The District of Columbia Legend on Stock Certificate Giving Notice of Restriction on Transfer refers to a legal requirement stating that a stockholder must first offer their shares for purchase to the corporation before making an offer to other stockholders. This restriction is enforced due to a stock redemption agreement, which outlines the procedure for the repurchase of shares. The purpose behind this legend is to protect the interests of the corporation and existing stockholders by ensuring that they have the opportunity to purchase the shares before they are offered to outsiders. This provision helps maintain control and stability within the company, preventing undesired ownership changes or potential dilution of shares. There are various types of District of Columbia Legends on Stock Certificates Giving Notice of Restriction on Transfer. Some common variations include: 1. First Offer to the Corporation: This type of legend states that before the shareholder can sell their shares externally, they must provide a written offer to the corporation offering the same terms as the proposed external sale. The company then has the right to exercise its option to repurchase the shares within a specified time period. 2. Offer to other Stockholders: In addition to the requirement to offer shares to the corporation, this legend stipulates that if the corporation does not exercise its option to repurchase the shares, the shareholder must then offer the shares to existing stockholders based on predetermined criteria, such as proportional ownership or seniority. 3. Restriction on Transfer: This general type of legend notifies any potential buyers that the shares are subject to restrictions on transfer, emphasizing that the sale cannot proceed without complying with the stock redemption agreement and following the proper procedure. These legends play a significant role in ensuring compliant share transfers and maintaining the integrity of the stockholder structure within the corporation. By giving notice of the restriction on transfer and outlining the required process, they add transparency to the stock market, safeguarding the interests of all parties involved.

District of Columbia Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description

