District of Columbia Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

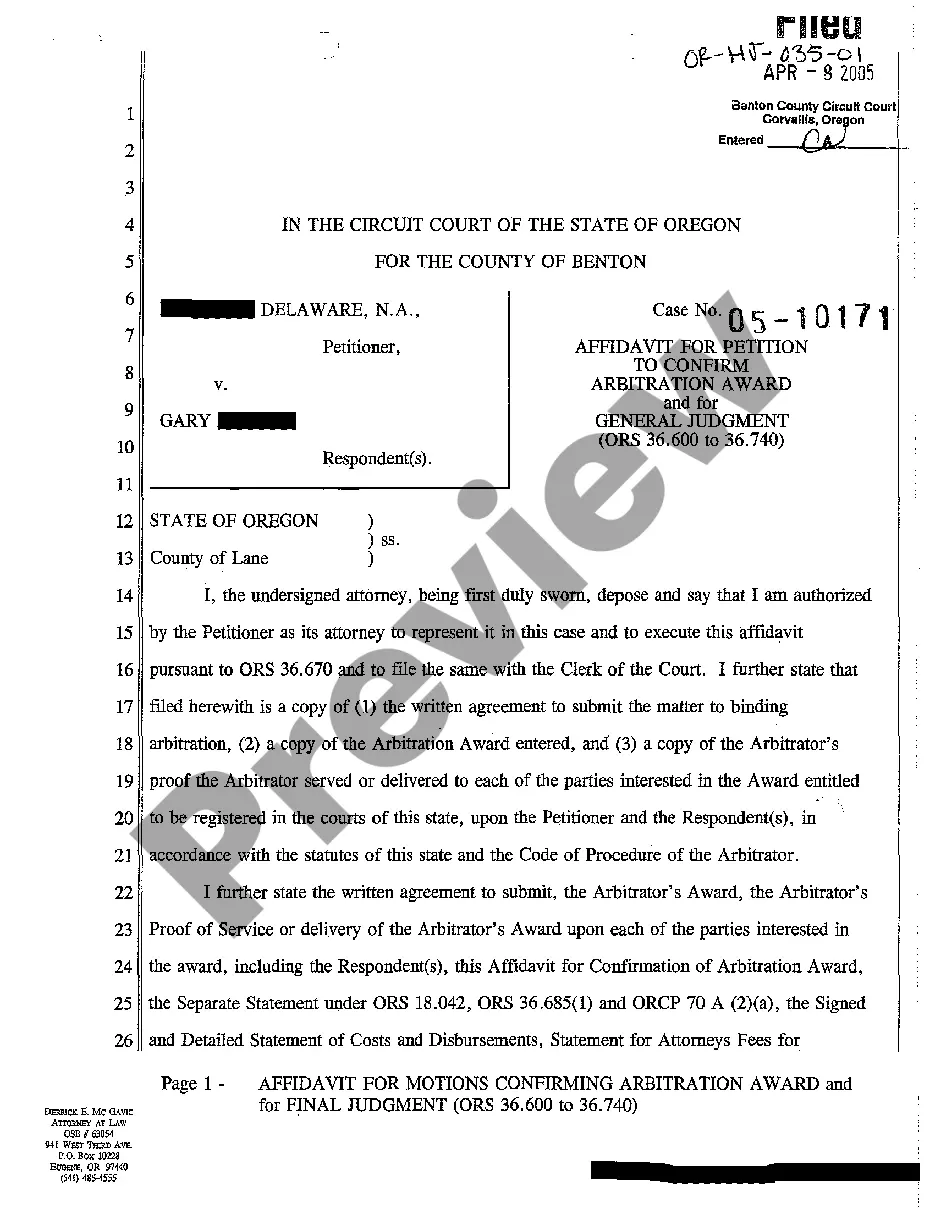

How to fill out Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

Are you currently in a situation where you require documents for possibly enterprise or specific reasons just about every day? There are plenty of authorized papers web templates available on the Internet, but finding versions you can depend on is not simple. US Legal Forms delivers a huge number of kind web templates, much like the District of Columbia Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty, which are published to satisfy state and federal specifications.

When you are presently familiar with US Legal Forms web site and possess a free account, simply log in. Following that, it is possible to obtain the District of Columbia Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty web template.

Should you not offer an profile and would like to begin using US Legal Forms, abide by these steps:

- Get the kind you will need and ensure it is for the appropriate metropolis/state.

- Take advantage of the Preview switch to analyze the form.

- See the description to actually have chosen the proper kind.

- If the kind is not what you are looking for, use the Search field to discover the kind that meets your needs and specifications.

- When you discover the appropriate kind, simply click Buy now.

- Pick the prices plan you would like, complete the specified information to produce your account, and pay for the transaction making use of your PayPal or credit card.

- Decide on a convenient paper formatting and obtain your version.

Locate each of the papers web templates you might have bought in the My Forms food list. You can get a more version of District of Columbia Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty any time, if possible. Just go through the required kind to obtain or print out the papers web template.

Use US Legal Forms, by far the most considerable selection of authorized forms, to conserve efforts and prevent faults. The assistance delivers expertly created authorized papers web templates which can be used for a range of reasons. Make a free account on US Legal Forms and start producing your life a little easier.