District of Columbia Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

If you aim to be thorough, obtain, or download official document patterns, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site's straightforward and convenient search feature to locate the documents you require.

Numerous templates for commercial and personal purposes are categorized by types and states, or by keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the subscription plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You may use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to find the District of Columbia Document Organizer and Retention with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the District of Columbia Document Organizer and Retention.

- You can also view forms you have previously downloaded through the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to analyze the form's content. Don't forget to check the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

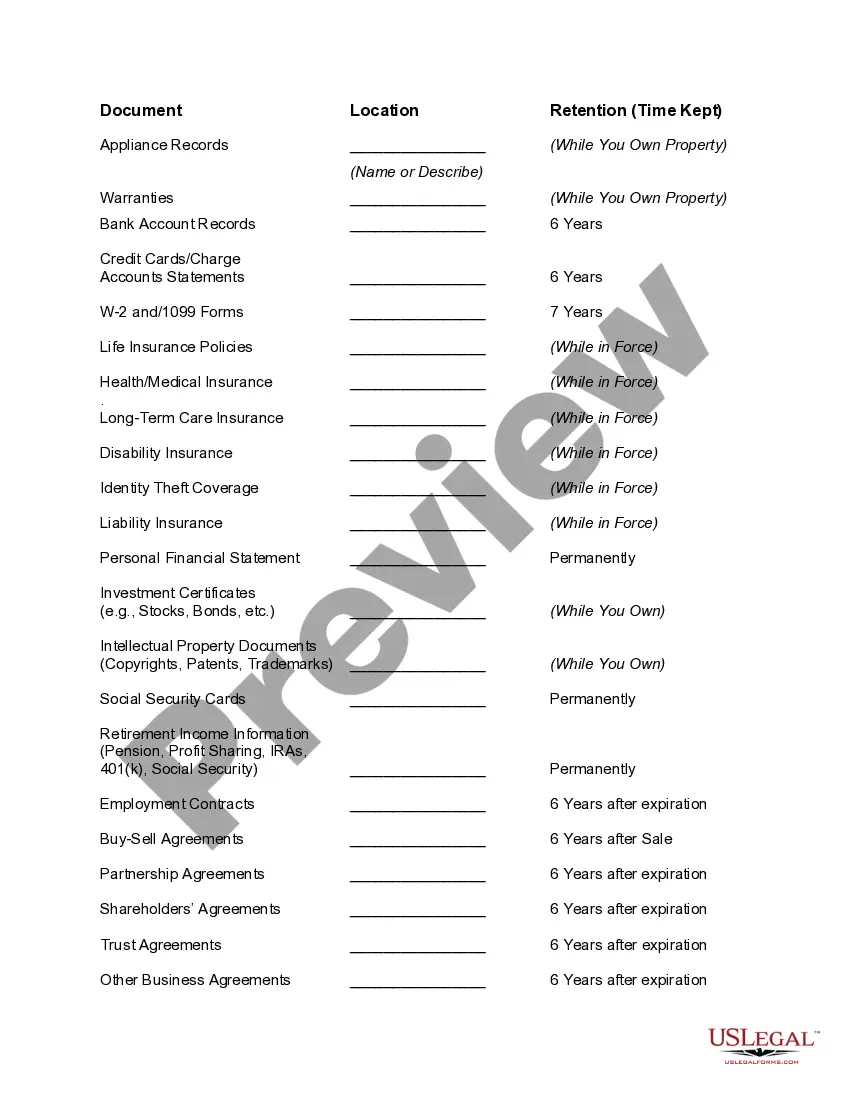

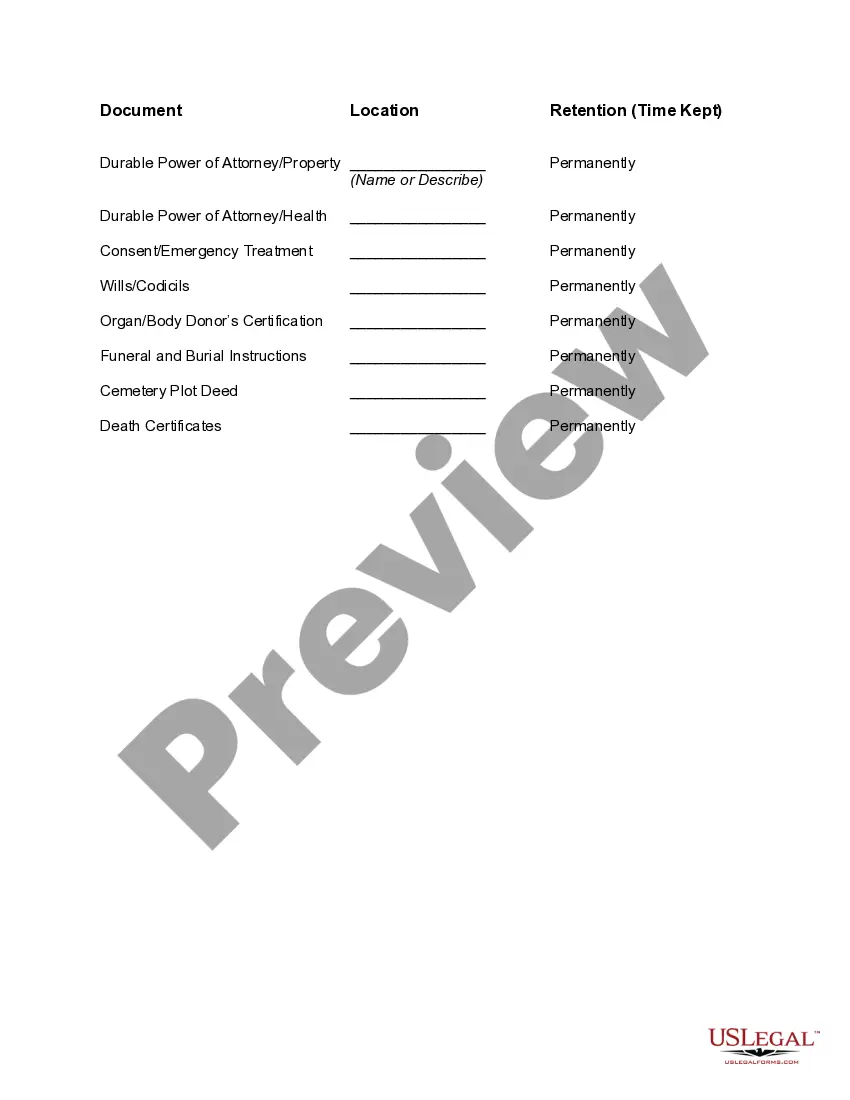

A record retention schedule is a list of records maintained by all or part of an organization together with the period of time that each record or group of records is to be kept.

A document retention policy is a company policy, which establishes the customary practice and guidelines regarding the retention and maintenance of company records, and sets forth a schedule for the destruction of certain documents received or created during the course of business.

A document retention policy identifies confidential information and categorizes it by how and where documents are stored (electronically or in paper) and the required retention period based on federal, state, and other regulatory requirements.

