District of Columbia Inquiry of Credit Cardholder Concerning Billing Error is a legal process designed to protect consumers who suspect errors on their credit card bills. This inquiry allows residents of the District of Columbia to raise concerns and seek correction of any billing errors they have identified. The District of Columbia has specific regulations in place to ensure that credit cardholders are treated fairly when it comes to addressing billing errors. The process starts with the credit cardholder recognizing a mistake or discrepancy on their billing statement. This can include unauthorized charges, incorrect amounts, duplicate charges, or payments not properly credited. To initiate the District of Columbia Inquiry of Credit Cardholder Concerning Billing Error, the cardholder must first contact the credit card issuer's customer service department. It is advised to do so promptly, as there are time limits imposed by law for raising a dispute. The credit card issuer will have a dedicated department responsible for handling these inquiries and resolving billing issues. During the inquiry, the cardholder should provide specific details about the billing error, such as the date of the transaction, the merchant's name, and the amount in question. The cardholder should also state how they believe the error occurred, whether it was due to a mistake on the merchant's side or a fraudulent activity. Various types of District of Columbia Inquiry of Credit Cardholder Concerning Billing Errors include: 1. Unauthorized Charges: In this scenario, the cardholder notices charges on their credit card statement that they did not authorize or were not involved in any transaction. 2. Incorrect Amounts: This type of error occurs when the charged amount differs from the agreed-upon amount during a transaction. It can be unintentional, such as a typographical error, or intentional. 3. Duplicate Charges: Duplicate charges refer to situations where the same transaction appears on a credit card statement multiple times, leading to an overpayment. 4. Payments Not Properly Credited: This issue arises when a payment made by the cardholder is not reflected or credited in their credit card account. Once the inquiry is initiated, the credit card issuer must conduct an investigation within a specific timeframe outlined by District of Columbia laws. During this period, the cardholder may be requested to provide any supporting documentation, such as receipts, transaction records, or communication with the merchant. The credit card issuer has an obligation to acknowledge the inquiry, investigate the error, and provide a written explanation of their findings and any actions taken. If the investigation confirms the billing error, the credit card issuer must rectify the mistake by adjusting the cardholder's account or issuing a refund. In case the credit card issuer fails to address the billing error, the cardholder may escalate the matter by filing a complaint with the appropriate authorities, such as the District of Columbia Department of Insurance, Securities, and Banking. It is essential for District of Columbia credit cardholders to be aware of their rights and utilize the District of Columbia Inquiry of Credit Cardholder Concerning Billing Error process whenever they encounter billing discrepancies. By taking prompt action and providing accurate information, consumers can ensure that their rights are protected and any errors are rectified promptly.

District of Columbia Inquiry of Credit Cardholder Concerning Billing Error

Description

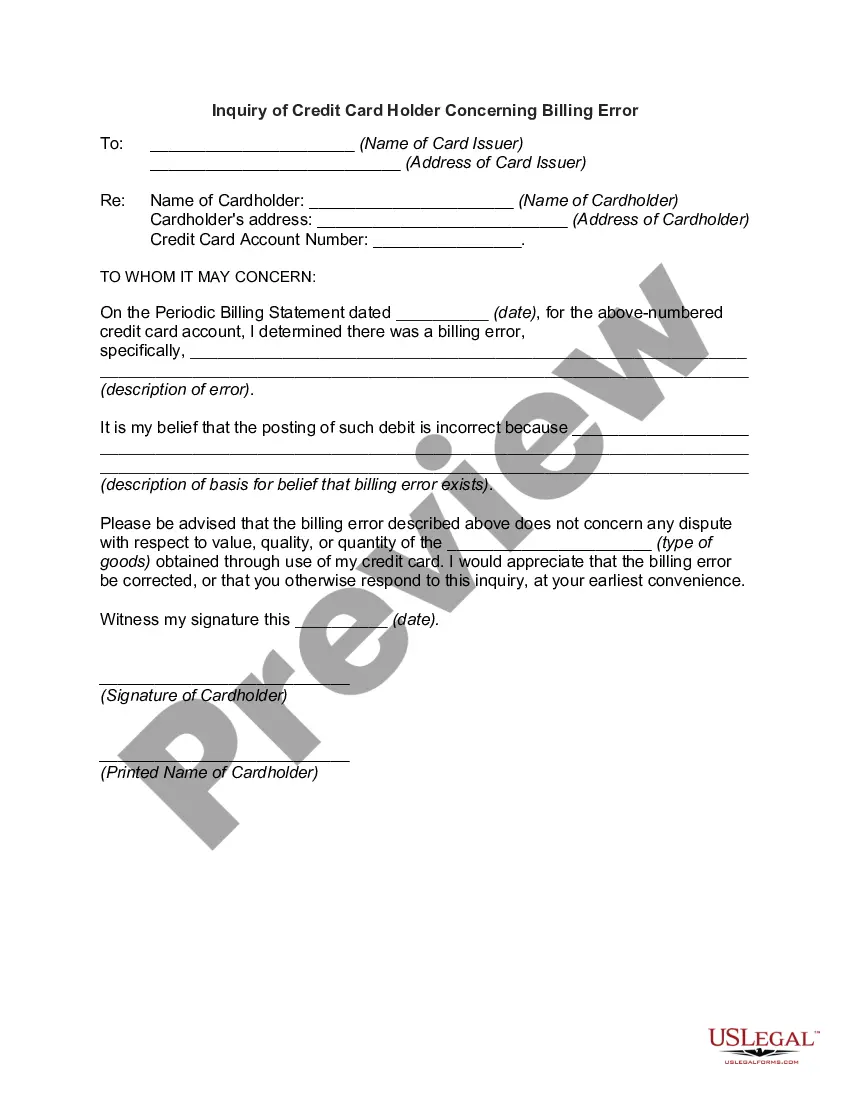

How to fill out District Of Columbia Inquiry Of Credit Cardholder Concerning Billing Error?

Finding the right legal papers design could be a have a problem. Obviously, there are tons of layouts available online, but how would you obtain the legal type you will need? Use the US Legal Forms website. The support delivers thousands of layouts, including the District of Columbia Inquiry of Credit Cardholder Concerning Billing Error, which you can use for company and private requirements. Every one of the types are checked out by pros and meet federal and state requirements.

When you are currently signed up, log in to your profile and click on the Down load key to get the District of Columbia Inquiry of Credit Cardholder Concerning Billing Error. Make use of your profile to look from the legal types you might have acquired in the past. Check out the My Forms tab of your own profile and get an additional version in the papers you will need.

When you are a new user of US Legal Forms, listed here are basic recommendations that you should adhere to:

- Initially, make certain you have selected the proper type to your metropolis/state. It is possible to examine the form making use of the Review key and look at the form explanation to guarantee this is basically the right one for you.

- In the event the type fails to meet your expectations, utilize the Seach field to get the right type.

- When you are sure that the form is proper, click the Buy now key to get the type.

- Opt for the pricing strategy you desire and enter in the essential details. Build your profile and purchase the order with your PayPal profile or bank card.

- Opt for the file file format and obtain the legal papers design to your gadget.

- Complete, change and print and sign the attained District of Columbia Inquiry of Credit Cardholder Concerning Billing Error.

US Legal Forms is definitely the most significant catalogue of legal types in which you will find a variety of papers layouts. Use the company to obtain appropriately-manufactured paperwork that adhere to condition requirements.