District of Columbia Security Interest Subordination Agreement

Description

How to fill out Security Interest Subordination Agreement?

Choosing the right legal file web template can be a have a problem. Naturally, there are plenty of templates available on the net, but how do you obtain the legal type you will need? Use the US Legal Forms web site. The services provides a large number of templates, such as the District of Columbia Security Interest Subordination Agreement, which you can use for business and personal demands. Each of the types are inspected by professionals and satisfy state and federal demands.

Should you be previously authorized, log in in your bank account and then click the Obtain switch to find the District of Columbia Security Interest Subordination Agreement. Make use of your bank account to check through the legal types you possess acquired formerly. Visit the My Forms tab of your respective bank account and acquire an additional duplicate from the file you will need.

Should you be a whole new end user of US Legal Forms, here are basic guidelines that you can adhere to:

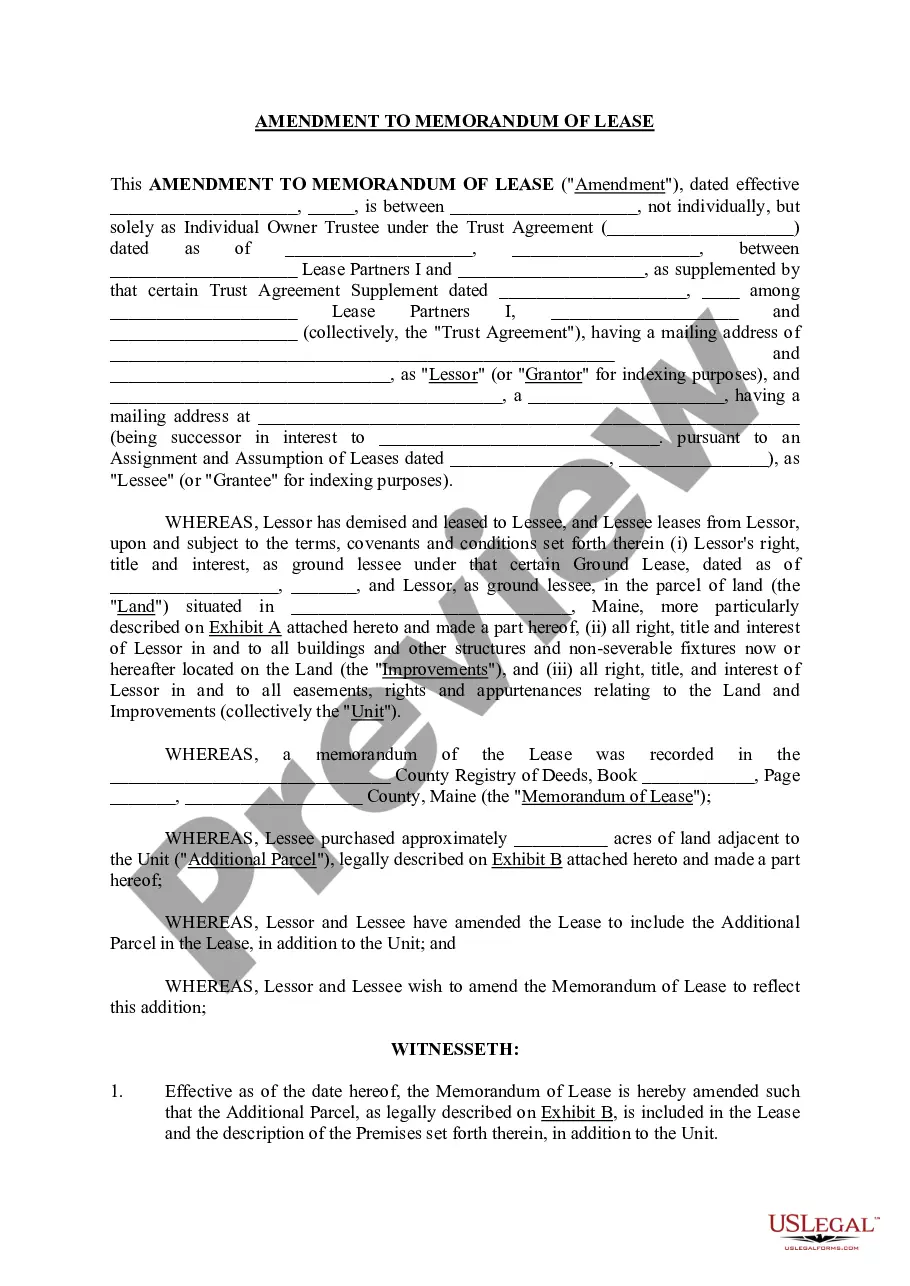

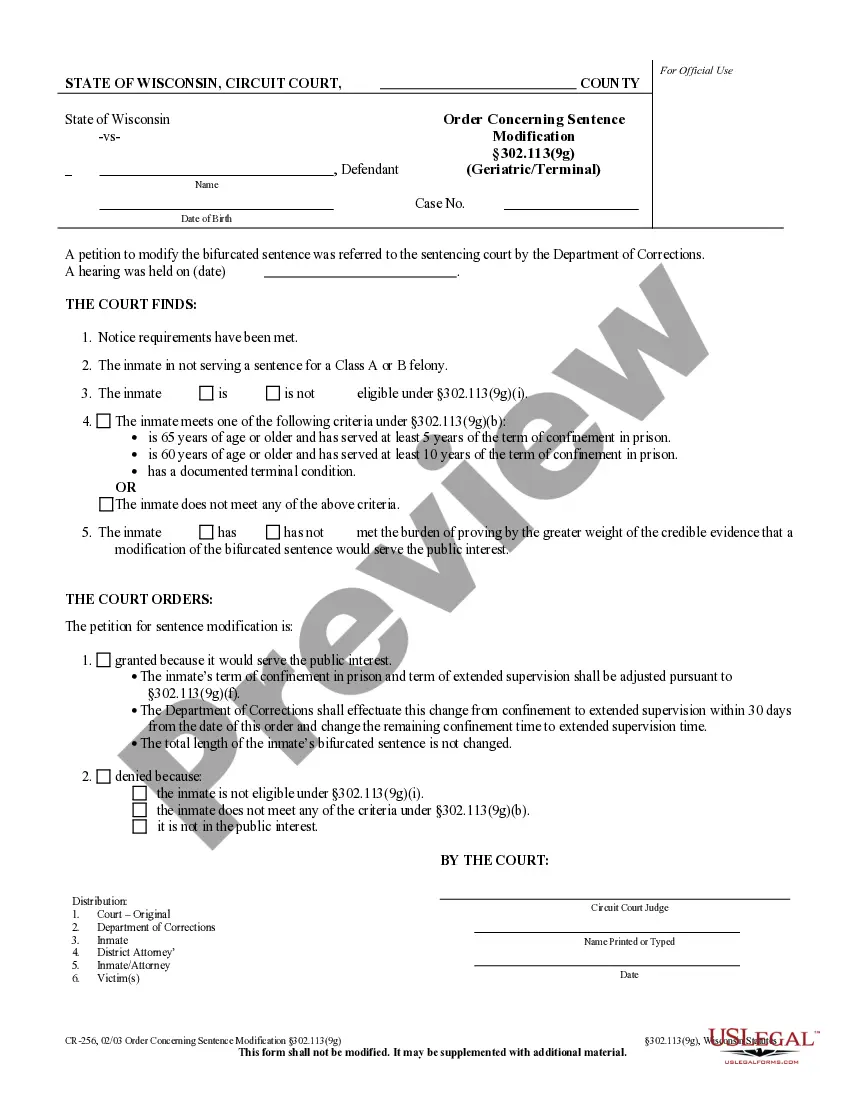

- Initially, be sure you have selected the right type for the town/area. You are able to check out the form utilizing the Review switch and look at the form description to make certain this is basically the right one for you.

- When the type will not satisfy your requirements, use the Seach field to discover the proper type.

- When you are positive that the form would work, go through the Acquire now switch to find the type.

- Pick the pricing strategy you want and enter the necessary details. Build your bank account and buy the transaction with your PayPal bank account or charge card.

- Pick the file structure and acquire the legal file web template in your gadget.

- Total, edit and produce and signal the attained District of Columbia Security Interest Subordination Agreement.

US Legal Forms is the most significant catalogue of legal types where you can discover a variety of file templates. Use the company to acquire skillfully-produced files that adhere to condition demands.

Form popularity

FAQ

Rights and duties of secured party having possession or control of collateral. (a) Except as otherwise provided in subsection (d), a secured party shall use reasonable care in the custody and preservation of collateral in the secured party's possession.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

(The UCC uses the term "authenticate" to include the possibility of electronic signatures.) A security agreement normally will contain a clear statement that the debtor is granting the secured party a security interest in specified goods. The agreement also must provide a description of the collateral.

One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

Security subordination means that the subordinated lender agrees that its security interest in the shared collateral is fully subordinated to the security interest of the senior lender.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.