The District of Columbia Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance refers to a specific type of employment contract in the District of Columbia that includes provisions for a nonqualified retirement plan funded with life insurance. This agreement is designed to offer additional retirement benefits to employees beyond what is provided by traditional retirement plans. Keywords: District of Columbia, employment agreement, nonqualified retirement plan, life insurance, retirement benefits. There are several variations of the District of Columbia Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, including: 1. Defined Benefit Plan: This type of agreement provides employees with a specified retirement benefit amount based on a predetermined formula. The plan is funded through life insurance policies. 2. Salary Continuation Plan: Under this agreement, the employer agrees to continue paying a portion of the employee's salary during retirement. The plan's funding is accomplished through life insurance policies. 3. Deferred Compensation Plan: This type of plan allows employees to defer a portion of their income to a later date, usually retirement. The deferred amounts are invested in life insurance policies, which are used to fund retirement benefits. 4. Supplemental Executive Retirement Plan (SERP): Designed for top-level executives, this plan provides additional retirement benefits beyond what is offered through traditional retirement plans. Funding is achieved through life insurance policies. The District of Columbia Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a comprehensive contract that ensures employees receive enhanced retirement benefits. It offers flexibility and additional financial security, allowing employees to have a comfortable retirement.

District of Columbia Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

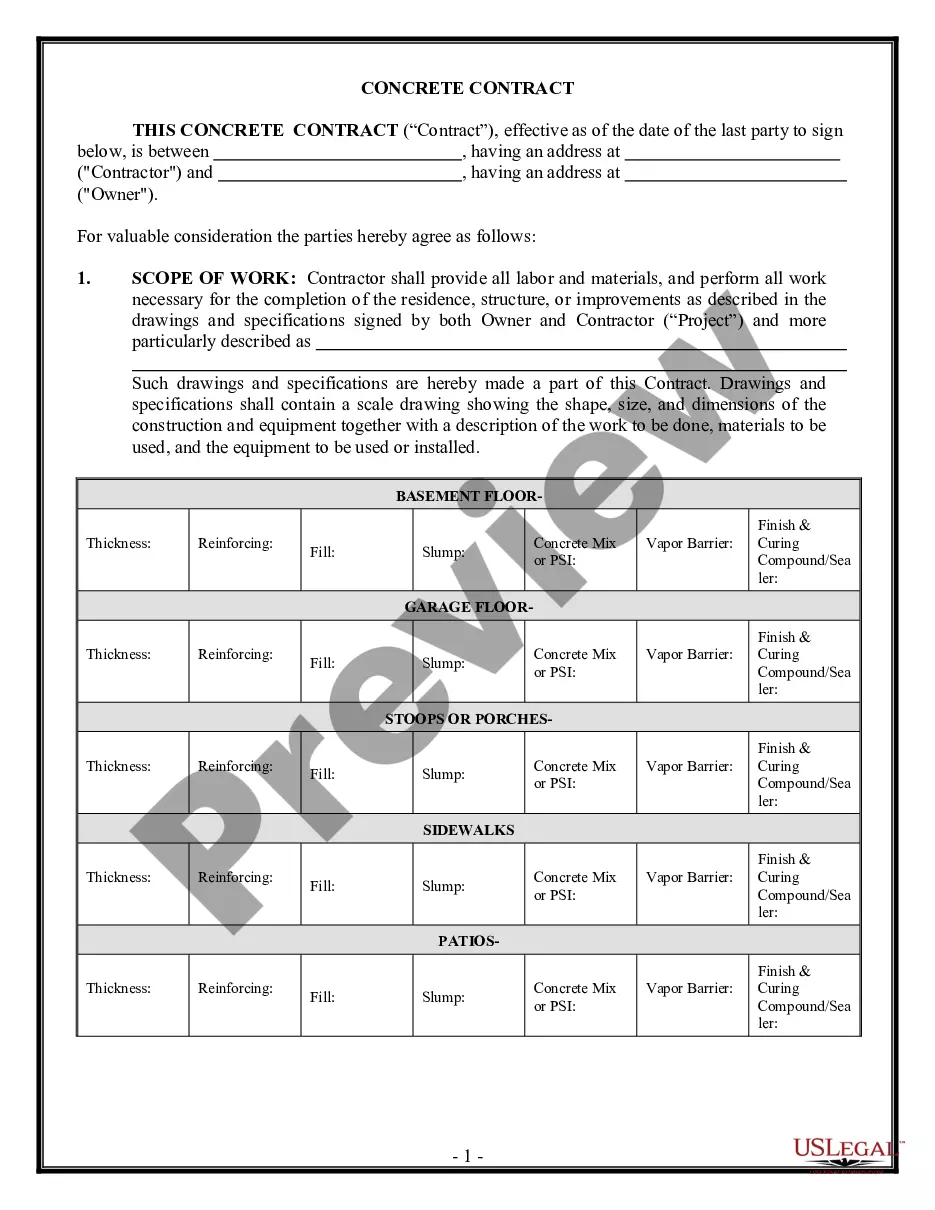

How to fill out District Of Columbia Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

Finding the right lawful document design can be a battle. Needless to say, there are tons of web templates available on the net, but how would you discover the lawful form you want? Take advantage of the US Legal Forms website. The service gives a huge number of web templates, including the District of Columbia Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, that you can use for organization and private demands. All the types are checked out by specialists and meet federal and state specifications.

When you are currently registered, log in to the bank account and then click the Down load option to find the District of Columbia Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance. Make use of your bank account to search from the lawful types you may have purchased in the past. Check out the My Forms tab of the bank account and get an additional backup from the document you want.

When you are a whole new consumer of US Legal Forms, allow me to share simple recommendations that you should adhere to:

- First, make sure you have selected the appropriate form for your personal city/state. You may look over the shape while using Review option and study the shape outline to make certain this is the best for you.

- If the form will not meet your needs, take advantage of the Seach area to get the appropriate form.

- Once you are positive that the shape is suitable, click the Buy now option to find the form.

