District of Columbia Contract with Independent Contractor to Work as a Consultant

Description

How to fill out Contract With Independent Contractor To Work As A Consultant?

Choosing the best authorized document web template might be a have a problem. Needless to say, there are a variety of themes available online, but how would you find the authorized form you will need? Make use of the US Legal Forms web site. The service offers thousands of themes, such as the District of Columbia Contract with Independent Contractor to Work as a Consultant, which can be used for business and private requirements. Every one of the kinds are inspected by professionals and meet state and federal specifications.

If you are previously authorized, log in to the account and click on the Down load button to find the District of Columbia Contract with Independent Contractor to Work as a Consultant. Utilize your account to appear from the authorized kinds you possess bought earlier. Proceed to the My Forms tab of your account and acquire one more backup of the document you will need.

If you are a new consumer of US Legal Forms, listed here are basic directions so that you can comply with:

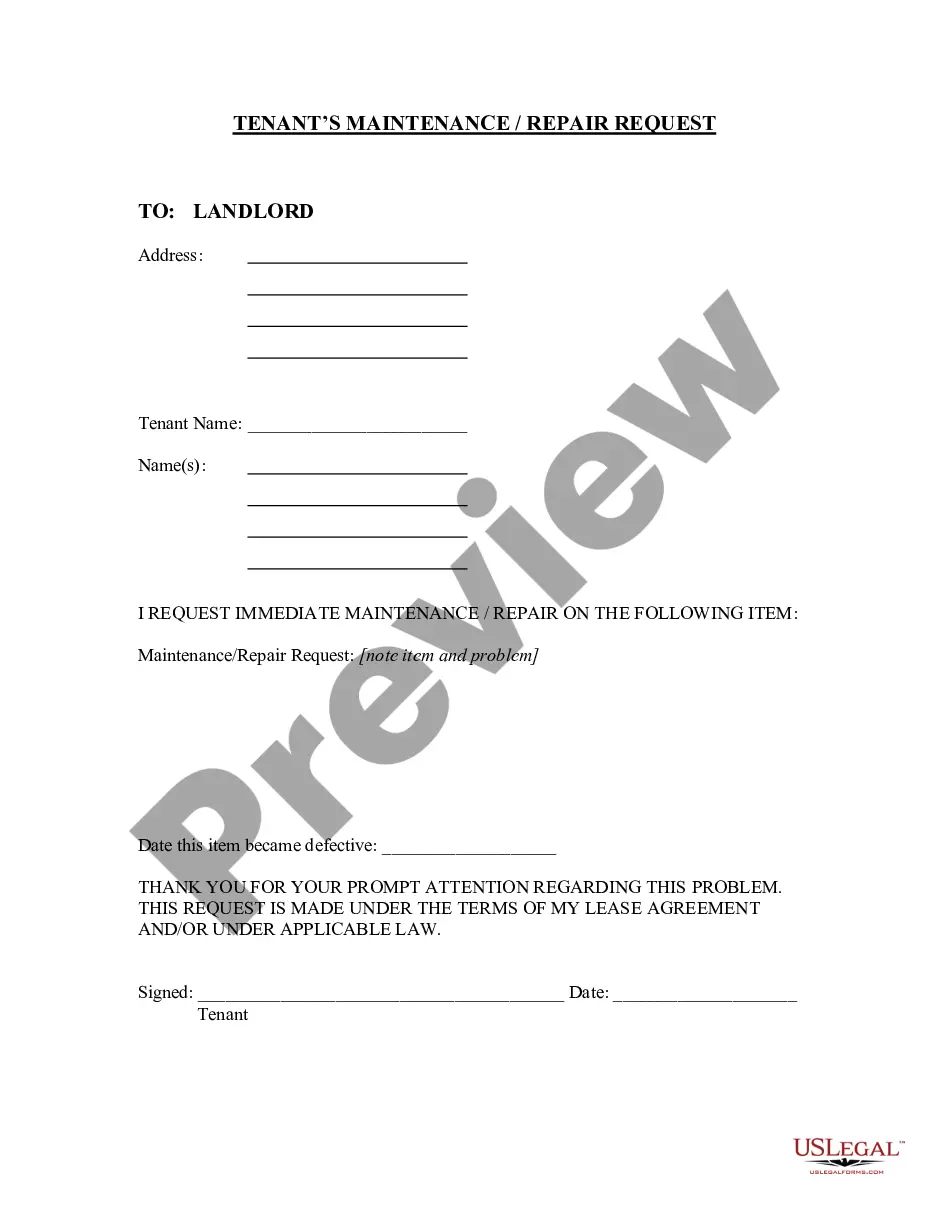

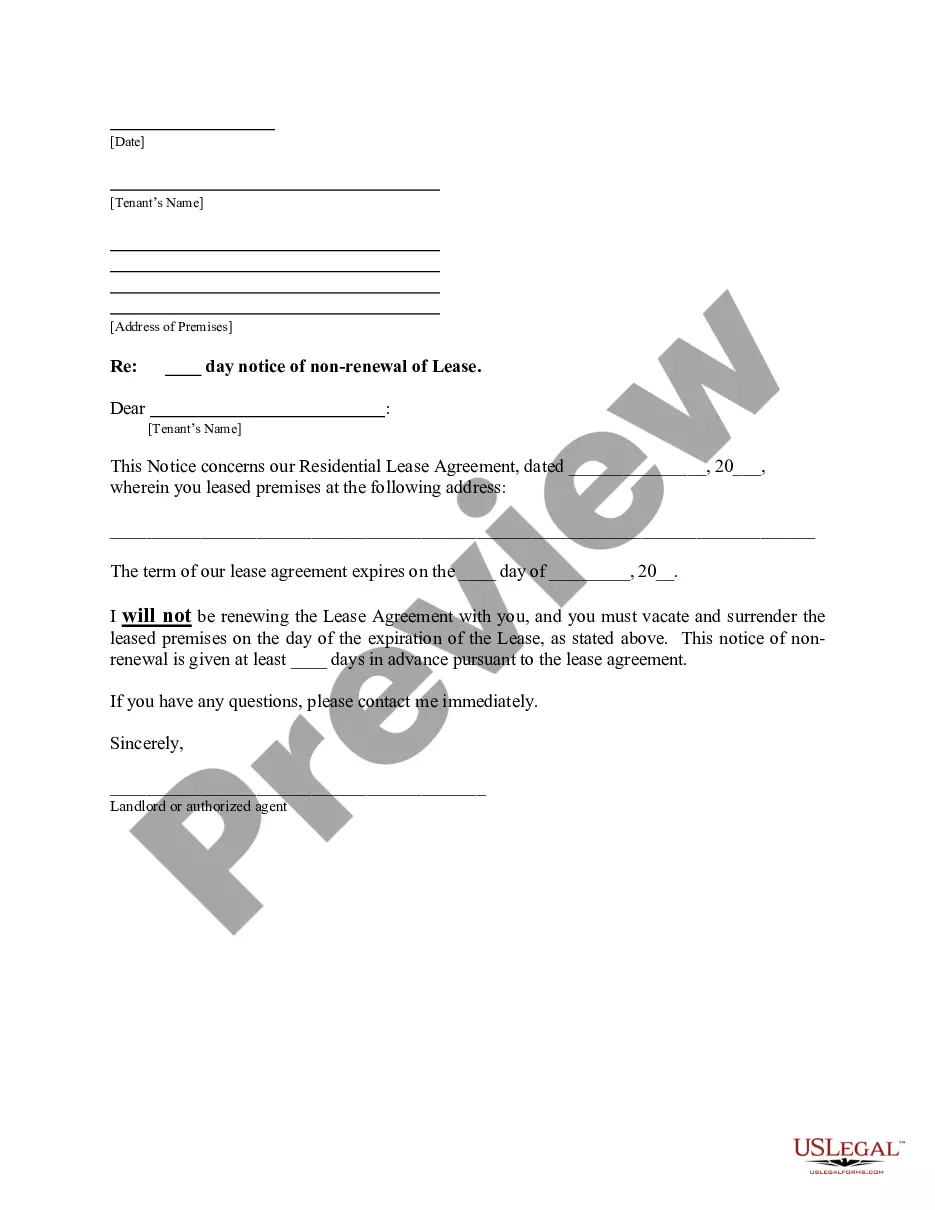

- Initially, make certain you have chosen the proper form for your personal metropolis/region. You can look through the form utilizing the Preview button and read the form explanation to ensure it will be the best for you.

- If the form is not going to meet your preferences, make use of the Seach field to obtain the right form.

- When you are certain the form is suitable, click the Acquire now button to find the form.

- Choose the prices program you need and enter in the required details. Make your account and pay for your order using your PayPal account or Visa or Mastercard.

- Pick the data file format and download the authorized document web template to the gadget.

- Complete, change and produce and sign the obtained District of Columbia Contract with Independent Contractor to Work as a Consultant.

US Legal Forms is the most significant catalogue of authorized kinds for which you can find different document themes. Make use of the service to download expertly-made papers that comply with state specifications.

Form popularity

FAQ

No, they cannot. To stress, any employee who has rendered at least one year of service, whether such service is continuous or broken, shall be considered a regular employee. Note that no declaration or appointment paper is necessary to make one a regular employee.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Pay self-employment taxAs an independent consultant you are considered self-employed, so if you earn more than $400 for the year, the IRS expects you to pay your own tax. The self-employment tax rate is 15.3% of your net earnings.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.