Title: District of Columbia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code Keywords: District of Columbia, minutes of meeting, special meeting, board of directors, corporation, stock ownership plan, Section 1244, Internal Revenue Code Introduction: In accordance with the regulations set forth by the District of Columbia, this document presents a detailed description of the Minutes of a Special Meeting of the Board of Directors of (Name of Corporation) held to adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. This meeting serves as a crucial step in implementing a strategic plan to ensure enhanced employee motivation, ownership, and the possibility of potential tax benefits. Types of District of Columbia Minutes of Special Meeting to Adopt Stock Ownership Plan: 1. Regular District of Columbia Minutes of Special Meeting of the Board of Directors 2. Emergency District of Columbia Minutes of Special Meeting of the Board of Directors 3. Virtual District of Columbia Minutes of Special Meeting of the Board of Directors 4. Adjourned District of Columbia Minutes of Special Meeting of the Board of Directors Detailed Description: I. Meeting Date, Time, and Location: The Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code was held on [Date] at [Time] in [Location]. The meeting was called to order by the (Title of the Chairman/President) at exactly [Time]. II. Attendance: The following directors were present at the meeting: 1. (Name of Director) 2. (Name of Director) 3. (Name of Director) 4. (Name of Director) ... [Include all directors and their titles] III. Quorum Determination: The Chairman/President verified that a quorum was present, constituting a majority of the directors. The meeting, therefore, proceeded accordingly. IV. Call to Order and Purpose: The Chairman/President formally called the meeting to order and stated the purpose, which was to discuss and adopt a Stock Ownership Plan as authorized by Section 1244 of the Internal Revenue Code. V. Presentation and Discussion of Stock Ownership Plan: The Board of Directors was presented with a comprehensive plan, outlining the details, objectives, and benefits of implementing a stock ownership plan. Clarifications and discussions regarding the plan were facilitated to address any concerns or queries raised by the directors. VI. Voting and Adoption: Following the presentation and discussion, a motion was made to adopt the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. The motion was seconded by (Director's Name) and then put to a vote. The vote resulted in [number of votes in favor]/[total votes cast] in favor of adopting the plan. VII. Resolutions and Approval: Upon the successful adoption of the Stock Ownership Plan, the following resolutions were approved by the Board of Directors: 1. Approval of the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. 2. Designation of (Name of Official) as the administrator of the plan. 3. Authorization to implement the necessary administrative processes and actions for the successful execution of the plan. VIII. Adjournment: With no further business to discuss, the Chairman/President announced the closing of the Special Meeting at [Time]. The minutes of the meeting were recorded by (Secretary's Name). Conclusion: These detailed Minutes of the Special Meeting of the Board of Directors highlight the adoption of a Stock Ownership Plan under Section 1244 of the Internal Revenue Code by (Name of Corporation). By implementing this plan, the company aims to foster employee engagement, motivation, and potential tax benefits. These minutes ensure the transparent documentation of the meeting's proceedings, resolutions, and approvals in accordance with the regulations of the District of Columbia.

