District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance

Description

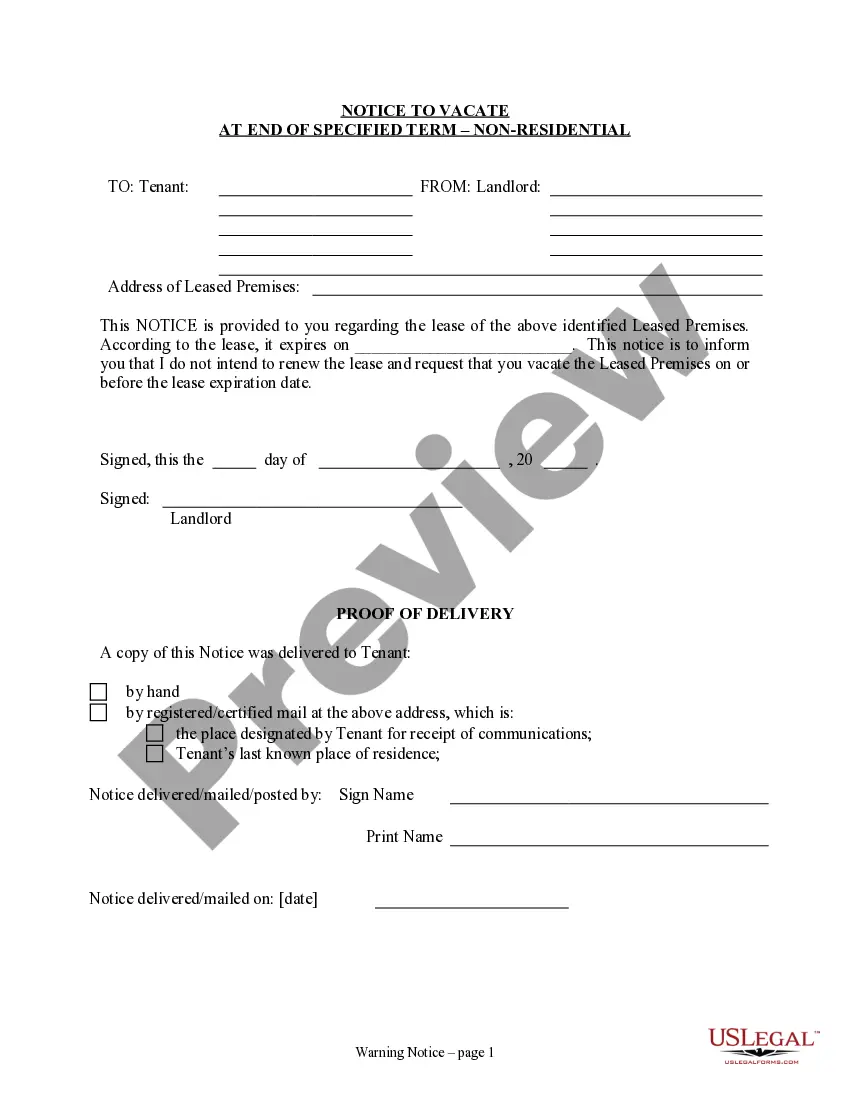

How to fill out Insurance General Agency Agreement With Exclusive Representation For All Lines Of Insurance?

If you desire to download, obtain, or print authentic document templates, utilize US Legal Forms, the premier assortment of legitimate forms accessible online.

Take advantage of the site's simple and user-friendly search feature to locate the documents you require.

An array of templates for business and personal purposes are categorized by types and states or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and provide your information to register for an account.

Step 5. Process the payment. You can complete the transaction using your credit card or PayPal account.

- Utilize US Legal Forms to find the District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct region/country.

- Step 2. Use the Review option to examine the form's details. Don't forget to check the summary.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other templates in the legal form catalog.

Form popularity

FAQ

The purpose of an agency agreement in insurance is to establish clear guidelines and expectations for the relationship between an agent and an insurance company. This agreement defines the agent's authority, responsibilities, and the specific products they can sell. In the context of a District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, it serves as a crucial tool in fostering a successful partnership and ensuring compliance with regulations.

To become a life insurance agent in Washington, D.C., you must complete a pre-licensing education course, pass the state examination, and submit your application for licensure. Embracing the nuances of a District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance will also enhance your understanding of the industry. Resources like uslegalforms can assist you in navigating the application process and understanding the necessary requirements.

A life producer license is a credential that permits an individual to sell and produce life insurance policies. It signifies that the holder has met specific educational and testing requirements defined by insurance regulators. If you're looking to obtain this license, the District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance can provide a valuable framework for your career in insurance sales.

The primary difference between an agency and other types of contracts lies in the agency's authority to act on behalf of another party. While many contracts define a service or product exchange, an agency contract specifically empowers an agent to negotiate and finalize insurance agreements. This distinction is especially significant in a District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, emphasizing the fiduciary relationship between the insurer and the agent.

The difficulty of obtaining an insurance license can vary by state and the type of insurance. Generally, the life insurance license can be challenging due to the comprehensive understanding required of policies and state regulations. If you’re pursuing a life insurance license in Washington, D.C., consider utilizing resources offered by platforms like uslegalforms, which streamline the learning and application process through templates and guidance.

A life insurance producer is a professional who sells life insurance products to clients, helping them secure financial protection for their loved ones. These producers are often licensed and may work independently or alongside an agency under a District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance. Their role is crucial in connecting clients with appropriate coverage options.

An agency contract is a formal agreement between an insurance company and an agent that defines the terms of their relationship. This contract typically outlines the responsibilities of both parties, the scope of authority, and the specific lines of insurance covered. In the context of a District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, such contracts provide the framework for agents to represent insurers confidently.

In the insurance sector, 'agency' refers to a relationship where an agent represents an insurer to solicit and negotiate insurance policies. This relationship enables agents to provide a range of insurance products to clients under the terms outlined in a District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance. By understanding agency, clients can navigate their insurance needs more effectively.

In Washington, an insurance producer's license must be renewed every two years, similar to the District of Columbia’s requirements. Staying ahead of renewal deadlines is vital for maintaining your ability to operate as a producer in both regions. You might find that understanding the nuances of the District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance can offer helpful insights if you are servicing clients across both districts.

To become an insurance agent in the District of Columbia, you must complete pre-licensing education, pass the state’s licensing exam, and submit your application. It is helpful to understand the specifics of various insurance lines and the applicable laws. Developing a solid grasp of the District of Columbia Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance is beneficial, as it can provide clarity on your roles and responsibilities once licensed. Additionally, using platforms like uslegalforms can simplify the process of obtaining the necessary documents.