- Choose the rates plan you desire and enter in the required information. Design your bank account and buy the transaction utilizing your PayPal bank account or charge card.

- Pick the file file format and obtain the lawful document design to the device.

- Complete, edit and print out and indication the acquired District of Columbia Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

US Legal Forms is definitely the largest collection of lawful types in which you can see a variety of document web templates. Take advantage of the company to obtain appropriately-produced documents that adhere to condition specifications.

Form popularity

FAQ

Whenever life insurance is included in a qualified retirement plan, the insured is receiving an immediate benefit in the form of the life insurance protection. The value of this benefit is reported and added to the insured's taxable income each year.

Examples of nonqualified plans are deferred compensation plans, supplemental executive retirement plans, split-dollar arrangements and other similar arrangements. Contributions to a deferred compensation plan will reduce an employee's gross income, but there's no rollover option upon termination of employment.

Non-qualified plans are typically funded with cash value life insurance policies. Also known as permanent insurance, cash value policies accumulate cash inside the policy from a portion of the premiums paid. This type of policy becomes paid up once a certain amount of premium has been paid into it.

Examples of nonqualified plans are deferred compensation plans, supplemental executive retirement plans, split-dollar arrangements and other similar arrangements. Contributions to a deferred compensation plan will reduce an employee's gross income, but there's no rollover option upon termination of employment.

To set up a NQDC plan, you'll have to: Put the plan in writing: Think of it as a contract with your employee. Be sure to include the deferred amount and when your business will pay it. Decide on the timing: You'll need to choose the events that trigger when your business will pay an employee's deferred income.

A qualified plan is an employer-sponsored retirement plan that qualifies for special tax treatment under Section 401(a) of the Internal Revenue Code.

Qualified plans have tax-deferred contributions from the employee, and employers may deduct amounts they contribute to the plan. Nonqualified plans use after-tax dollars to fund them, and in most cases employers cannot claim their contributions as a tax deduction.

Qualified retirement plans give employers a tax break for the contributions they make for their employees. Those plans that allow employees to defer a portion of their salaries into the plan can also reduce employees' present income-tax liability by reducing taxable income.

Using life insurance in a qualified plan does offer several advantages, including: The ability to use pre-tax dollars to pay premiums that would otherwise not be tax-deductible. Fully funding the retirement benefit at the premature death of the plan participant.

A nonqualified plan is a set of unsecured financial promises you make to an employee. Because they operate outside of ERISA, nonqualified plans can meet the needs of your business and your employees without regard to funding, fairness, or eligibility mandates.