District of Columbia Balance Sheet Notes Payable

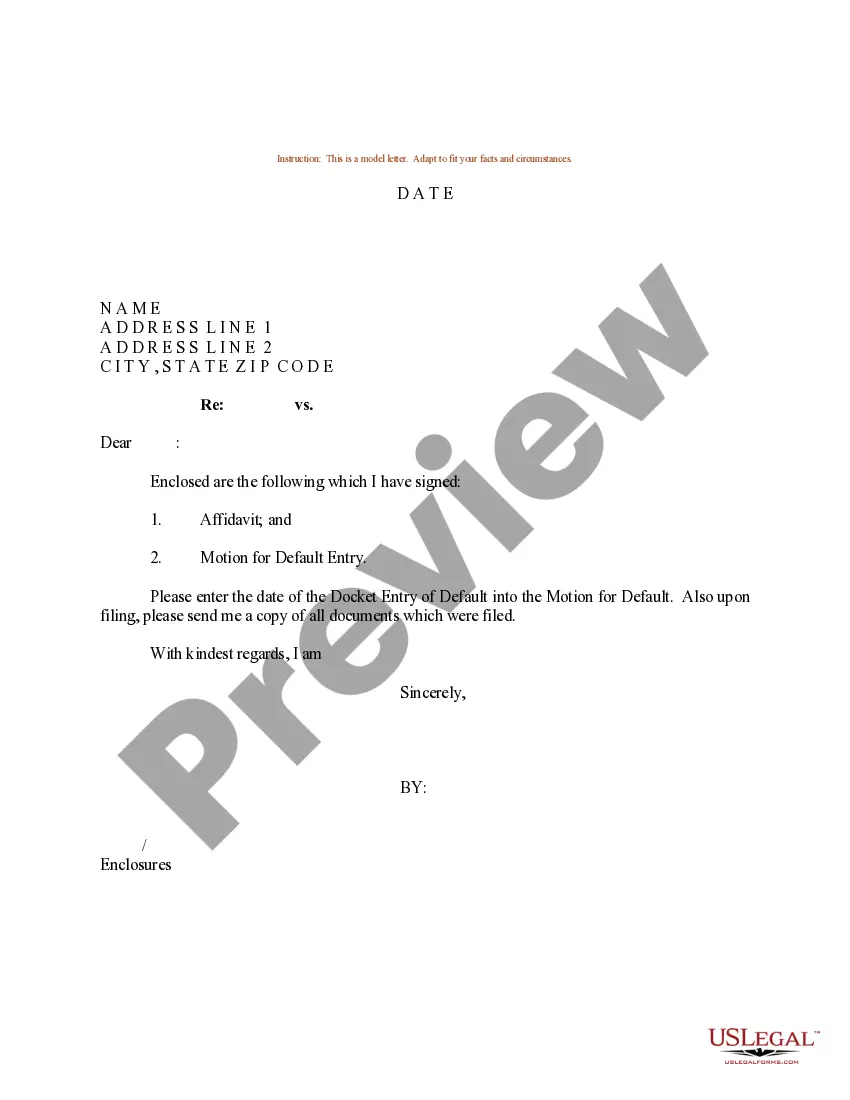

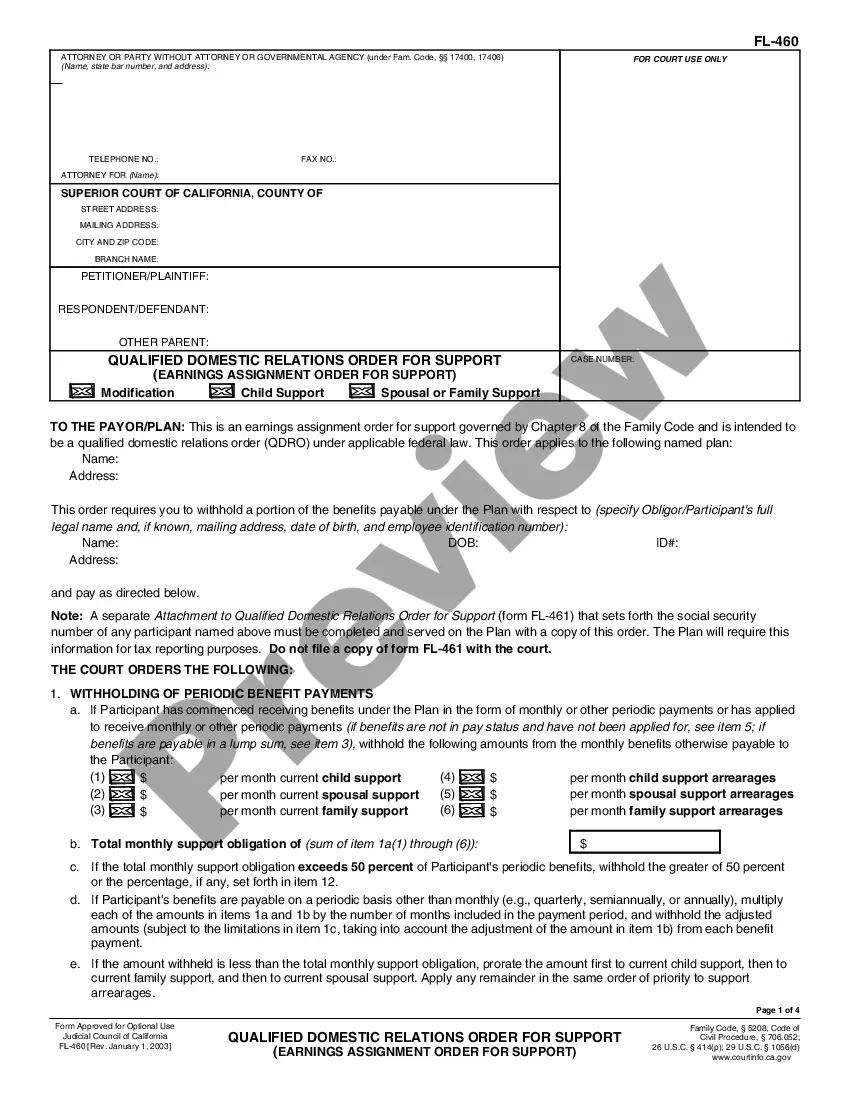

Description

How to fill out Balance Sheet Notes Payable?

Are you presently in a role where you need documents for various companies or specific tasks almost every day.

There are numerous legal document templates accessible online, but finding trustworthy ones is not easy.

US Legal Forms provides a vast array of form templates, such as the District of Columbia Balance Sheet Notes Payable, which are designed to satisfy state and federal regulations.

Once you locate the correct form, simply click Buy now.

Select the pricing plan you want, complete the required information to create your account, and pay for the order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you may download the District of Columbia Balance Sheet Notes Payable template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the appropriate city/state.

- Use the Review button to inspect the form.

- Read the description to confirm you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

To show notes payable on a balance sheet, list it under current liabilities if the payment is due within a year, or under long-term liabilities if due afterward. Make sure to include the total amount owed and any relevant interest if applicable. This clear representation ensures transparency in your District of Columbia Balance Sheet Notes Payable.