District of Columbia Jury Instruction - 10.10.6 Section 6672 Penalty

Description

How to fill out Jury Instruction - 10.10.6 Section 6672 Penalty?

Choosing the best authorized record template might be a have a problem. Of course, there are tons of themes available online, but how will you discover the authorized kind you need? Take advantage of the US Legal Forms web site. The service gives a large number of themes, such as the District of Columbia Jury Instruction - 10.10.6 Section 6672 Penalty, that you can use for organization and private needs. All of the forms are examined by specialists and meet up with federal and state demands.

In case you are currently authorized, log in in your bank account and click the Download option to have the District of Columbia Jury Instruction - 10.10.6 Section 6672 Penalty. Make use of bank account to check through the authorized forms you may have ordered in the past. Visit the My Forms tab of your bank account and acquire yet another duplicate of your record you need.

In case you are a whole new customer of US Legal Forms, listed below are straightforward guidelines so that you can follow:

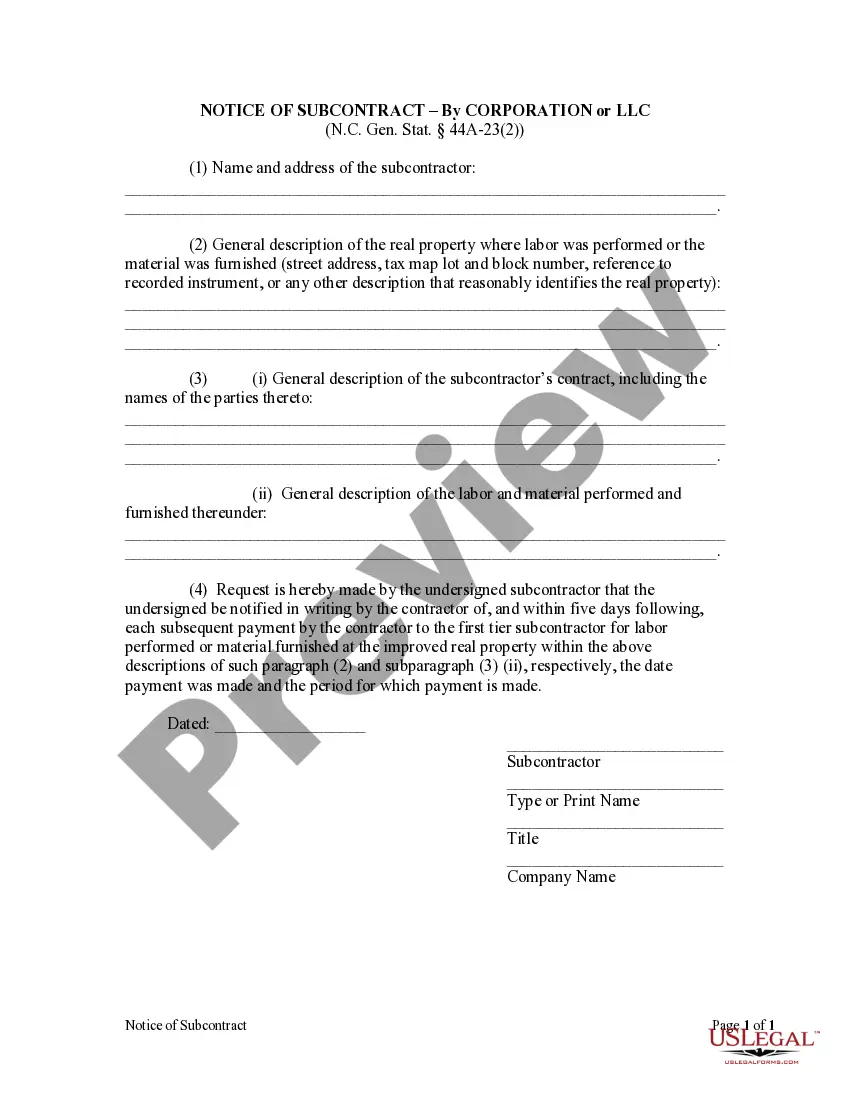

- Initial, be sure you have chosen the proper kind for the city/region. It is possible to check out the shape while using Review option and study the shape information to make sure this is basically the best for you.

- When the kind does not meet up with your preferences, make use of the Seach field to get the right kind.

- Once you are sure that the shape would work, click on the Get now option to have the kind.

- Choose the costs strategy you want and enter in the essential info. Create your bank account and pay for an order using your PayPal bank account or charge card.

- Select the data file format and acquire the authorized record template in your product.

- Full, revise and print and indicator the obtained District of Columbia Jury Instruction - 10.10.6 Section 6672 Penalty.

US Legal Forms is the largest library of authorized forms for which you can see numerous record themes. Take advantage of the company to acquire skillfully-manufactured papers that follow status demands.