District of Columbia Living Trust with Provisions for Disability

Description

How to fill out Living Trust With Provisions For Disability?

You may spend numerous hours online attempting to locate the legal document template that meets the state and federal requirements you require.

US Legal Forms provides thousands of legal forms that have been reviewed by experts.

You can effectively obtain or print the District of Columbia Living Trust with Provisions for Disability from my services.

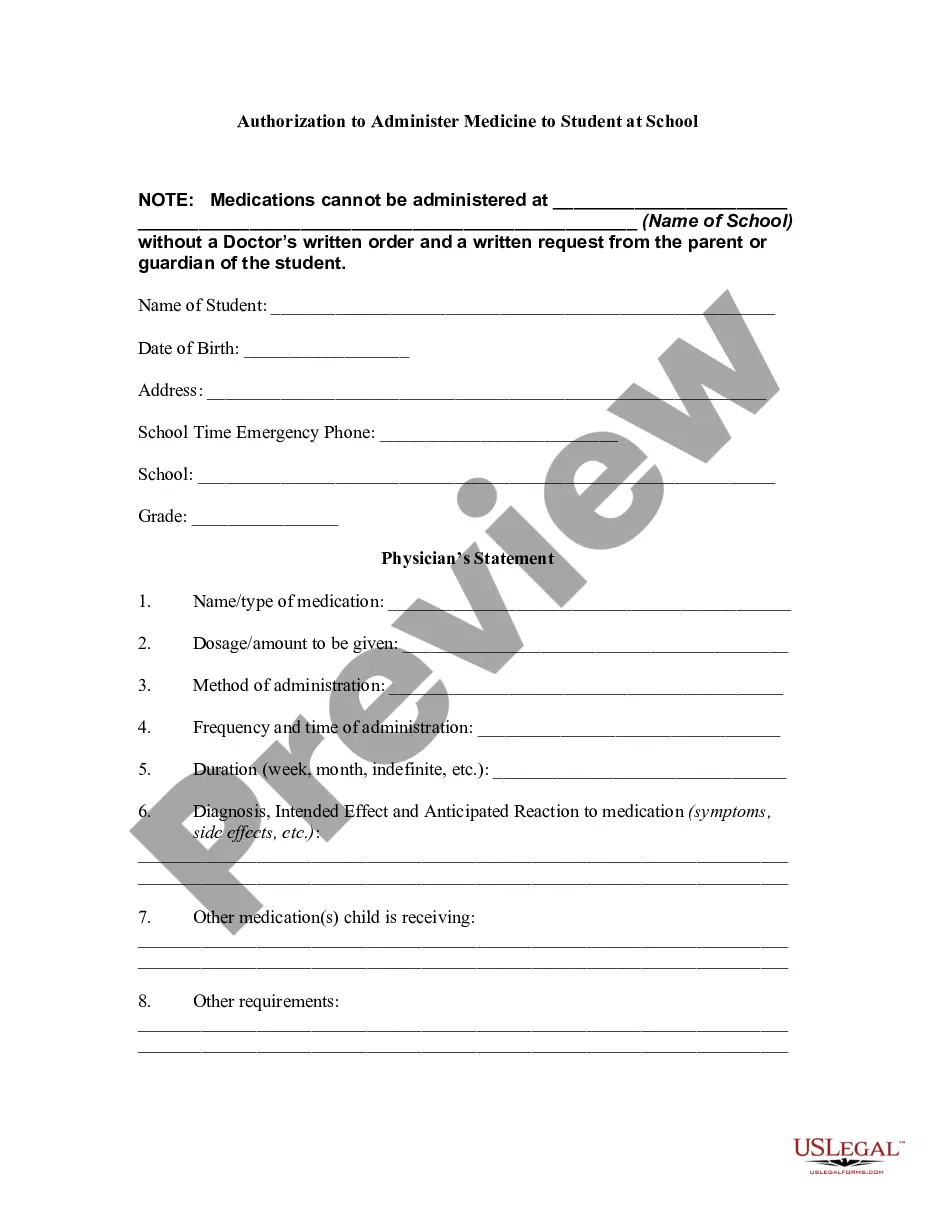

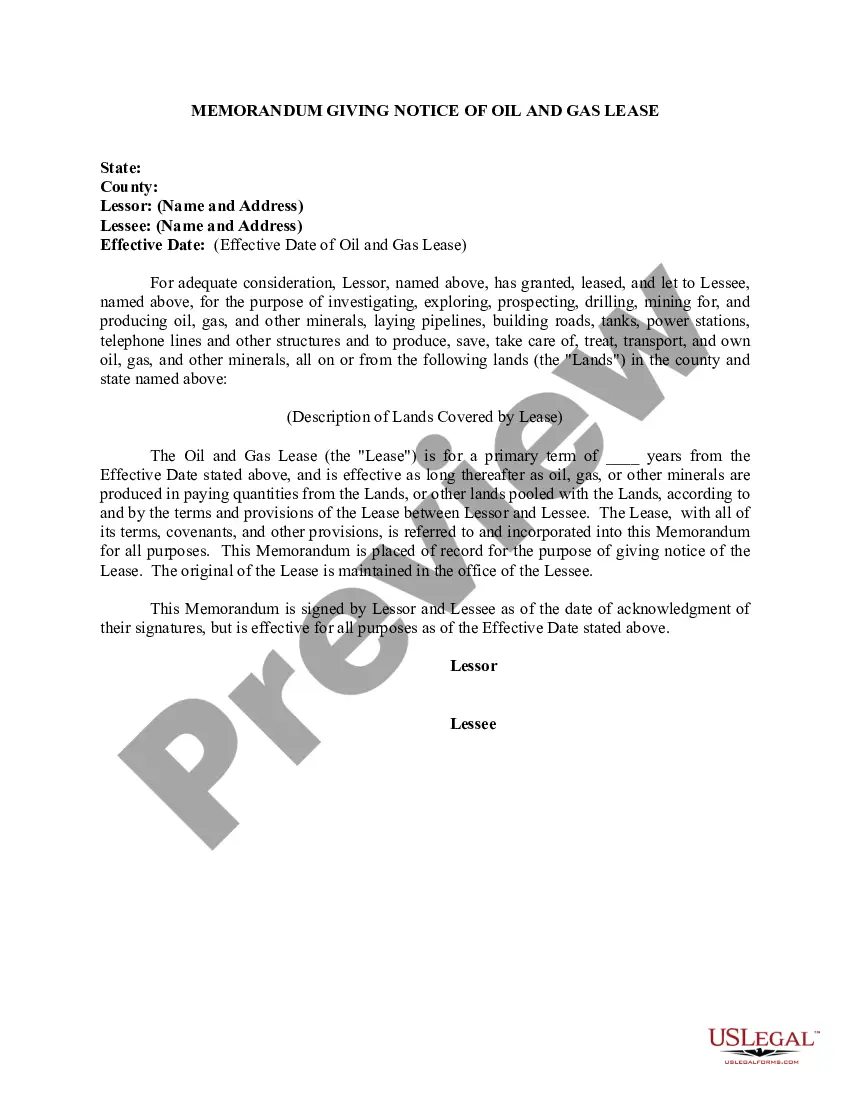

If available, use the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you are able to complete, edit, print, or sign the District of Columbia Living Trust with Provisions for Disability.

- Each legal document template you receive is yours indefinitely.

- To access another version of any purchased document, navigate to the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms site, adhere to the simple guidelines below.

- First, confirm that you have selected the correct document template for the county/city of your choice.

- Review the document description to ensure you have chosen the right form.

Form popularity

FAQ

In a trust, assets are held and managed by one person or people (the trustee) to benefit another person or people (the beneficiary). The person providing the assets is called the settlor. Different kinds of assets can be put in trust, including: cash.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

Establishing a trust requires serious legal help, which is not cheap. A typical living trust can cost $2,000 or more, while a basic last will and testament can be drawn up for about $150 or so.

Steps to Set Up a Living Trust:Decide whether you need a shared trust or an individual trust.Decide what items to leave in the trust.Decide who will inherit your trust property.Choose someone to be your successor trustee.Choose someone to manage property for youngsters.Prepare the trust document.More items...

A Washington, D.C. living trust holds your assets in trust during your life, but you continue to use and control them. After you die, the trust assets are distributed to your chosen beneficiaries. A revocable living trust (also called an inter vivos trust) offers a variety of estate planning benefits.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

To make a living trust in the District of Columbia, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...