The District of Columbia Finance Lease of Equipment refers to a financial arrangement where an entity based in the District of Columbia can acquire necessary equipment without purchasing it outright. This lease option allows businesses, government agencies, or organizations to utilize equipment for a defined period while making regular payments to the lessor. The lessor typically retains ownership of the equipment during the lease term, offering flexibility and operational efficiency to lessees. In the District of Columbia, there are several types of finance leases of equipment available, including: 1. Office Equipment Finance Lease: This type of lease is commonly used by businesses to acquire office equipment such as computers, printers, copiers, and telecommunication systems. It enables organizations to keep up with technological advancements without committing a significant upfront capital investment. 2. Manufacturing Equipment Finance Lease: Manufacturing businesses can benefit from this lease option as it allows them to access advanced machinery, production tools, and specialized equipment necessary for their operations. By leasing rather than purchasing equipment, businesses can preserve their cash flow and remain competitive in their respective industries. 3. Medical Equipment Finance Lease: Healthcare providers, clinics, and hospitals in the District of Columbia can utilize this lease to acquire medical equipment such as imaging machines, diagnostic devices, surgical instruments, or laboratory tools. The flexibility of leasing allows healthcare organizations to adapt to evolving medical technologies and provide enhanced patient care. 4. Construction Equipment Finance Lease: Construction firms often require various heavy machinery and equipment such as excavators, bulldozers, cranes, and loaders. This lease option enables them to access the necessary equipment for specific projects, eliminating the need for long-term ownership and maintenance costs. 5. Transportation Equipment Finance Lease: Fleet owners, logistics companies, or transportation service providers can enter into this lease agreement to acquire vehicles, trailers, or specialized transportation equipment. It provides businesses with the advantage of using the latest models without committing to a large capital outlay, particularly in a rapidly evolving transportation industry. The District of Columbia Finance Lease of Equipment is a cost-effective alternative for organizations seeking access to essential equipment, enabling them to preserve their liquidity, improve cash flow, and focus on core operations. By carefully considering their specific equipment needs, businesses can select the most suitable lease option, tailor the lease terms to their requirements, and benefit from the numerous advantages of finance leasing in the District of Columbia.

District of Columbia Finance Lease of Equipment

Description

How to fill out District Of Columbia Finance Lease Of Equipment?

You can invest hrs online searching for the authorized papers web template which fits the federal and state needs you require. US Legal Forms supplies a huge number of authorized varieties that happen to be analyzed by experts. It is possible to down load or printing the District of Columbia Finance Lease of Equipment from the support.

If you have a US Legal Forms accounts, you may log in and then click the Down load button. Next, you may total, revise, printing, or sign the District of Columbia Finance Lease of Equipment. Each and every authorized papers web template you purchase is the one you have forever. To acquire one more version of any bought form, visit the My Forms tab and then click the related button.

