The District of Columbia Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trust or is a legal document that aims to protect and provide for the financial well-being of a disabled child. This agreement is specifically tailored to the laws and regulations of the District of Columbia and ensures that the child's needs are met even after the parents or guardians are no longer able to provide for them. Keywords: District of Columbia, special needs, irrevocable trust, agreement, benefit, disabled child, trust or. There are different types of District of Columbia Special Needs Irrevocable Trust Agreements for the Benefit of Disabled Children of the Trust or, depending on the specific needs and circumstances of the child and their family. Some of these variations may include: 1. Third-Party Supplemental Needs Irrevocable Trust Agreement: This type of agreement is established and funded by a third party, such as grandparents or other relatives, to enhance the quality of life and support the disabled child, while still preserving the child's eligibility for government benefits. 2. First-Party Special Needs Irrevocable Trust Agreement: This agreement is created using the assets owned by the disabled child. It is typically utilized when the child receives a legal settlement, inheritance, or any other significant financial resources that could jeopardize their eligibility for means-tested government benefits. 3. Pooled Special Needs Irrevocable Trust Agreement: This type of trust combines the assets of multiple disabled individuals into a common fund, managed by a non-profit organization. It allows beneficiaries to pool their resources while still maintaining eligibility for government assistance programs. 4. Testamentary Special Needs Irrevocable Trust Agreement: This agreement is established through the provisions of a will and only takes effect upon the death of the trust or. It ensures that the disabled child's financial needs are met and protected by the trust assets after the trust or's passing. These different types of District of Columbia Special Needs Irrevocable Trust Agreements provide flexibility and options for families caring for disabled children, enabling them to choose the most suitable approach to secure the child's financial future. Consulting an experienced attorney specializing in special needs planning is crucial to ensure compliance with the District's laws and regulations while maximizing the benefits available to the child.

District of Columbia Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor

Description

How to fill out District Of Columbia Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

US Legal Forms - one of the biggest libraries of authorized types in the United States - provides a wide array of authorized document themes it is possible to down load or print out. While using site, you can find a huge number of types for organization and person functions, categorized by groups, says, or key phrases.You can get the newest versions of types just like the District of Columbia Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor within minutes.

If you already have a subscription, log in and down load District of Columbia Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor through the US Legal Forms library. The Download button will show up on each kind you perspective. You gain access to all earlier delivered electronically types from the My Forms tab of your respective profile.

In order to use US Legal Forms the very first time, here are straightforward guidelines to help you get started off:

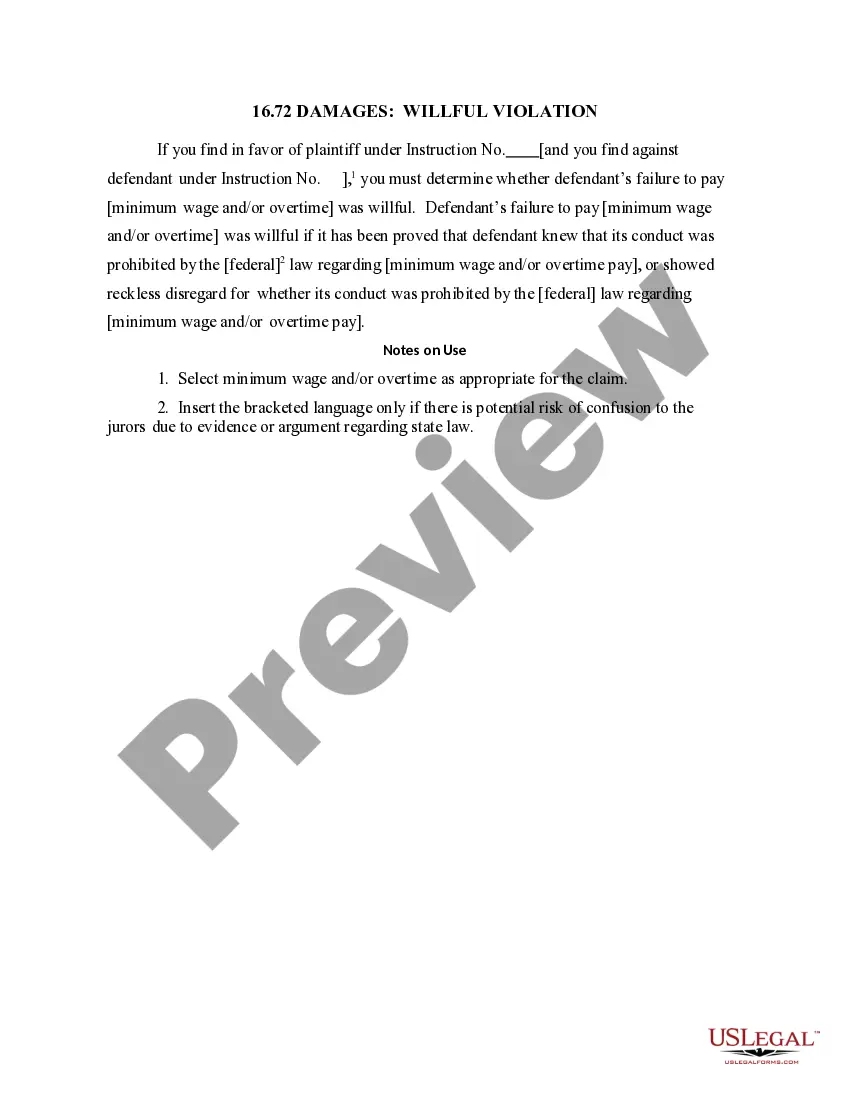

- Be sure to have picked out the proper kind for your city/area. Go through the Preview button to check the form`s articles. See the kind outline to actually have selected the correct kind.

- If the kind doesn`t match your needs, make use of the Research industry towards the top of the screen to obtain the one that does.

- In case you are satisfied with the shape, validate your selection by simply clicking the Get now button. Then, opt for the pricing strategy you like and provide your credentials to sign up to have an profile.

- Method the financial transaction. Make use of bank card or PayPal profile to perform the financial transaction.

- Pick the format and down load the shape on your device.

- Make modifications. Fill up, change and print out and signal the delivered electronically District of Columbia Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor.

Each web template you included in your bank account does not have an expiry date and is also your own permanently. So, in order to down load or print out another duplicate, just visit the My Forms segment and click in the kind you want.

Get access to the District of Columbia Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor with US Legal Forms, probably the most extensive library of authorized document themes. Use a huge number of skilled and condition-distinct themes that meet your company or person needs and needs.