The District of Columbia (DC) Credit Inquiry refers to the process of evaluating an individual's creditworthiness within the District of Columbia. This credit inquiry is essential for various financial transactions, including obtaining loans, credit cards, or mortgages. It involves assessing an individual's credit history, determining their financial responsibility, and predicting their ability to repay borrowed funds. The types of District of Columbia Credit Inquiry can generally be categorized into soft inquiries and hard inquiries: 1. Soft Inquiries: Soft inquiries occur when a person or organization requests access to an individual's credit report for informational purposes without the individual's direct consent. Soft inquiries do not impact the credit score and are typically initiated by credit monitoring services, pre-approved credit offers, or routine background checks conducted by potential employers or landlords. 2. Hard Inquiries: Hard inquiries, on the other hand, occur when an individual specifically applies for credit, such as a loan or credit card. These inquiries are initiated with the explicit consent of the individual and can have a temporary negative impact on their credit score. Hard inquiries are typically conducted by financial institutions, lenders, or credit card issuers to assess the risk associated with lending money to a borrower and to determine the terms and conditions of the credit. The District of Columbia Credit Inquiry process involves gathering and analyzing information from multiple sources, including credit bureaus such as Experian, Equifax, and TransUnion. These bureaus maintain detailed credit reports containing an individual's credit history, payment patterns, outstanding debts, bankruptcies, and any judgments or liens against them. Credit inquiries also consider factors such as employment history, income, and existing financial obligations. The District of Columbia Credit Inquiry is a crucial step in evaluating an individual's creditworthiness and determining if they qualify for credit products. It helps financial institutions make informed decisions regarding lending, ensuring responsible borrowing and minimizing the risk of default. Moreover, the credit inquiry process ensures compliance with federal and state regulations, including the Fair Credit Reporting Act (FCRA), which protects consumers' rights and privacy. In conclusion, the District of Columbia Credit Inquiry is an integral part of financial transactions within the district. It assesses an individual's creditworthiness, predicts their ability to repay borrowed funds, and ensures compliance with relevant regulations. Soft and hard inquiries are the two primary types of credit inquiries conducted, each serving different purposes in evaluating an individual's credit history.

District of Columbia Credit Inquiry

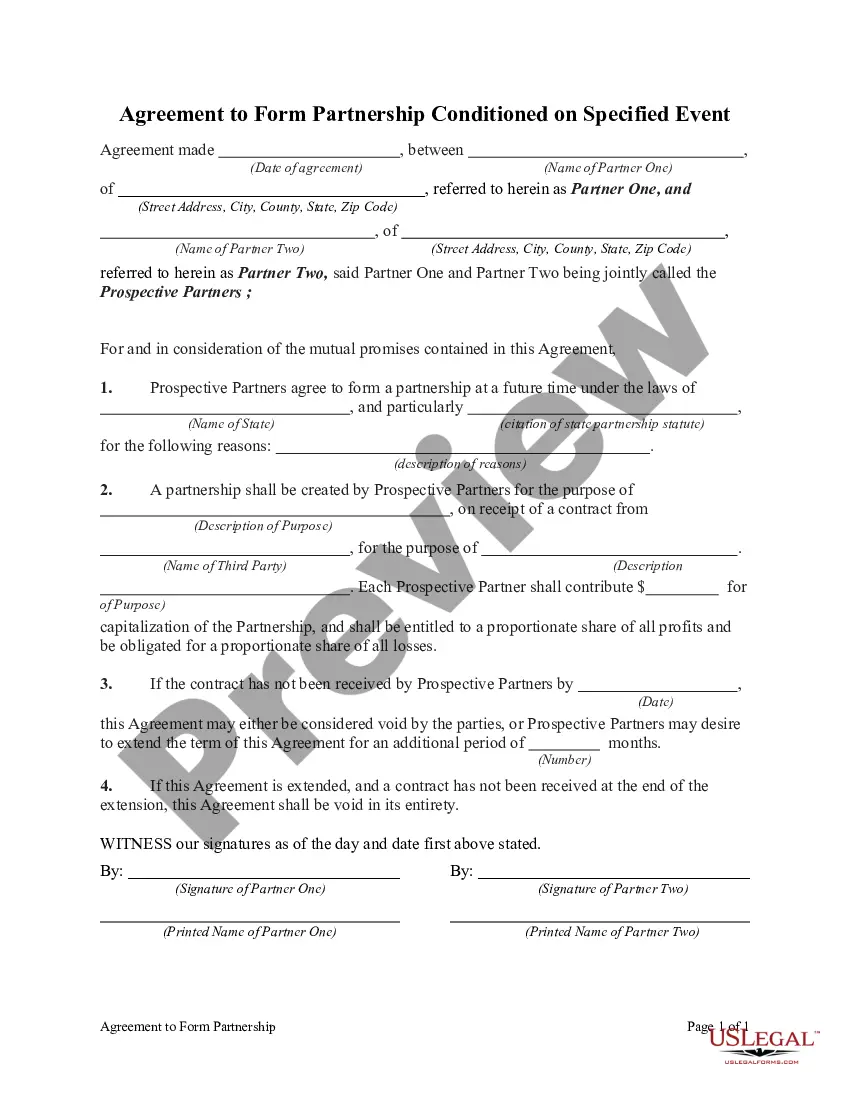

Description

How to fill out District Of Columbia Credit Inquiry?

If you wish to full, download, or print authorized document templates, use US Legal Forms, the greatest variety of authorized types, that can be found online. Take advantage of the site`s easy and practical research to find the documents you will need. Numerous templates for enterprise and person uses are categorized by classes and suggests, or keywords. Use US Legal Forms to find the District of Columbia Credit Inquiry in a handful of clicks.

Should you be currently a US Legal Forms client, log in to the account and click the Acquire key to find the District of Columbia Credit Inquiry. You can also accessibility types you previously delivered electronically inside the My Forms tab of your respective account.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape to the appropriate metropolis/region.

- Step 2. Take advantage of the Review method to examine the form`s information. Do not neglect to learn the description.

- Step 3. Should you be not satisfied with the form, take advantage of the Research field on top of the display screen to get other variations of your authorized form web template.

- Step 4. When you have identified the shape you will need, select the Get now key. Pick the prices strategy you choose and include your credentials to sign up to have an account.

- Step 5. Process the financial transaction. You may use your credit card or PayPal account to accomplish the financial transaction.

- Step 6. Find the formatting of your authorized form and download it in your system.

- Step 7. Total, edit and print or indication the District of Columbia Credit Inquiry.

Each and every authorized document web template you purchase is the one you have for a long time. You have acces to each form you delivered electronically with your acccount. Click the My Forms segment and decide on a form to print or download once more.

Remain competitive and download, and print the District of Columbia Credit Inquiry with US Legal Forms. There are thousands of professional and state-distinct types you can utilize to your enterprise or person requirements.