Six Key Steps to Developing a Record Retention PolicySTEP 1: Identify Types of Records & Media.STEP 2: Identify Business Needs for Records & Appropriate Retention Periods.STEP 3: Addressing Creation, Distribution, Storage & Retrieval of Documents.STEP 4: Destruction of Documents.STEP 5: Documentation & Implementation.More items...?

A document retention policy establishes and describes how a company expects its employees to manage company information (whether in electronic files, emails, hard copies, or other formats) from creation through destruction, according to applicable laws and the company's particular legal and business needs.

A document retention plan is a policy that provides for the systematic review, retention and destruction of documents.

(1) Category-I (e-Files/records to preserved permanently on which are of historical importance) For 10 years, it will be kept in the Department's sever and thereafter transferred to the server of the National Archives of India.

Retention policies help to manage many risks including lost or stolen information, excessive backlog of paper files, loss of time and space while internally managing records and lack of organization system for records, making them hard to find, just to name a few.

Six Key Steps to Developing a Record Retention PolicySTEP 1: Identify Types of Records & Media.STEP 2: Identify Business Needs for Records & Appropriate Retention Periods.STEP 3: Addressing Creation, Distribution, Storage & Retrieval of Documents.STEP 4: Destruction of Documents.STEP 5: Documentation & Implementation.More items...?

For example, if financial records have a retention period of five years, and the records were created during the 1995-1996 fiscal year (July 1, 1995 - June 30, 1996), the five-year retention period begins on July 1, 1996 and ends five years later on July 1, 2001.