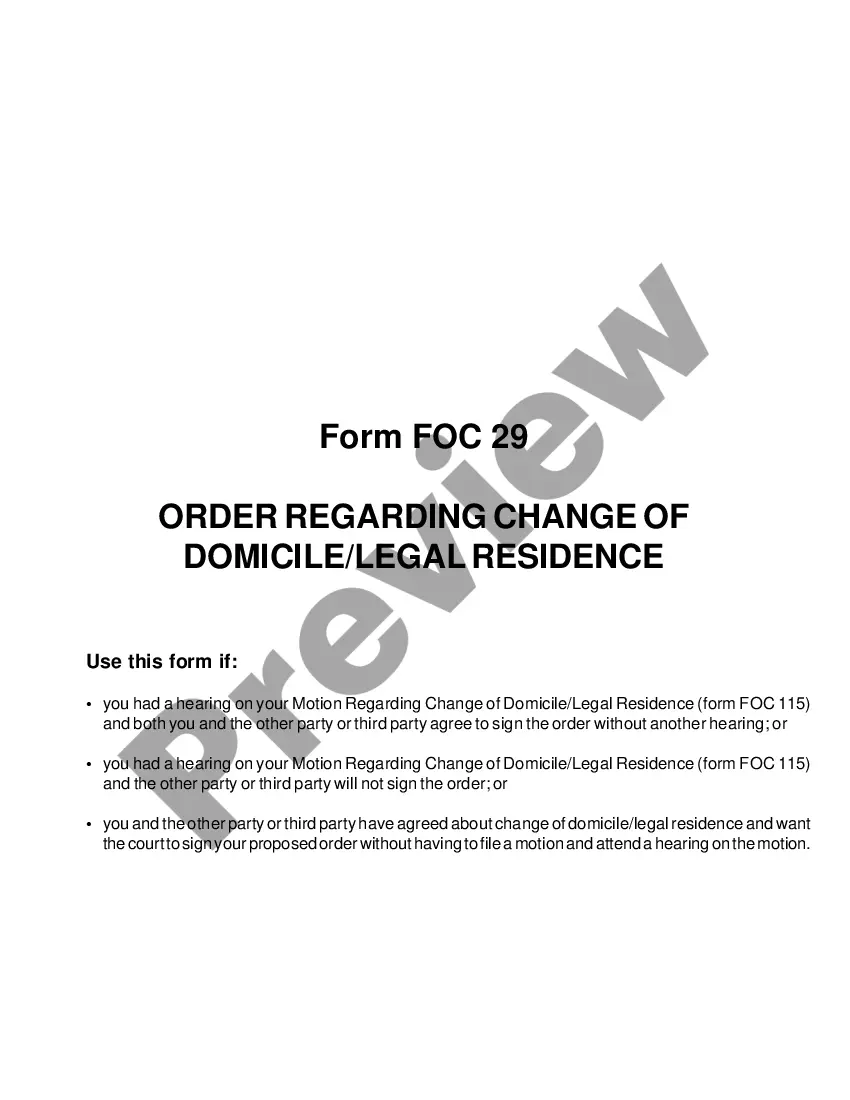

The District of Columbia Re-Hire Employee Information Form is a document used by employers in the District of Columbia to gather crucial information from re-hired employees. This form ensures that employers have updated and accurate details to facilitate seamless re-employment procedures. Here is a detailed description of the District of Columbia Re-Hire Employee Information Form: 1. Purpose: The District of Columbia Re-Hire Employee Information Form serves as a means to compile essential information about previously employed individuals who are returning to work for an organization based in the District of Columbia. 2. Employee Information: The form requires the re-hired employee to provide basic personal details such as their full name, address, contact information, Social Security number, and date of birth. This information enables employers to identify and verify the individual's identity and establish a connection with their previous employment records. 3. Employment History: The form includes sections where the re-hired employee can provide details about their prior work history, including the name of the previous employer, dates of employment, position held, and any changes in job titles or promotions during their previous tenure. This information helps employers understand the employee's experience and aids in determining appropriate job assignments or salary adjustments. 4. Reason for Re-employment: This section allows re-hired employees to explain the reasons for leaving their previous employment and their motivation for returning to the same organization. Understanding the employee's decision to return helps employers assess their commitment and anticipate potential challenges or opportunities for improvement. 5. Compensation and Benefits: The form may include sections related to compensation, where the re-hired employee can specify their desired salary or hourly rate, as well as the position for which they are being re-hired. It may also inquire about any changes in benefit preferences or the need to update beneficiary information, such as health insurance, retirement plans, or other applicable benefits. 6. Acknowledgment and Consent: In this section, the re-hired employee acknowledges that the information provided is accurate and grants consent for the employer to verify their details and conduct background checks if necessary. Additionally, this section may also include relevant clauses related to confidentiality agreements, non-disclosure agreements, or any other legal aspects pertinent to the employee's re-employment. Types of the District of Columbia Re-Hire Employee Information Form (if applicable): 1. Standard Re-Hire Employee Information Form: This type is applicable for most re-employment scenarios and collects the necessary information mentioned above. 2. Re-Hire Employee Information Form for Sensitive Positions: In cases where the re-hired employee is being re-employed in a position involving sensitive information, access to classified systems, or elevated security requirements, a more elaborate version of the form may be utilized. It may include additional sections related to security clearance, background checks, or measures to ensure compliance with relevant laws and regulations. 3. Re-Hire Employee Information Form for Union Members: In situations where the re-hired employee is a member of a labor union, a specialized version of the form may be used to address specific collective bargaining agreement provisions, union-related benefits, or any updates concerning the union representation. In summary, the District of Columbia Re-Hire Employee Information Form is an essential document for employers in the District of Columbia when re-hiring former employees. It aims to collect accurate information about the employee's personal details, employment history, reason for re-employment, compensation and benefits preferences, and legal acknowledgments. Different types of the form may exist depending on the nature of the re-employment, such as sensitive positions or union representation.

