The District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is a legal document that outlines the process of terminating a partnership between the surviving partners and the estate of a deceased partner in the District of Columbia. This agreement serves as a roadmap for handling the dissolution of the partnership and distributing the assets and liabilities among the remaining partners and the estate of the deceased partner. The primary purpose of this agreement is to establish clear guidelines and procedures for the dissolution and winding up of the partnership. It ensures that the interests of all parties involved are protected and that the process is carried out in a fair and equitable manner. Some key elements covered in the District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner include: 1. Identification of the partnership: This agreement will specify the name and nature of the partnership, as well as the date it was formed. 2. Dissolution clause: This section outlines the method or event that triggered the dissolution of the partnership, which in this case, is the death of one of the partners. 3. Notification and withdrawal: The surviving partners will be responsible for notifying the estate of the deceased partner of the dissolution. It will also specify the timeline for the withdrawing partner to settle any outstanding obligations. 4. Inventory and valuation: The agreement will include a provision for conducting an inventory of the partnership's assets and liabilities. Valuation methods will be outlined to determine the fair market value of each asset and liability. 5. Allocation of assets: Once the inventory and valuation are complete, the agreement will outline how the assets and liabilities will be distributed among the surviving partners and the estate of the deceased partner. This may include the transfer of assets, payment of debts, and allocation of any profits or losses. 6. Release and indemnity: To protect all parties involved, the agreement will typically include a provision for the surviving partners to release the estate of the deceased partner from any future claims or liabilities. It is important to note that there may be variations of the District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner, depending on the specific circumstances and requirements of each partnership. These variations can be tailored to address unique situations and ensure a smooth and orderly winding up of the partnership. In conclusion, the District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner is a crucial legal document that provides a framework for the dissolution and distribution of assets and liabilities between the surviving partners and the estate of a deceased partner. It is essential to consult with legal professionals well-versed in partnership law in the District of Columbia to draft a comprehensive and customized agreement that meets the specific needs and objectives of the partnership involved.

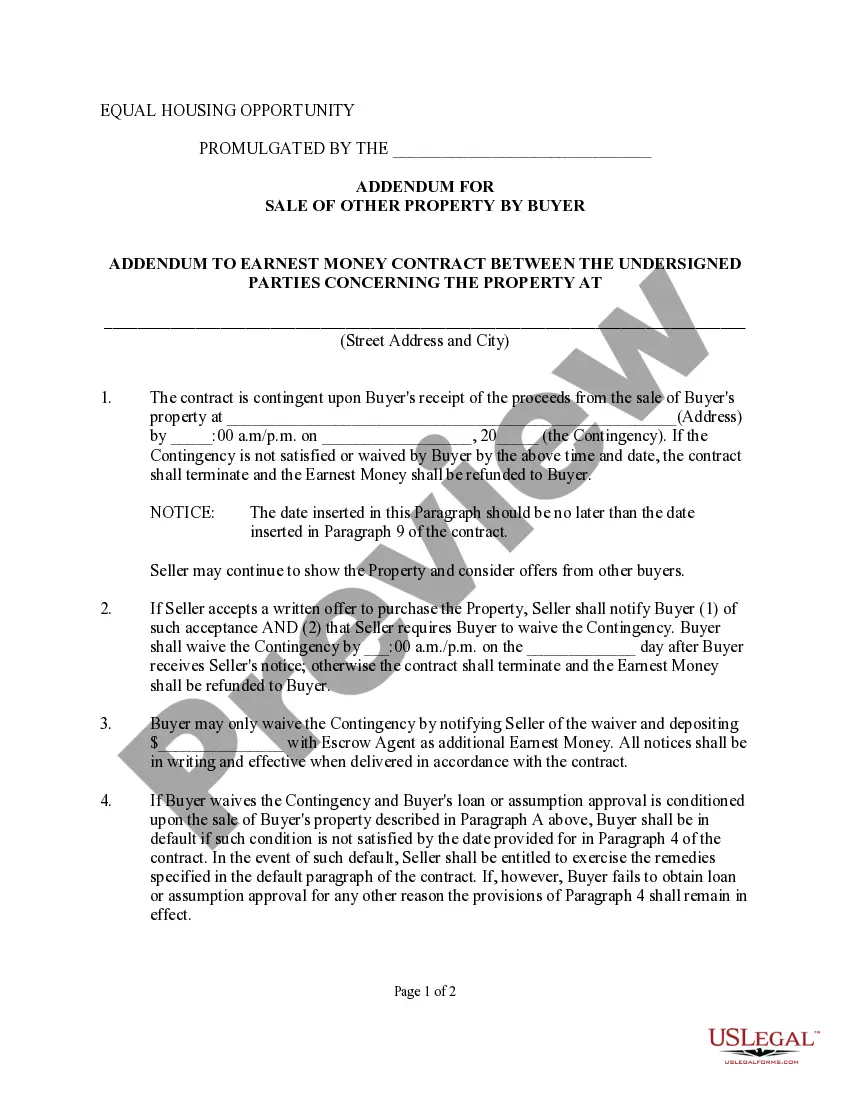

District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out District Of Columbia Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

US Legal Forms - one of several biggest libraries of legitimate types in the States - delivers a wide array of legitimate document layouts you may obtain or printing. While using site, you may get a large number of types for business and specific reasons, sorted by types, states, or keywords and phrases.You will find the newest variations of types much like the District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner within minutes.

If you have a subscription, log in and obtain District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner from your US Legal Forms library. The Obtain option will show up on each type you perspective. You have accessibility to all earlier acquired types in the My Forms tab of your own bank account.

If you wish to use US Legal Forms for the first time, listed here are straightforward instructions to get you started off:

- Make sure you have picked the proper type for your personal metropolis/area. Go through the Review option to examine the form`s content. Browse the type outline to ensure that you have chosen the correct type.

- In the event the type does not satisfy your requirements, take advantage of the Research industry towards the top of the screen to find the one that does.

- In case you are content with the shape, affirm your option by clicking the Buy now option. Then, pick the pricing prepare you favor and give your qualifications to register for an bank account.

- Method the transaction. Make use of your charge card or PayPal bank account to perform the transaction.

- Find the formatting and obtain the shape in your gadget.

- Make adjustments. Fill up, revise and printing and indicator the acquired District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner.

Each and every web template you put into your bank account lacks an expiration day which is the one you have forever. So, in order to obtain or printing another version, just check out the My Forms segment and then click about the type you want.

Obtain access to the District of Columbia Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner with US Legal Forms, the most extensive library of legitimate document layouts. Use a large number of expert and condition-distinct layouts that meet up with your small business or specific demands and requirements.

Form popularity

FAQ

After the Death of a Business PartnerThe deceased's estate takes over their share of the partnership. A transfer happens of the other partner's share to you on a payment to the estate. You buy the share of the partnership using a financial formula.

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.

The liquidation or dissolution process for partnerships is similar to the liquidation process for corporations. Over a period of time, the partnership's non-cash assets are converted to cash, creditors are paid to the extent possible, and remaining funds, if any, are distributed to the partners.

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

Dissolution of a partnership firm on account of death of one of the partners is subject to the contract entered into by the parties. The clause of the partnership deed clearly stated that the death of any partner would not have the effect of dissolving the firm.

On the death of a partner, the partnership ceases to exist. But the firm may not cease to exist as the other remaining partners may decide to continue the business. In case of death of a partner, the treatment of various items is similar to that at the time of retirement of the partner.

The Supreme Court held as under: Section 42(c) of the Partnership Act can appropriately be applied to a' partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

Section 42(c) of the partnership Act can appropriately be applied to a partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.