District of Columbia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

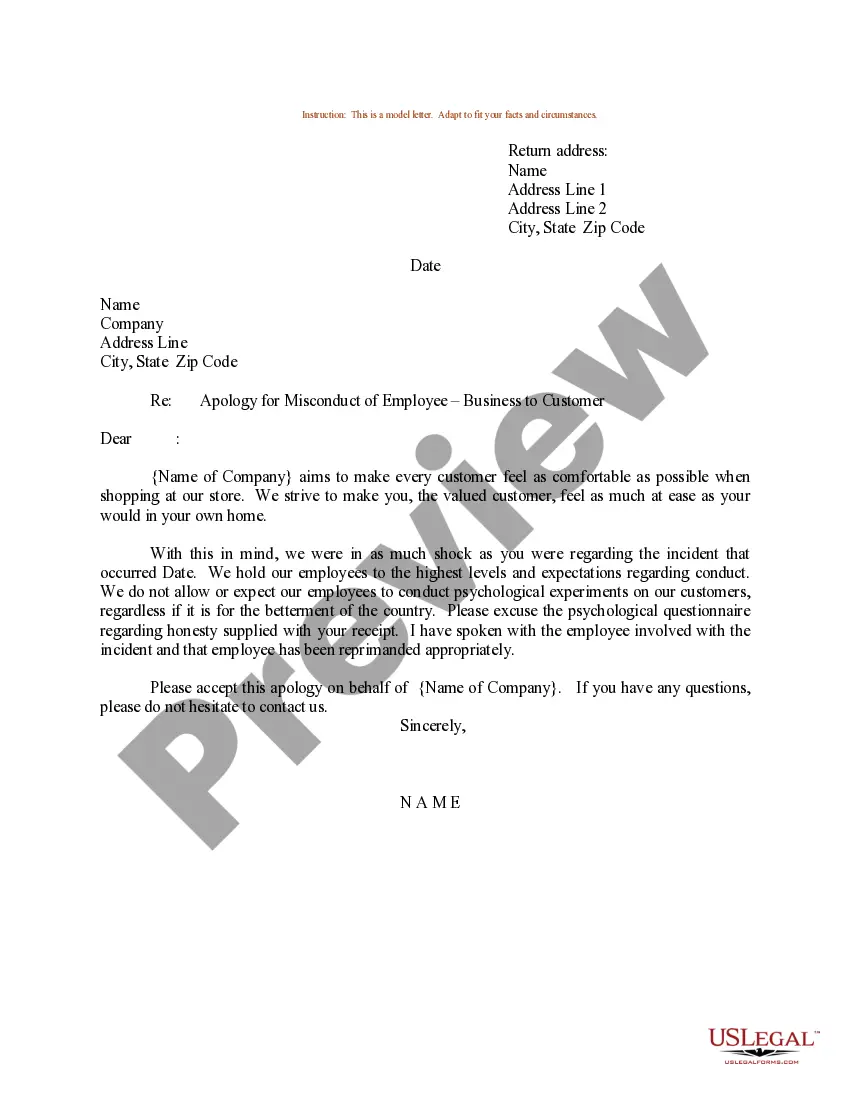

How to fill out District Of Columbia Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

US Legal Forms - one of several greatest libraries of legitimate types in America - offers an array of legitimate papers templates you are able to download or produce. Using the internet site, you will get a huge number of types for business and person uses, sorted by classes, says, or keywords.You can get the newest versions of types like the District of Columbia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code in seconds.

If you have a monthly subscription, log in and download District of Columbia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code from the US Legal Forms collection. The Acquire button will appear on every develop you view. You have accessibility to all formerly acquired types within the My Forms tab of your own accounts.

If you would like use US Legal Forms the very first time, listed here are easy directions to help you started:

- Be sure you have picked out the right develop for your personal metropolis/area. Select the Preview button to review the form`s information. Browse the develop explanation to ensure that you have chosen the correct develop.

- When the develop does not satisfy your requirements, utilize the Research area near the top of the monitor to get the the one that does.

- When you are pleased with the shape, confirm your decision by visiting the Buy now button. Then, select the prices prepare you want and give your credentials to register for the accounts.

- Procedure the purchase. Use your bank card or PayPal accounts to complete the purchase.

- Pick the format and download the shape on your own system.

- Make alterations. Load, edit and produce and indicator the acquired District of Columbia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

Each and every template you included with your account does not have an expiration day which is your own for a long time. So, if you want to download or produce another copy, just go to the My Forms segment and then click in the develop you want.

Gain access to the District of Columbia Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code with US Legal Forms, one of the most substantial collection of legitimate papers templates. Use a huge number of professional and status-certain templates that meet your organization or person requires and requirements.

Form popularity

FAQ

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

What information must a corporate charter include regarding the company's stock? Par value; Classes and series; Number of shares.

1244 losses are allowed for NOL purposes without being limited by nonbusiness income. An annual limitation is imposed on the amount of Sec. 1244 ordinary loss that is deductible. The maximum deductible loss is $50,000 per year ($100,000 if a joint return is filed) (Sec.

Under Section 1244, an individual stockholder of a corporation can claim an ordinary (rather than capital) loss of up to $50,000 per year (or $100,000 for on a joint return) from the sale or worthlessness of Section 1244 stock. For most stockholders, an ordinary loss is much more beneficial than a capital loss.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Section 1244 stock refers to the tax treatment of qualified restricted shares. Section 1244 stock allows firms to report certain capital losses as ordinary losses for tax purposes. This lets new or smaller companies take advantage of lower effective tax rates and increased deductions.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

The determination of whether stock qualifies as Section 1244 stock is made at the time of issuance. Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test.

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

To qualify under Section 1244, these five requirements must be adhered to:The stock must be acquired in exchange for cash or property contributed to the corporation.The corporation must issue the stock directly to the investors.The corporation must be an actual, operating company.More items...?