Title: District of Columbia Sample Letter for Reinstatement of Loan — Compromise of Matter Keyword: District of Columbia Loan Reinstatement, Sample Letter, Compromise of Matter Introduction: In the District of Columbia, if you are faced with a loan issue and need to reinstate it after a compromise of matter, it is crucial to follow the proper procedures and communicate effectively with your lender. This article provides a detailed description of what a District of Columbia Sample Letter for Reinstatement of Loan — Compromise of Matter entails, guiding you through the process with relevant information. 1. District of Columbia Loan Reinstatement Process: a. Understand the Compromise of Matter: Before drafting the letter, ensure you fully comprehend the compromise of matter that led to the suspension or modification of your loan. Gather all the necessary documents and information related to the situation to strengthen your case. b. Draft the Sample Letter: i. Heading: Include your name, address, contact information, and the date. ii. Lender's Information: Provide the lender's name, address, and contact details. iii. Proper Salutation: Greet the lender with the appropriate salutation, such as "Dear Mr./Ms./Dr. [Lender's Last Name]." c. Explain the Compromising Circumstances: i. Clearly state the reason behind the compromise of matter that led to the loan's suspension, modification, or termination. ii. Enumerate any extenuating circumstances that caused the compromise, such as unexpected medical expenses, job loss, or natural disasters. d. Demonstrate Efforts to Overcome the Issue: i. Elaborate on the steps taken to address the compromising circumstances and resolve the financial difficulty. ii. Provide evidence of proactive measures you have taken, such as attending financial counseling, securing a new job, or creating a revised repayment plan. e. Request Loan Reinstatement: Clearly state your intent to reinstate the loan and express a genuine commitment to meet the loan obligations. Include the proposed terms and conditions you are willing to adhere to ensure successful loan reinstatement. f. Additional Documentation if required: Attach any supporting documents, such as financial statements, letters of recommendation, or proof of rehabilitation, to strengthen your case for loan reinstatement. 2. Different Types of District of Columbia Sample Letters: a. District of Columbia Sample Letter for Reinstatement of Loan due to Medical Emergency b. District of Columbia Sample Letter for Reinstatement of Loan after Job Loss c. District of Columbia Sample Letter for Reinstatement of Loan following Natural Disaster d. District of Columbia Sample Letter for Reinstatement of Loan due to Financial Hardship Conclusion: In the District of Columbia, drafting a District of Columbia Sample Letter for Reinstatement of Loan — Compromise of Matter is crucial to effectively communicate your intentions and resolve loan suspensions, modifications, or terminations resulting from compromising circumstances. By following the provided guidelines and tailoring the letter to your specific situation, you can increase your chances of successfully reinstating your loan and getting back on track financially.

District of Columbia Sample Letter for Reinstatement of Loan - Compromise of Matter

