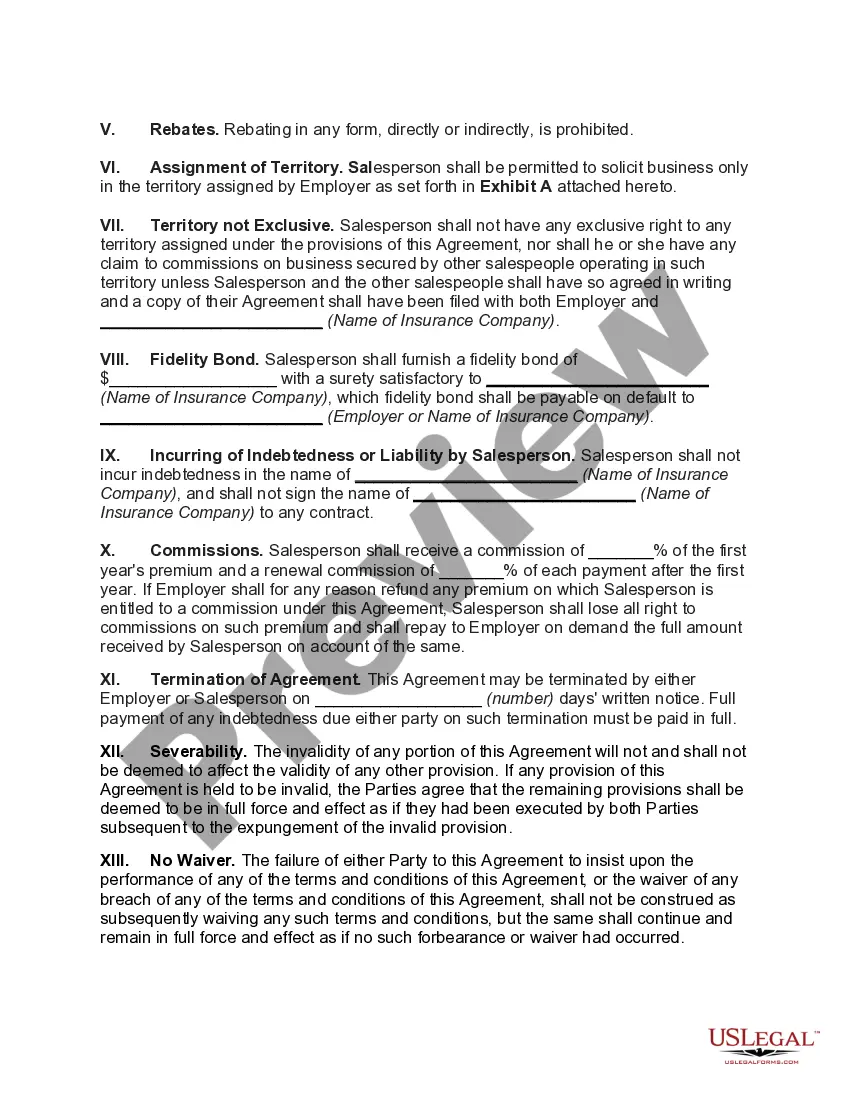

Description: District of Columbia Employment Agreement between General Agent as Employer and Salesperson — Sale of Insurance In the District of Columbia, an Employment Agreement between a General Agent as an Employer and a Salesperson for the Sale of Insurance plays a crucial role in defining the professional relationship and obligations between the parties involved. This agreement outlines the terms and conditions under which the salesperson will be employed by the general agent to sell insurance products within the designated jurisdiction. In the District of Columbia, there are primarily two types of Employment Agreements between General Agent and Salesperson involved in the Sale of Insurance: 1. Exclusive Employment Agreement: This type of agreement establishes an exclusive working relationship between the general agent and the salesperson. It typically includes provisions that prohibit the salesperson from representing or selling insurance products for any other general agent or company during the employment period. The exclusivity clause ensures that the salesperson prioritizes the interests of the employing general agent and the insurance products they offer. 2. Non-Exclusive Employment Agreement: This type of agreement allows the salesperson to represent and sell insurance products for multiple general agents or insurance companies simultaneously. It does not restrict the salesperson's ability to work with other businesses in the insurance field. This agreement is often preferred by salespeople who wish to diversify their portfolio and maximize their earning potential by representing different insurance products from various sources. Key provisions found in a District of Columbia Employment Agreement between a General Agent as Employer and Salesperson — Sale of Insurance may include: 1. Parties: Identifies and provides the names and contact details of the General Agent and the Salesperson entering the agreement. 2. Term: Defines the duration of the employment relationship, including the start and end dates or any provisions for automatic renewal. 3. Salesperson's Duties and Obligations: Specifies the responsibilities and activities expected from the salesperson, such as prospecting clients, conducting sales presentations, submitting applications, and maintaining accurate records. 4. Compensation and Commission: Outlines the salesperson's compensation structure, commission rates, bonuses, and any other financial arrangements or incentive programs. 5. Territory and Limitations: Defines the geographical area in which the salesperson is authorized to sell insurance products and any restrictions on entering or soliciting business from specific territories or clients. 6. Confidentiality and Non-Disclosure: Details the salesperson's obligations to maintain the confidentiality of the general agent's trade secrets, client information, and any proprietary information related to the insurance products being offered. 7. Termination: Outlines the circumstances under which either party can terminate the agreement, including provisions for notice periods, severance pay, and non-compete clauses upon termination. 8. Governing Law and Dispute Resolution: Specifies that the agreement is governed by the laws of the District of Columbia and provides mechanisms for resolving any disputes or conflicts that may arise between the parties, such as arbitration or mediation. It is crucial for both the general agent and the salesperson to thoroughly review and understand the terms and conditions of the District of Columbia Employment Agreement before entering into the agreement. Consulting with legal professionals experienced in insurance laws and employment regulations in the District of Columbia is highly recommended ensuring compliance and protect the rights and interests of both parties involved in the Sale of Insurance.

District of Columbia Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance

Description

How to fill out District Of Columbia Employment Agreement Between General Agent As Employer And Salesperson - Sale Of Insurance?

It is possible to spend hrs on the Internet trying to find the lawful papers template which fits the federal and state needs you require. US Legal Forms offers 1000s of lawful varieties that are examined by experts. It is possible to down load or print out the District of Columbia Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance from my assistance.

If you currently have a US Legal Forms bank account, you may log in and then click the Obtain key. After that, you may comprehensive, change, print out, or indicator the District of Columbia Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance. Each and every lawful papers template you acquire is yours eternally. To obtain yet another duplicate for any bought kind, visit the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms internet site initially, keep to the easy instructions listed below:

- Very first, make sure that you have chosen the correct papers template for that state/city of your liking. Browse the kind outline to ensure you have chosen the appropriate kind. If offered, use the Review key to search from the papers template at the same time.

- If you would like get yet another edition of your kind, use the Look for discipline to find the template that meets your needs and needs.

- When you have identified the template you would like, just click Acquire now to proceed.

- Pick the costs prepare you would like, type your references, and sign up for an account on US Legal Forms.

- Full the deal. You can use your charge card or PayPal bank account to pay for the lawful kind.

- Pick the format of your papers and down load it to your gadget.

- Make alterations to your papers if needed. It is possible to comprehensive, change and indicator and print out District of Columbia Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance.

Obtain and print out 1000s of papers layouts using the US Legal Forms site, which provides the biggest variety of lawful varieties. Use skilled and condition-distinct layouts to handle your organization or personal requires.