The District of Columbia Investment Club Partnership Agreement is a legally binding document that outlines the rules, regulations, and obligations for members of an investment club based in the District of Columbia. This agreement serves as a framework for collaboration and decision-making among club members who pool their resources to invest in various financial instruments and opportunities. The main purpose of the District of Columbia Investment Club Partnership Agreement is to establish clear guidelines regarding the club's structure, management, and allocation of profits and losses. It typically covers important aspects such as: 1. Club Structure: The agreement defines the club's legal structure, usually in the form of a partnership. This includes outlining the roles and responsibilities of each member, as well as the decision-making process within the club. 2. Contributions and Membership: It specifies the minimum and maximum amount each member is required to contribute to the club's investment fund. Eligibility criteria for membership, including any restrictions or prerequisites, are also outlined. 3. Allocations and Distributions: The agreement details how profits, losses, and investment returns are distributed among members. It may establish a specific allocation formula, taking into consideration factors such as the size of each member's contribution or duration of membership. 4. Decision-Making Process: The agreement outlines the voting rights and decision-making procedures within the investment club. It may establish rules regarding the frequency and format of meetings, as well as the percentage of members' votes required to approve investment decisions. 5. Dissolution and Exit Strategies: In the event that the investment club needs to be dissolved or a member wants to exit, the agreement outlines the procedures for liquidating assets, settling liabilities, and distributing remaining funds. It is important to note that while the District of Columbia Investment Club Partnership Agreement provides a general framework, it can be customized to meet the specific needs and preferences of the club members. Different investment clubs within the District of Columbia may have variations of the agreement based on their specific investment strategies, objectives, and risk tolerance. For example, some investment clubs may focus on long-term stock market investments, while others might prefer real estate or alternative investments. Therefore, the District of Columbia Investment Club Partnership Agreement can be tailored accordingly to incorporate provisions specific to these investment types. In summary, the District of Columbia Investment Club Partnership Agreement is a comprehensive legal document that governs the operations, responsibilities, and decision-making processes within an investment club. By defining the roles, rules, and financial arrangements, this agreement helps ensure transparency, accountability, and harmonious collaboration among club members.

