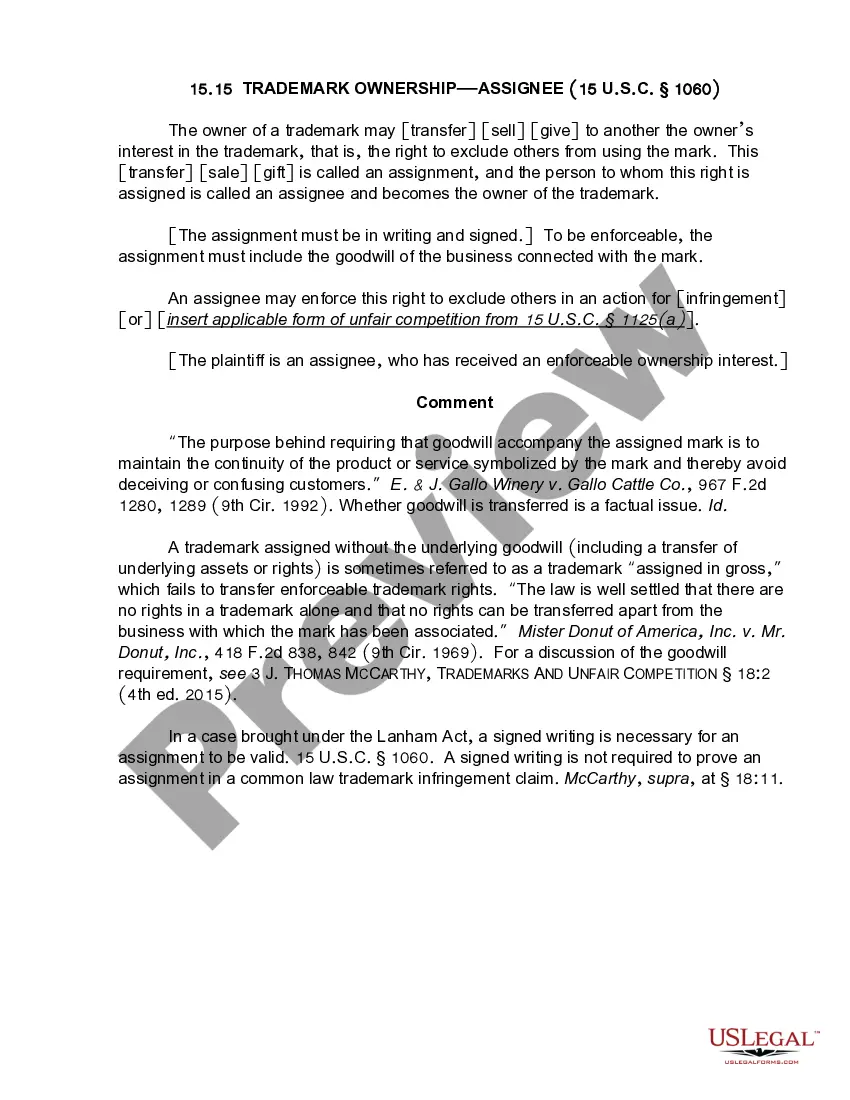

The District of Columbia Loan Commitment Agreement Letter is a legal document that clarifies the terms and conditions for a loan commitment made between a lender and a borrower in the District of Columbia. This agreement letter formally outlines the specifics of the loan, including the amount, interest rate, repayment terms, and any additional terms and conditions that both parties have agreed upon. The purpose of the District of Columbia Loan Commitment Agreement Letter is to provide a written record of the loan commitment terms to ensure that both the lender and the borrower are aware of their responsibilities and obligations. This letter helps protect the interests of both parties, as it establishes a clear understanding of the loan commitment and serves as a reference document throughout the loan process. The District of Columbia Loan Commitment Agreement Letter may vary based on the type of loan being committed to. Here are some different types of loan commitment letters that may exist within the District of Columbia: 1. Residential Mortgage Loan Commitment Agreement: This type of commitment letter is used in real estate transactions involving residential properties. It outlines the terms and conditions of the mortgage loan, including the loan amount, interest rate, loan duration, and any contingencies related to property appraisal or title search. 2. Commercial Loan Commitment Agreement: This commitment letter is specific to commercial loans, which are typically used for business purposes. It details the loan amount, interest rate, loan term, repayment schedule, collateral requirements, and any other provisions related to the specific commercial endeavor. 3. Construction Loan Commitment Agreement: Construction loans are used to finance the construction or renovation of properties. This commitment letter outlines the loan terms applicable during the construction process, such as disbursement schedules, draw conditions, interest accrual, and inspection requirements. 4. Small Business Administration (SBA) Loan Commitment Agreement: SBA loans are guaranteed by the U.S. Small Business Administration. This type of commitment agreement letter details the terms surrounding SBA loans, including loan amounts, interest rates, repayment terms, and specific requirements set forth by the SBA for eligibility. In summary, the District of Columbia Loan Commitment Agreement Letter is a crucial legal document that ensures both lenders and borrowers in the District of Columbia have a clear understanding of the terms and conditions of a loan commitment. It provides security and protection for both parties involved throughout the loan process, and various types of commitment letters exist depending on the nature of the loan.