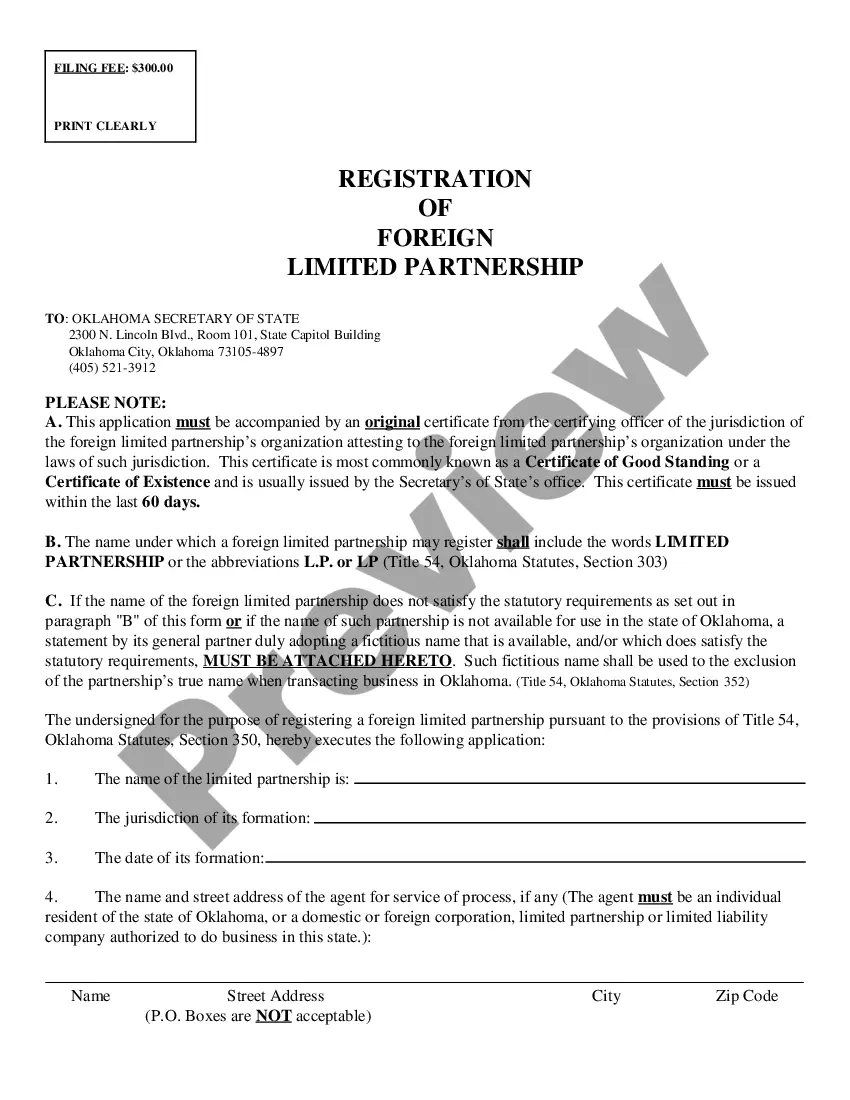

If you use the US Legal Forms website for the first time, stick to the basic recommendations under:

- Initial, be sure that you have selected the correct papers web template for your state/metropolis of your choice. Read the form outline to make sure you have picked out the proper form. If offered, utilize the Review button to look with the papers web template also.

- If you want to discover one more model in the form, utilize the Look for area to obtain the web template that fits your needs and needs.

- Upon having found the web template you would like, click Purchase now to continue.

- Select the rates prepare you would like, enter your references, and register for a free account on US Legal Forms.

- Total the financial transaction. You should use your bank card or PayPal accounts to purchase the authorized form.

- Select the file format in the papers and down load it in your gadget.

- Make alterations in your papers if necessary. You can total, revise and sign and printing District of Columbia Finance Lease of Equipment.

Down load and printing a huge number of papers templates while using US Legal Forms website, which offers the most important variety of authorized varieties. Use specialist and express-certain templates to take on your organization or person needs.

Form popularity

FAQ

For the purposes of this chapter (not alone of this subchapter) and unless otherwise required by the context, the term unincorporated business means any trade or business, conducted or engaged in by any individual, whether resident or nonresident, statutory or common-law trust, estate, partnership, or limited or

Goods that are subject to sales tax in Washington D.C. include physical property, like furniture, home appliances, and motor vehicles. Prescription and non-prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Washington D.C. are subject to sales tax.

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

The unincorporated business franchise tax (Form D-30) must be filed by any D.C. business that is unincorporated, which includes partnerships, sole proprietorships, and joint ventures, so long as such a business derives rental income or any other income from D.C. sources in excess of $12,000 per year.

You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. (A resident is an individual domiciled in DC at any time during the taxable year);

DC does not allow the bonus depreciation deduction nor any additional IRC §179 expenses. Do not claim the 30, 50, or 100 percent federal bonus depreciation deduction or the additional IRC A§179 expenses on your DC return.

If you meet the single status tax filing requirements and you're under 65, you must file if your federal gross income was $12,550 or more. If you're 65 or older, you must file if your federal gross income was $14,250 or more.

DC does not allow NOL carry backs. Therefore, you may not claim a NOL carry back for DC tax purposes.

Additional information. Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

DC does not allow NOL carry backs. Therefore, you may not claim a NOL carry back for DC tax purposes.