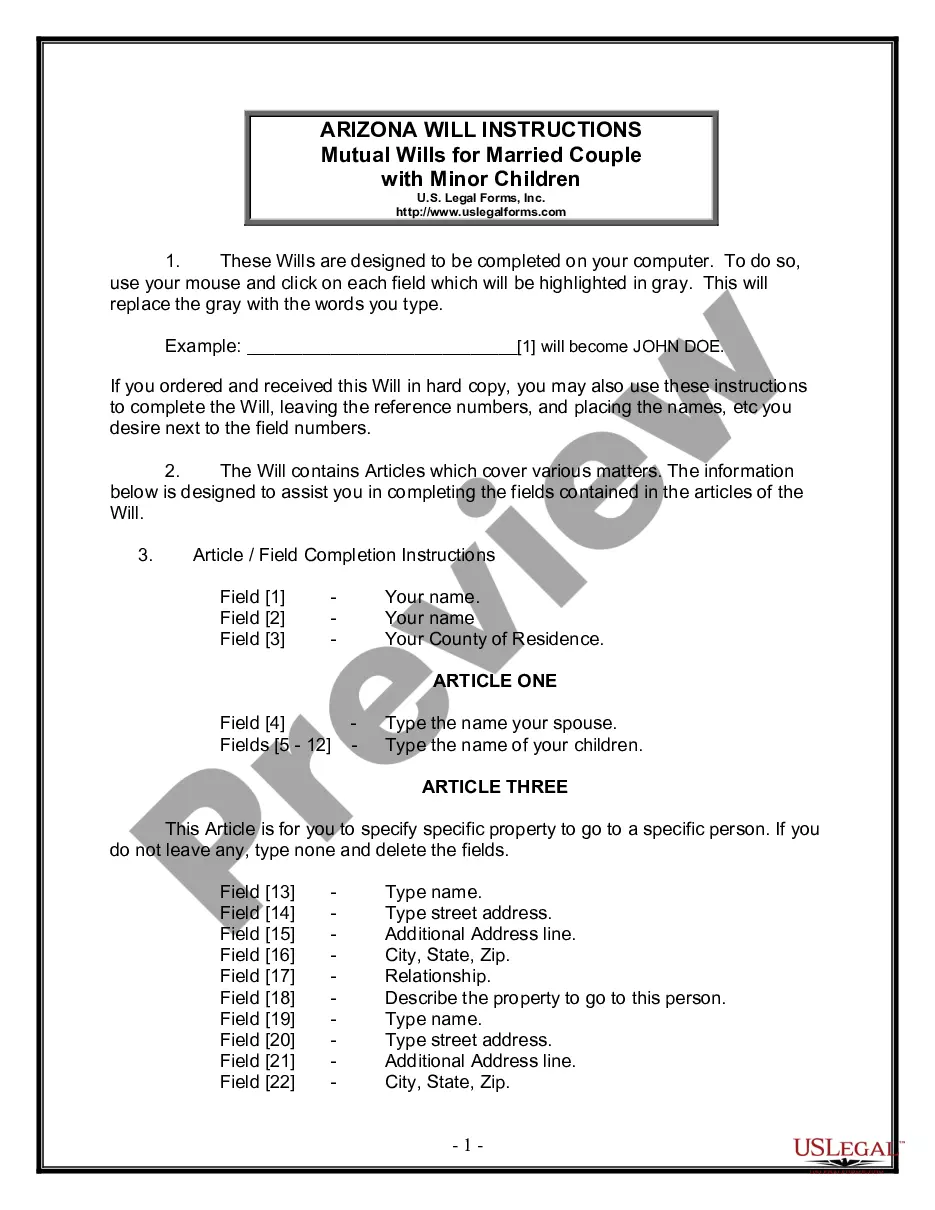

How to fill out District Of Columbia Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

US Legal Forms - one of several biggest libraries of authorized types in America - gives a variety of authorized document themes you can obtain or printing. Making use of the site, you will get thousands of types for business and personal purposes, sorted by classes, suggests, or key phrases.You can find the latest versions of types much like the District of Columbia Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders in seconds.

If you already have a monthly subscription, log in and obtain District of Columbia Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders from your US Legal Forms library. The Down load option will show up on every type you look at. You have access to all in the past downloaded types within the My Forms tab of your respective profile.

If you would like use US Legal Forms for the first time, here are basic guidelines to get you started:

- Be sure to have picked the proper type for the metropolis/region. Go through the Preview option to examine the form`s articles. Read the type explanation to actually have selected the right type.

- In the event the type doesn`t fit your needs, take advantage of the Look for field on top of the monitor to find the one which does.

- When you are satisfied with the shape, confirm your decision by clicking the Acquire now option. Then, select the prices program you prefer and provide your references to register on an profile.

- Approach the financial transaction. Make use of your credit card or PayPal profile to complete the financial transaction.

- Pick the formatting and obtain the shape on the system.

- Make adjustments. Load, change and printing and indicator the downloaded District of Columbia Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders.

Every web template you included with your bank account lacks an expiry time and is the one you have for a long time. So, if you wish to obtain or printing yet another copy, just go to the My Forms section and then click on the type you will need.

Gain access to the District of Columbia Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders with US Legal Forms, the most considerable library of authorized document themes. Use thousands of skilled and status-specific themes that meet up with your business or personal demands and needs.

Form popularity

FAQ

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.

How to complete a stock transfer form in 10 Steps 1 Consideration money. ... 2 Full name of Undertaking. ... 3 Full description of Security. ... 4 Number or amount of Shares, Stock or other security. ... 5 Name(s) and address of registered holder(s) ... 6 Signature(s) ... 7 Name(s) and address of person(s) receiving the shares. Stock transfer form J30 template and guide - Inform Direct informdirect.co.uk ? shares ? how-to-compl... informdirect.co.uk ? shares ? how-to-compl...

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal. Using stock certificates to help your business grow | .com ? articles ? using-stock-certif... .com ? articles ? using-stock-certif...

In the Stock Transfer Ledger, the names of the shareholders can be listed along with important information such as their places of residence, the time that they gained ownership within the corporation, the number of shares issued, the amount paid for the shares, and the stock certificate number that was distributed (if ... Sample Stock Transfer Ledger | Harvard Business Services Harvard Business Services ? blog ? sample-stock-tr... Harvard Business Services ? blog ? sample-stock-tr...

Key information on a share certificate includes: Certificate number. Company name and registration number. Shareholder name and address. Number of shares owned. Class of shares. Issue date of shares. Amount paid (or treated as paid) on the shares. Share Certificate: Definition, How They Work, and Key Information investopedia.com ? terms ? share-certificate investopedia.com ? terms ? share-certificate