your immediate attention to this matter. I trust that we can work towards a resolution that is fair and legally sound. Sincerely, [Your Name] [Your Contact Information] Alternative Types of District of Columbia Sample Letters relating to Foreclosure: 1. District of Columbia Sample Letter to Foreclosure Attorney: Request Loan Modification Options and Avoid Foreclosure 2. District of Columbia Sample Letter to Foreclosure Attorney: Request Explanation of Default and Foreclosure Process 3. District of Columbia Sample Letter to Foreclosure Attorney: Demand Transparency in Foreclosure Proceedings 4. District of Columbia Sample Letter to Foreclosure Attorney: File Complaint Regarding Unlawful Foreclosure Practices 5. District of Columbia Sample Letter to Foreclosure Attorney: Negotiate Repayment Plan to Prevent Foreclosure.

District of Columbia Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure

Description

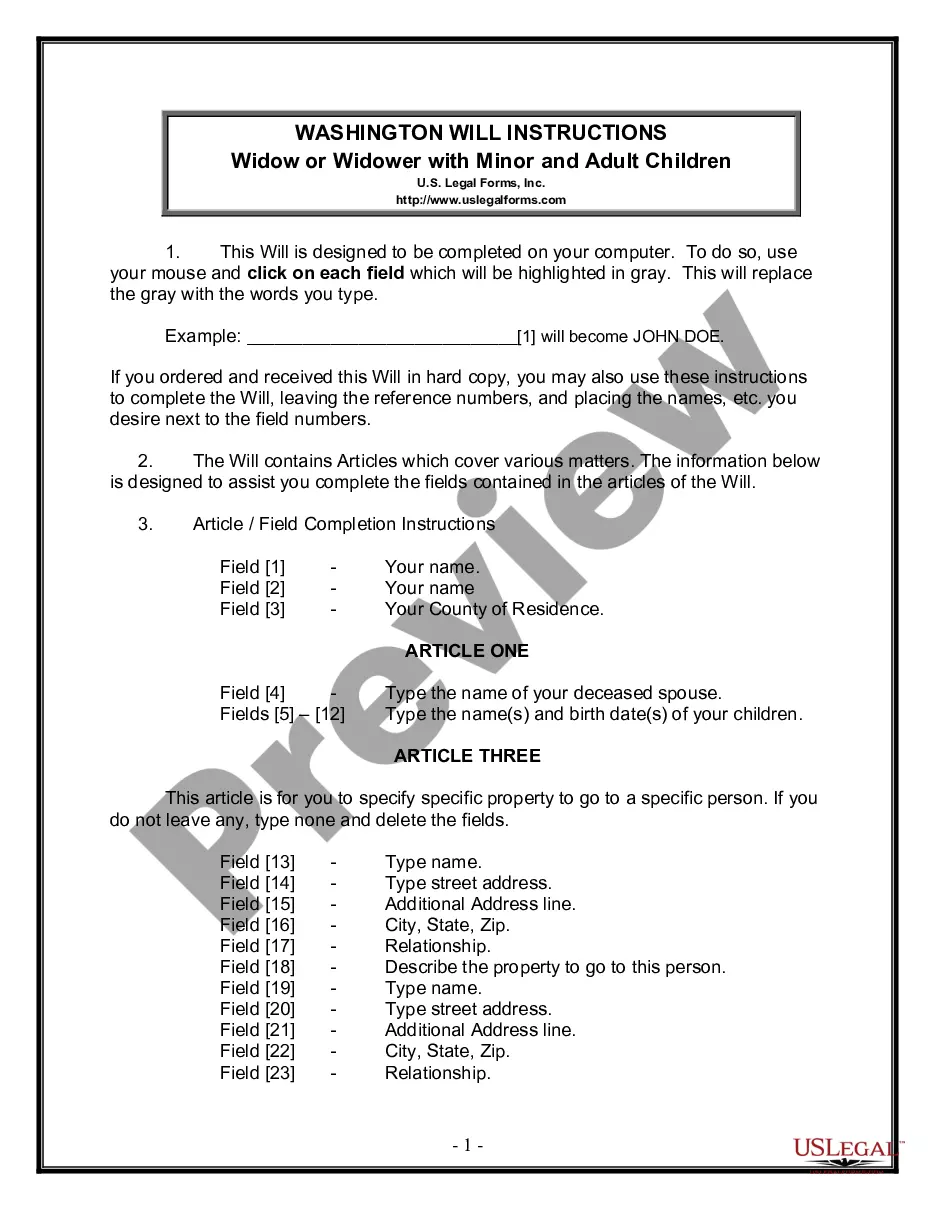

How to fill out Sample Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure?

Discovering the right lawful papers format could be a struggle. Needless to say, there are a variety of layouts available online, but how do you find the lawful develop you need? Use the US Legal Forms site. The services provides thousands of layouts, like the District of Columbia Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure, that can be used for company and private demands. Each of the varieties are checked by pros and meet federal and state specifications.

Should you be presently signed up, log in in your profile and click on the Down load switch to have the District of Columbia Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure. Make use of profile to search with the lawful varieties you may have ordered formerly. Check out the My Forms tab of the profile and have an additional version of the papers you need.

Should you be a new end user of US Legal Forms, allow me to share simple guidelines so that you can adhere to:

- Very first, make sure you have chosen the right develop for your personal area/region. You may look over the shape utilizing the Review switch and study the shape description to make sure this is the best for you.

- In the event the develop fails to meet your requirements, take advantage of the Seach industry to obtain the appropriate develop.

- When you are positive that the shape is suitable, go through the Purchase now switch to have the develop.

- Select the prices strategy you want and enter in the required info. Create your profile and purchase an order using your PayPal profile or Visa or Mastercard.

- Opt for the data file file format and obtain the lawful papers format in your product.

- Comprehensive, change and printing and indication the obtained District of Columbia Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure.

US Legal Forms will be the largest collection of lawful varieties where you will find numerous papers layouts. Use the service to obtain appropriately-made files that adhere to express specifications.

Form popularity

FAQ

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

Although you can ask for many details, debt collectors are only required to provide information on the original creditor, the balance owed and the name of the person who owes the debt before resuming collection efforts.

Generally, you should send a debt validation request if you're contacted by a collection agency and you don't recognize the debt. Send a validation request within 30 days of receiving contact from a collection agency, otherwise, they'll assume the debt is valid and can legally continue to contact you about it.

A debt validation letter is a letter that debt collectors must provide that includes information about the size of your debt, when to pay it, and how to dispute it. A debt collection letter essentially proves you owe the debt collector money.

If you've already paid the debt If you're sure that you're talking with a legitimate debt collector, you can send copies of documents that prove you made the payments, including cancelled checks or credit card statements. You may also include copies of any correspondence about settling the debt.

If you feel you've been contacted in error, send a letter disputing a debt in writing. Ask the agency to stop contacting you. If the agency can't provide proof, you owe the money, by law, they must stop collection efforts. If you don't owe the bill, don't pay anything ? ever.