District of Columbia Loan Commitment Agreement Letter

Description

How to fill out District Of Columbia Loan Commitment Agreement Letter?

US Legal Forms - one of several greatest libraries of legal kinds in the States - gives a wide range of legal record themes it is possible to download or print out. Utilizing the website, you may get a huge number of kinds for business and individual uses, sorted by groups, suggests, or key phrases.You will discover the most recent models of kinds just like the District of Columbia Loan Commitment Agreement Letter in seconds.

If you have a registration, log in and download District of Columbia Loan Commitment Agreement Letter from your US Legal Forms library. The Acquire key will show up on every single type you view. You gain access to all previously delivered electronically kinds within the My Forms tab of the accounts.

In order to use US Legal Forms the first time, listed below are simple directions to help you get started off:

- Ensure you have chosen the right type to your metropolis/area. Click on the Review key to analyze the form`s content material. Look at the type outline to ensure that you have selected the right type.

- In the event the type doesn`t fit your requirements, take advantage of the Look for field near the top of the monitor to get the the one that does.

- Should you be satisfied with the form, verify your option by clicking on the Buy now key. Then, choose the pricing prepare you like and provide your accreditations to register for the accounts.

- Process the deal. Use your credit card or PayPal accounts to perform the deal.

- Choose the format and download the form on your device.

- Make alterations. Fill up, edit and print out and sign the delivered electronically District of Columbia Loan Commitment Agreement Letter.

Every web template you put into your account lacks an expiration time which is your own property for a long time. So, if you would like download or print out yet another backup, just go to the My Forms segment and click on about the type you will need.

Gain access to the District of Columbia Loan Commitment Agreement Letter with US Legal Forms, probably the most extensive library of legal record themes. Use a huge number of expert and condition-distinct themes that satisfy your company or individual demands and requirements.

Form popularity

FAQ

A commitment letter is typically not the final approval for a loan or financing. While a commitment letter indicates that a lender is willing to provide funding, it is usually contingent upon certain conditions being met.

Legal impact A signed letter of commitment is a legally binding document. If you break the agreement, the other party can take legal action against you. A signed letter of intent is not legally binding.

What is a Letter of Commitment? A letter of commitment is a formal binding agreement between a lender and a borrower. It outlines the terms and conditions of the loan and the nature of the prospective loan. It serves as the agreement that initiates an official loan borrowing process.

How Long Does it Take to Get a Mortgage Commitment Letter? Exactly when you'll receive the letter varies, but it typically takes between 20 and 45 days. The commitment letter is issued after you submit your application with all the required documents, such as pay stubs, bank statements, etc.

A mortgage commitment letter includes the amount being borrowed, the interest rate, and the length of the loan. There will also be conditions attached, such as the requirement to carry homeowner's insurance. A lender can still deny a loan at closing if these conditions have not been met.

A mortgage commitment letter is not the same as final approval, but it shows that you're in a good position to buy a home. Once you make an offer on a home and the seller accepts it, you can move on to the full application process, which involves a more in-depth review of your finances and the property you want to buy.

A loan commitment is an agreement by a commercial bank or other financial institution to lend a business or individual a specified sum of money.

A loan commitment is a letter from a lender indicating your eligibility for a home loan. In essence, it is the lender's promise to fund the loan as stated by the terms in the letter. You receive a loan commitment letter once your application has been reviewed and the underwriting process is complete.