Description

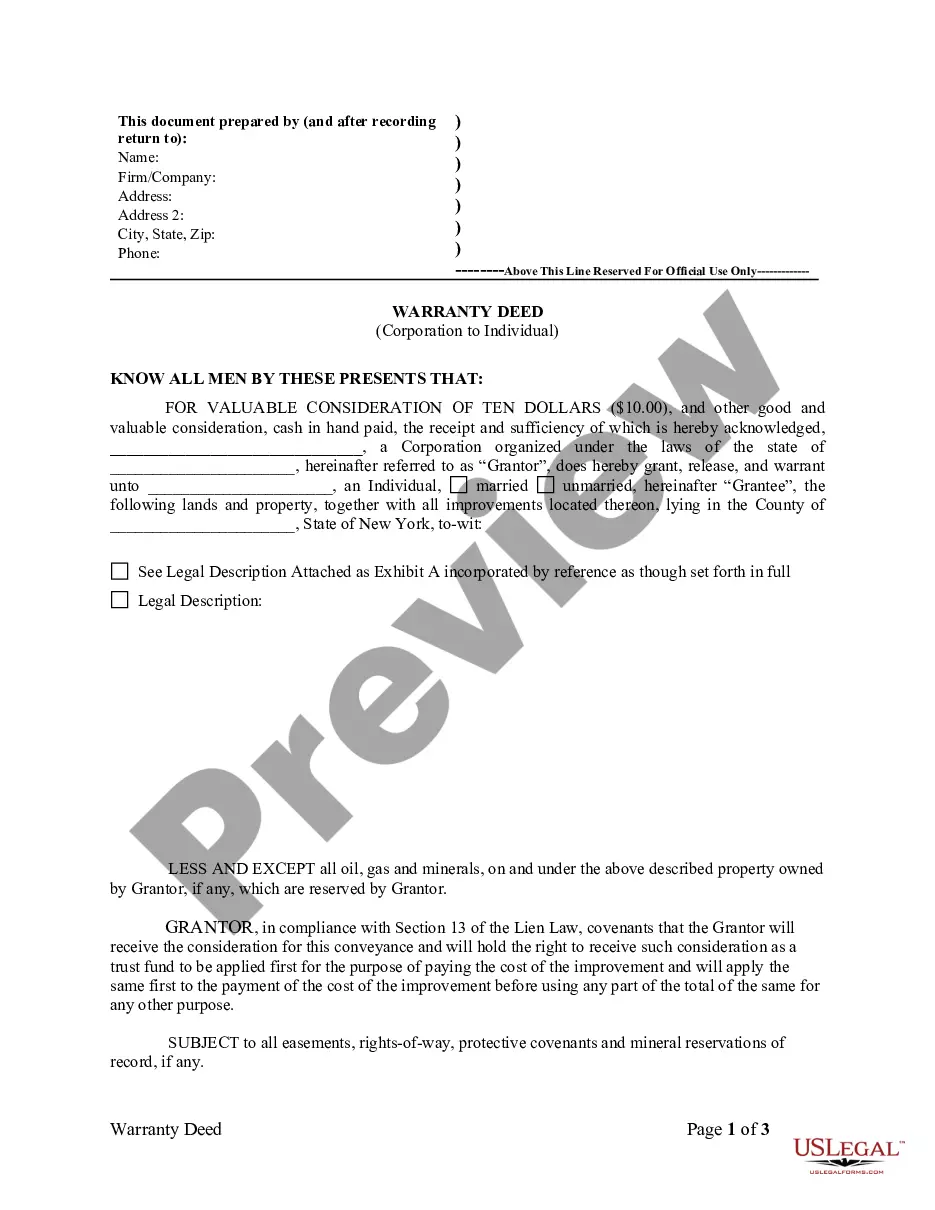

How to fill out Sample Letter For Reinstatement Of Loan - Compromise Of Matter?

Are you currently in a situation that you will need documents for possibly enterprise or person purposes nearly every working day? There are a variety of authorized document themes available on the Internet, but locating kinds you can depend on is not easy. US Legal Forms provides a huge number of develop themes, such as the District of Columbia Sample Letter for Reinstatement of Loan - Compromise of Matter, which are written in order to meet federal and state needs.

If you are presently knowledgeable about US Legal Forms website and have a free account, basically log in. Next, you are able to download the District of Columbia Sample Letter for Reinstatement of Loan - Compromise of Matter design.

If you do not provide an account and would like to begin using US Legal Forms, abide by these steps:

- Get the develop you will need and ensure it is for the right town/region.

- Utilize the Preview key to check the form.

- See the outline to ensure that you have selected the correct develop.

- When the develop is not what you`re seeking, utilize the Research discipline to obtain the develop that fits your needs and needs.

- If you discover the right develop, click Purchase now.

- Opt for the rates program you want, fill in the specified information to generate your money, and buy the order with your PayPal or Visa or Mastercard.

- Select a handy data file formatting and download your copy.

Locate each of the document themes you have purchased in the My Forms menu. You may get a extra copy of District of Columbia Sample Letter for Reinstatement of Loan - Compromise of Matter at any time, if needed. Just select the essential develop to download or produce the document design.

Use US Legal Forms, one of the most considerable selection of authorized kinds, to save lots of time and avoid errors. The assistance provides appropriately manufactured authorized document themes that can be used for a range of purposes. Create a free account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

Negotiating a ReinstatementDefaulting property owners can also negotiate reinstatement of their mortgage loans with their lenders. Negotiating a reinstatement of a defaulted mortgage with that loan's lender is a bit more involved than simply paying all missed payments and late fees though.

Mortgage reinstatement, sometimes called loan reinstatement, is the process of restoring your mortgage after a mortgage default by paying the total amount past due. You will arrive at the point of a mortgage default after missing payments for several months.

Write your own explanation letter. For example: Date: To Whom it may concern, I am applying for reinstatement because I (state your violation) during the semester. This happened because (provide the reason especially emphasizing any circumstances beyond your control).

A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured individual or business files a claim due to previous loss or damage. Reinstatement clauses don't usually reset a policy's terms, but they do allow the policy to restart coverage for future claims.

Reinstatement in the insurance industry means a person's previously terminated policy can resume if the already insured meets the specific requirements for reinstatement. Typically insurance companies offer policyholders a grace period for late payments before a policy terminates.

Verify Previous Employment. Call the human resources department for the name of the senior recruiter, HR manager or the hiring manager for the job for which you're applying.Contact Former Supervisor.Write Introduction.Describe Skills and Company Knowledge.Ask for an Interview.

How to write a reinstatement letterKnow who you're writing to.Look at the current job openings.Start with a friendly introduction.State the reason for writing.Explain why they should hire you.Conclude with a call to action.Include your contact information.

Reinstatement period is a phase where a borrower has an opportunity to stop a foreclosure by paying money which the borrower owes to a lender. The mortgage reinstatement period begins when the lender files legal document with the court to start foreclosure proceedings.

You may be able to get it back by reinstating your loan. Typically, you do this by bringing your loan up-to-date with a lump-sum payment that covers all past due payments, fees, and late charges. Your right to reinstatement might be built into your loan contract, or state law may require your lender to allow it.

The deadline for reinstating your loan is 90 days after you were served with a foreclosure notice. By this deadline, you will be required to make up the missed payments and pay other fees and expenses.