District of Columbia Re-Hire Employee Information Form

Description

How to fill out District Of Columbia Re-Hire Employee Information Form?

You can invest time on the Internet attempting to find the authorized papers design which fits the state and federal specifications you want. US Legal Forms supplies a large number of authorized kinds which can be examined by pros. You can actually obtain or produce the District of Columbia Re-Hire Employee Information Form from our support.

If you already possess a US Legal Forms account, it is possible to log in and click on the Acquire option. Following that, it is possible to complete, edit, produce, or sign the District of Columbia Re-Hire Employee Information Form. Each authorized papers design you purchase is your own eternally. To acquire one more backup of the acquired kind, check out the My Forms tab and click on the related option.

If you work with the US Legal Forms website for the first time, follow the straightforward directions under:

- Initial, be sure that you have chosen the best papers design for your area/town of your liking. Read the kind explanation to ensure you have selected the proper kind. If offered, use the Review option to search from the papers design too.

- If you want to discover one more model from the kind, use the Lookup field to get the design that meets your needs and specifications.

- Upon having found the design you would like, click Buy now to continue.

- Pick the rates plan you would like, type in your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the deal. You may use your Visa or Mastercard or PayPal account to cover the authorized kind.

- Pick the formatting from the papers and obtain it to your gadget.

- Make modifications to your papers if possible. You can complete, edit and sign and produce District of Columbia Re-Hire Employee Information Form.

Acquire and produce a large number of papers layouts while using US Legal Forms website, that provides the greatest variety of authorized kinds. Use skilled and express-certain layouts to handle your small business or personal needs.

Form popularity

FAQ

To know how much income tax to withhold from employees' wages, you should have a Form W-4, Employee's Withholding Certificate, on file for each employee. Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment.

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Employee's Withholding Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4.

Employees must submit basic information including name, Social Security number and citizenship status. Employees also must supply documentation along with this form to prove they are eligible to work in the United States. Documentation examples include a current passport, state issued I.D. and Social Security card.

California employers must provide the following documents for example: I-9 Employment Eligibility Verification completed. W-4 federal and state tax withholding forms completed. Workers' Compensation Time of Hire Pamphlet: Personal Chiropractor or Acupuncturist Designation Form and Personal Physician Designation Form.

Employee's Withholding Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4.

If you have landed your first job or are starting a new job, you will need to fill out a W-4 (Employee's Withholding Certificate) form so that your employer can determine how much tax to withhold from your paycheck.

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

Here are some forms you can expect to fill out when you begin a new job:Job-specific forms. Employers usually create forms unique to specific positions in a company.Employee information.CRA and tax forms.Compensation forms.Benefits forms.Company policy forms.Job application form.Signed offer letter.More items...?