District of Columbia Investment Club Partnership Agreement

Description

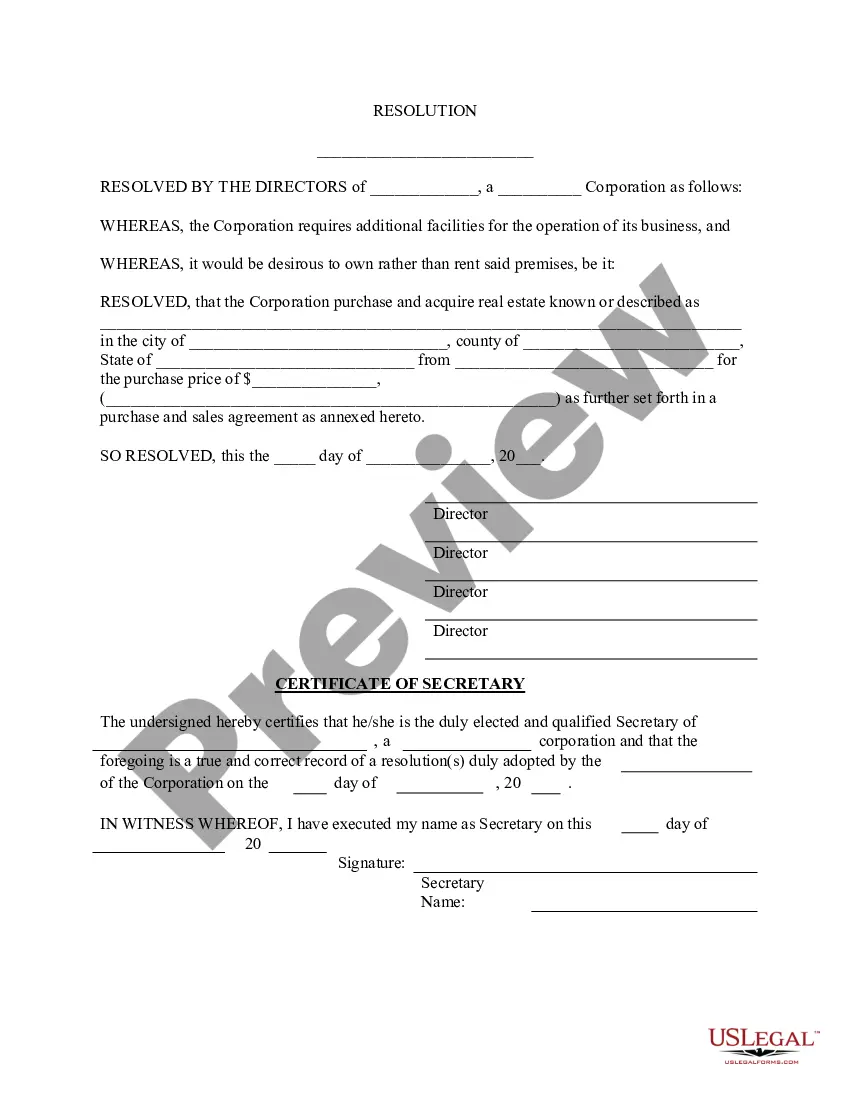

How to fill out Investment Club Partnership Agreement?

If you want to complete, download, or print out authorized papers web templates, use US Legal Forms, the greatest assortment of authorized forms, that can be found on the web. Utilize the site`s easy and practical research to find the papers you want. A variety of web templates for enterprise and personal functions are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to find the District of Columbia Investment Club Partnership Agreement in a couple of clicks.

If you are already a US Legal Forms customer, log in for your account and click on the Download button to find the District of Columbia Investment Club Partnership Agreement. You may also gain access to forms you in the past saved inside the My Forms tab of the account.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for the correct metropolis/region.

- Step 2. Take advantage of the Preview solution to examine the form`s content. Never neglect to learn the explanation.

- Step 3. If you are unhappy using the form, make use of the Look for area at the top of the screen to find other models of your authorized form template.

- Step 4. Once you have found the form you want, select the Acquire now button. Choose the rates prepare you favor and put your references to sign up to have an account.

- Step 5. Approach the deal. You may use your credit card or PayPal account to accomplish the deal.

- Step 6. Choose the format of your authorized form and download it on the system.

- Step 7. Total, change and print out or indicator the District of Columbia Investment Club Partnership Agreement.

Every authorized papers template you acquire is yours for a long time. You have acces to every single form you saved inside your acccount. Go through the My Forms area and choose a form to print out or download again.

Compete and download, and print out the District of Columbia Investment Club Partnership Agreement with US Legal Forms. There are millions of skilled and express-certain forms you can utilize for your personal enterprise or personal requirements.

Form popularity

FAQ

To create a partnership agreement, start by defining the purpose and goals of your business. Then, outline each partner's contributions, responsibilities, and profit-sharing arrangements, particularly within the context of a District of Columbia Investment Club Partnership Agreement. It is also wise to consult legal resources, like USLegalForms, to ensure compliance with local laws.

When you start an investment club, you are starting a business and you need to decide on what type of business operating structure you will use. Different business types have different operating, federal and state reporting and taxation requirements. We recommend you operate as a general partnership.

Investment Clubs That Buy and Sell TogetherMembers of clubs that invest in a single portfolio often form a legal partnership or a limited liability company (LLC) or partnership (LLP).

Investment Clubs That Buy and Sell TogetherMembers of clubs that invest in a single portfolio often form a legal partnership or a limited liability company (LLC) or partnership (LLP).

Step 1: Find Potential Members for Your Stock Investment Club.Step 2: Hold Meetings With Potential Members to Organize.Step 3: Form a Legal Entity and Create a Partnership Agreement.Step 4: Establish Club Operating Procedures.Step 5: Open a Brokerage Account for Investing in the Stock Market.More items...?

You can think of an investment club as a small-scale mutual fund where decisions are made by a committee of non-professional club members. Clubs can be informal or established as a legal entity such as a partnership. Either way, the club may be subject to regulatory oversight and must account for taxes properly.

An investment club refers to a group of people who pool their money to make investments. Usually, investment clubs are organized as partnershipsafter the members study different investments, the group decides to buy or sell based on a majority vote of the members.

A partnership is classified as an investment partnership if at least 90 percent of its assets are investments in stocks, bonds, options, and similar intangible assets, and at least 90 percent of its income is derived from that kind of asset.

A partnership agreement is the legal document that dictates the way a business is run and details the relationship between each partner.

Investment clubs will usually form a legal entity, such as a partnership or limited liability company (LLC).