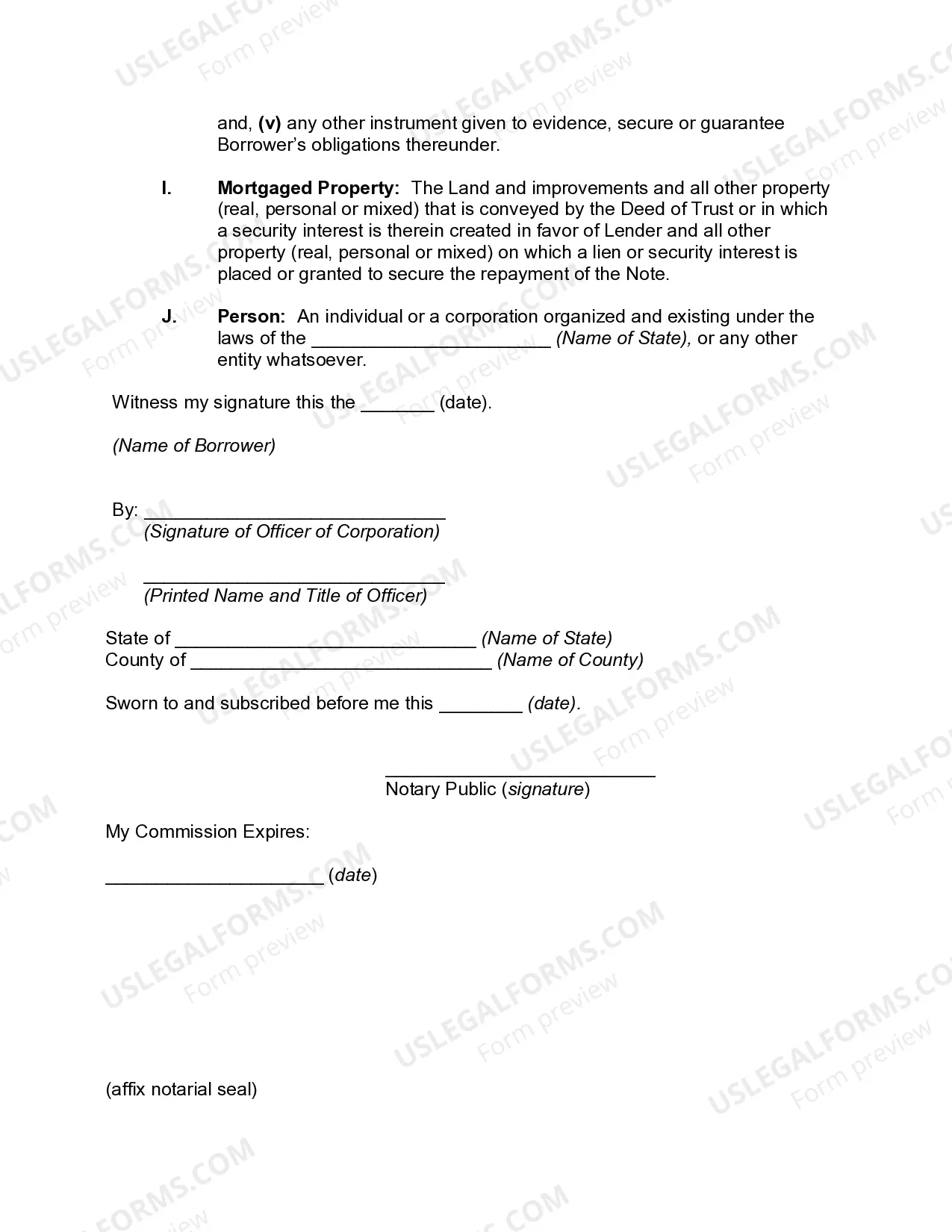

The District of Columbia Certificate of Borrower regarding Commercial Loan is an important legal document that relates to the borrowing and lending of funds for commercial purposes within the District of Columbia. This certificate signifies the agreement between the borrower and the lender and outlines various terms and conditions associated with the commercial loan. Keywords: District of Columbia, Certificate of Borrower, Commercial Loan The District of Columbia Certificate of Borrower regarding Commercial Loan typically contains the following information: 1. Borrower Information: This section includes detailed information about the borrower, such as their legal name, contact details, and business address. It may also include the borrower's tax identification number and other identifying information. 2. Lender Information: This portion provides information about the lender involved in the commercial loan. It typically includes the lender's legal name, contact details, and business address. 3. Loan Details: This section specifies the details of the commercial loan, including the loan amount, interest rate, repayment term, and any other specific terms agreed upon by both parties. It may also include information about collateral or security provided by the borrower to mitigate the risk associated with the loan. 4. Representations and Warranties: This segment outlines the representations and warranties made by the borrower regarding their financial status, legal capacity, and ability to enter into the loan agreement. It ensures that the borrower provides accurate and truthful information regarding their creditworthiness and ability to repay the loan. 5. Covenants: This section outlines the obligations and responsibilities of the borrower throughout the term of the loan. It may include provisions related to maintaining adequate insurance coverage, financial reporting requirements, and restrictions on the use of funds. 6. Default and Remedies: This part explains the consequences of defaulting on the loan and the remedies available to the lender in case of default. It may include provisions related to late payment penalties, foreclosure rights, and other actions the lender can take to recover the outstanding amount. Different types of District of Columbia Certificate of Borrower regarding Commercial Loan may exist based on the specific nature or purpose of the loan. For instance, there may be certificates tailored for construction loans, equipment financing, real estate loans, or business acquisition loans. Each type of certificate may have additional clauses specific to the particular type of loan. In conclusion, the District of Columbia Certificate of Borrower regarding Commercial Loan is a vital document that establishes the terms and conditions of a commercial loan in the District of Columbia. It provides legal clarity and protection for both the borrower and the lender, ensuring that both parties are aware of their rights and obligations.

District of Columbia Certificate of Borrower regarding Commercial Loan

Description

How to fill out District Of Columbia Certificate Of Borrower Regarding Commercial Loan?

Discovering the right lawful file web template can be a have a problem. Obviously, there are plenty of web templates available on the Internet, but how can you find the lawful kind you need? Use the US Legal Forms site. The assistance provides thousands of web templates, including the District of Columbia Certificate of Borrower regarding Commercial Loan, which you can use for organization and personal needs. Each of the kinds are checked by experts and meet state and federal requirements.

If you are presently registered, log in to the account and then click the Down load button to have the District of Columbia Certificate of Borrower regarding Commercial Loan. Utilize your account to search with the lawful kinds you may have purchased in the past. Proceed to the My Forms tab of your account and obtain yet another copy of your file you need.

If you are a whole new consumer of US Legal Forms, listed below are straightforward recommendations that you should follow:

- Very first, make certain you have chosen the correct kind to your area/state. You are able to check out the shape while using Preview button and browse the shape information to ensure this is basically the best for you.

- In case the kind does not meet your requirements, take advantage of the Seach field to discover the appropriate kind.

- Once you are positive that the shape would work, go through the Purchase now button to have the kind.

- Choose the rates plan you need and enter the required information and facts. Design your account and pay for the transaction making use of your PayPal account or credit card.

- Select the data file structure and down load the lawful file web template to the system.

- Comprehensive, modify and produce and indication the received District of Columbia Certificate of Borrower regarding Commercial Loan.

US Legal Forms is the greatest catalogue of lawful kinds where you can find different file web templates. Use the service to down load appropriately-produced files that follow express requirements.