District of Columbia Sample Letter for Denial of Cash Advances

Category:

State:

Multi-State

Control #:

US-0558LR

Format:

Word;

Rich Text

Instant download

Description

This form is a sample letter in Word format covering the subject matter of the title of the form.

How to fill out Sample Letter For Denial Of Cash Advances?

If you desire to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Take advantage of the website's simple and convenient search feature to locate the documents you require.

Different templates for business and personal purposes are organized by categories and states or keywords.

Step 4. Once you have identified the form you need, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment process. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the District of Columbia Sample Letter for Denial of Cash Advances with just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and click the Download button to retrieve the District of Columbia Sample Letter for Denial of Cash Advances.

- You can also find forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

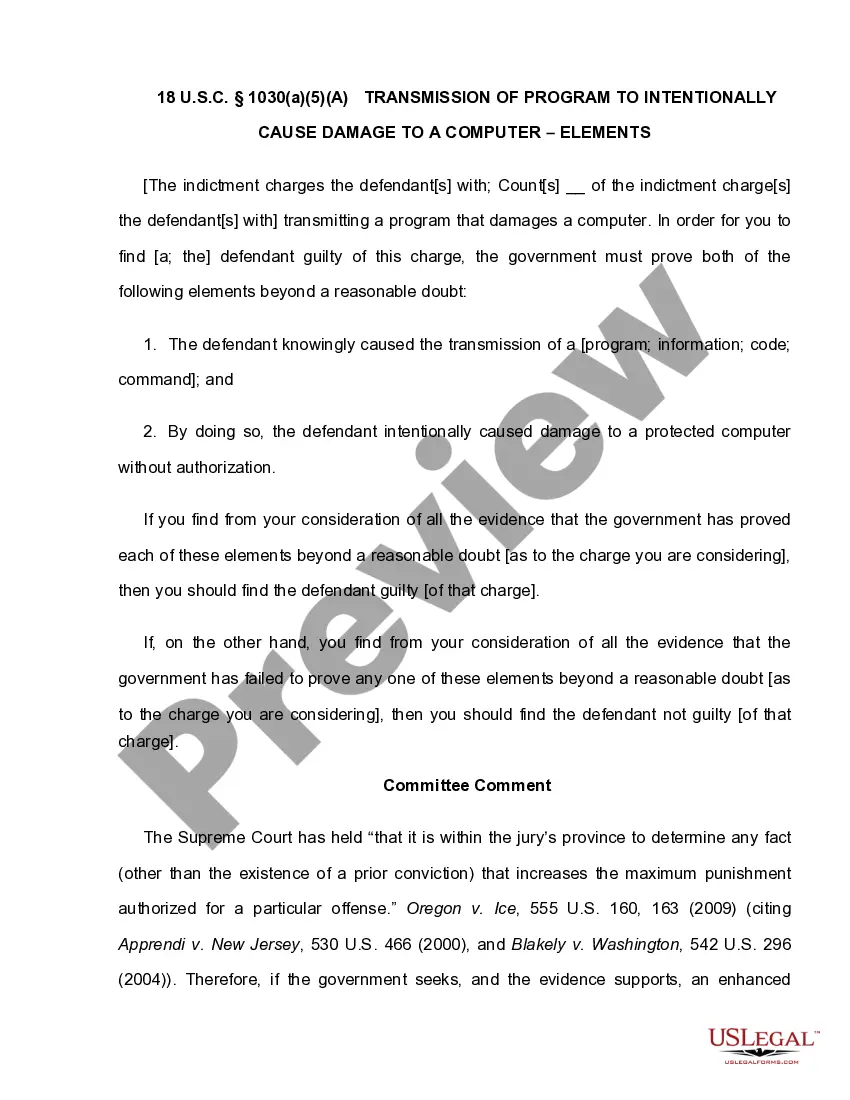

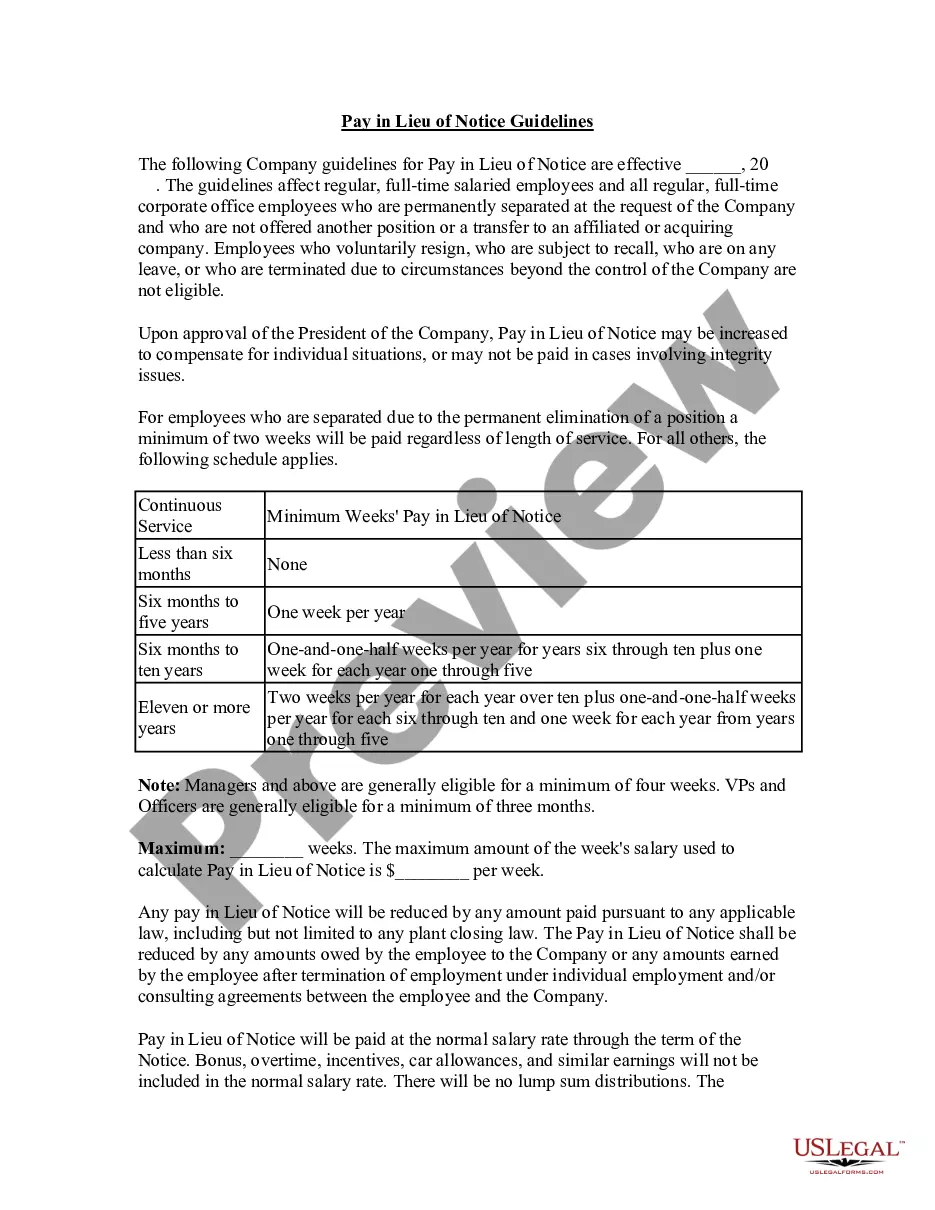

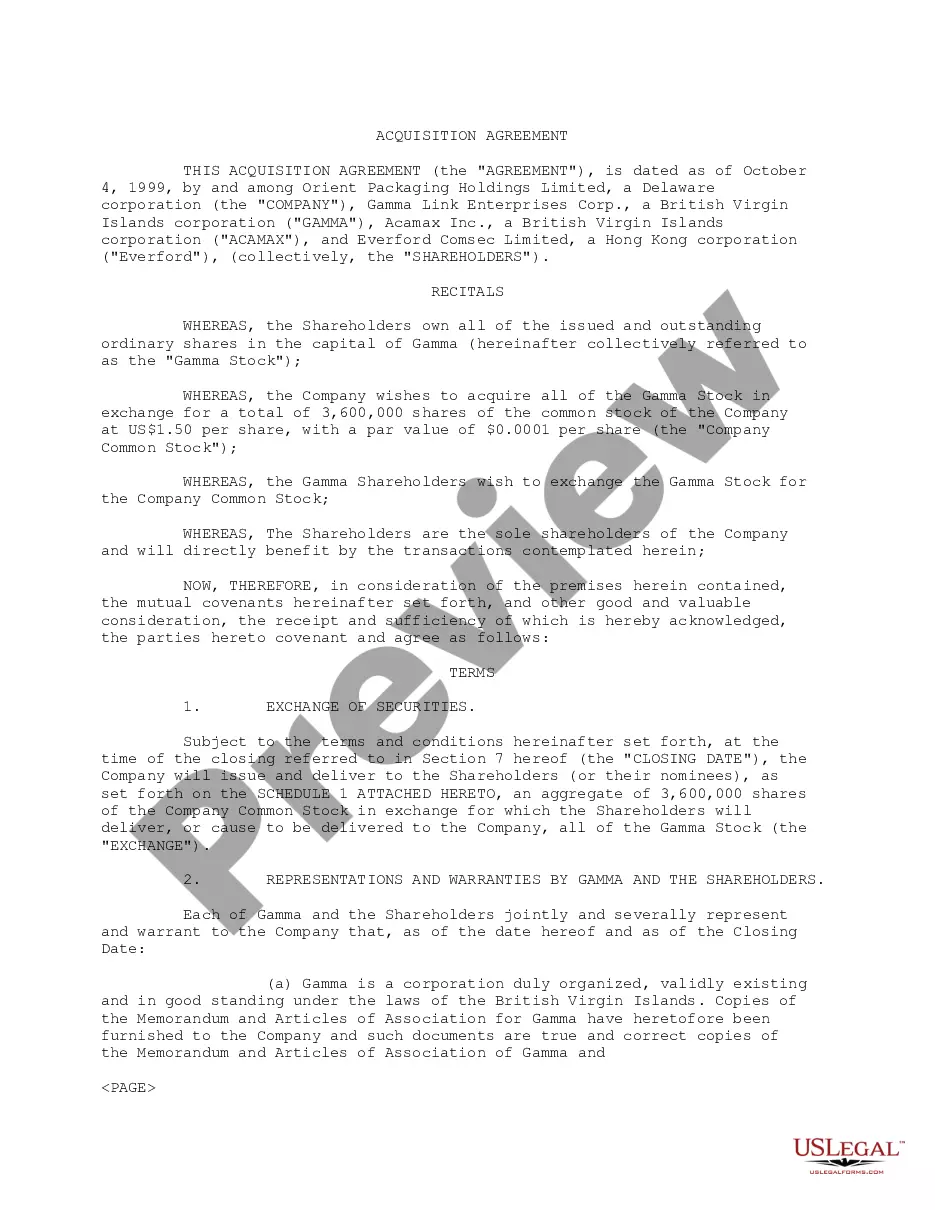

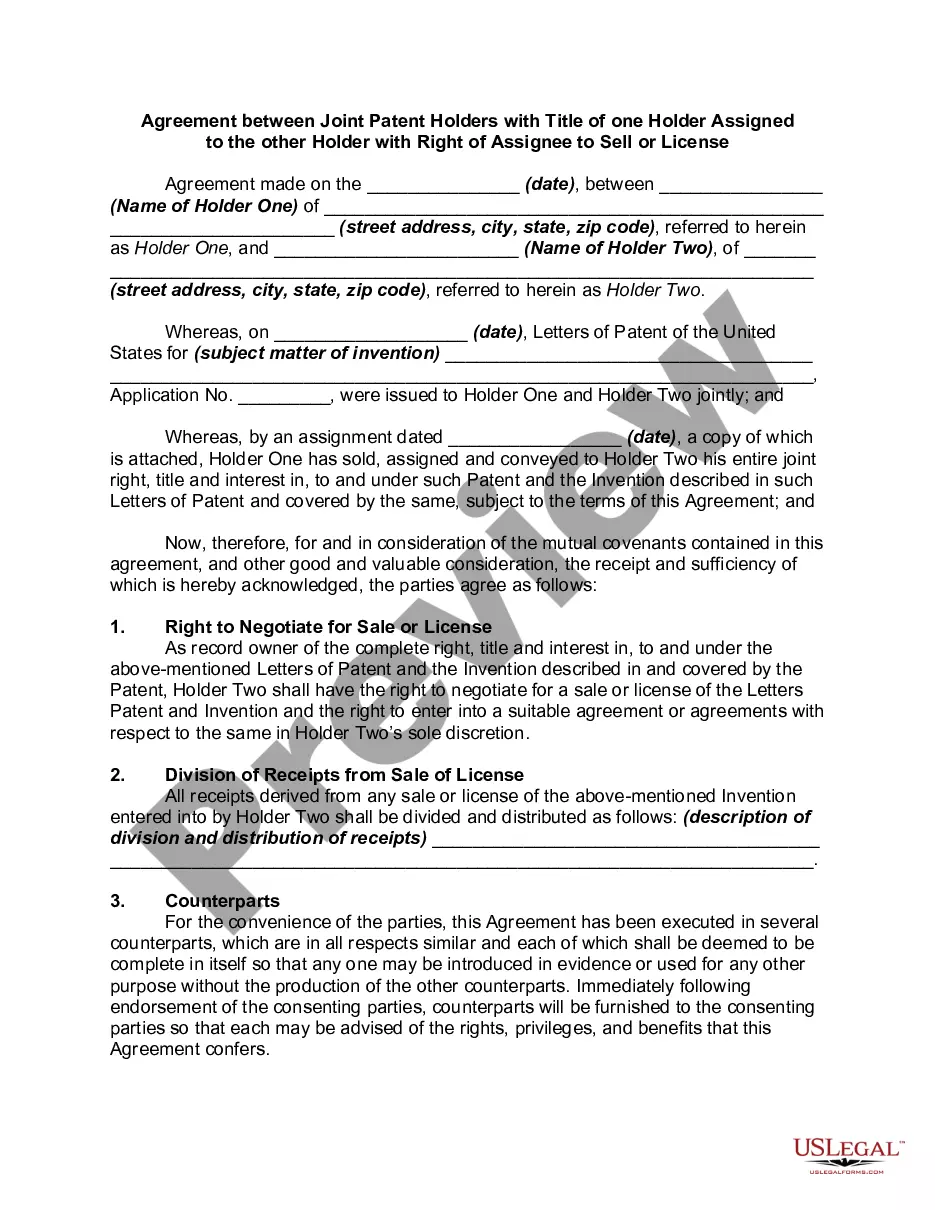

- Step 2. Use the Preview option to review the form's content. Always remember to check the information.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.