District of Columbia Daily Accounts Receivable

Category:

State:

Multi-State

Control #:

US-137-AZ

Format:

Word;

PDF;

Rich Text

Instant download

Description

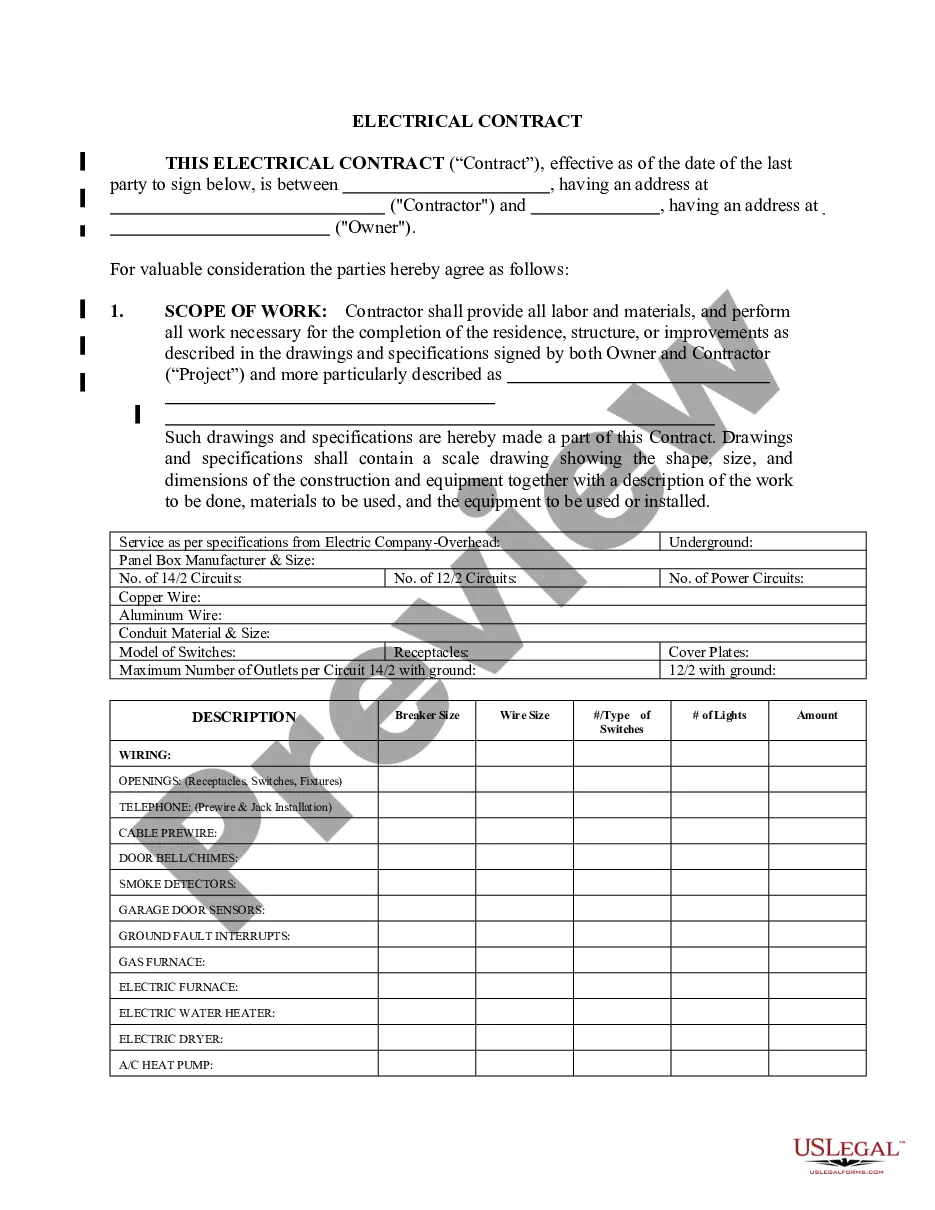

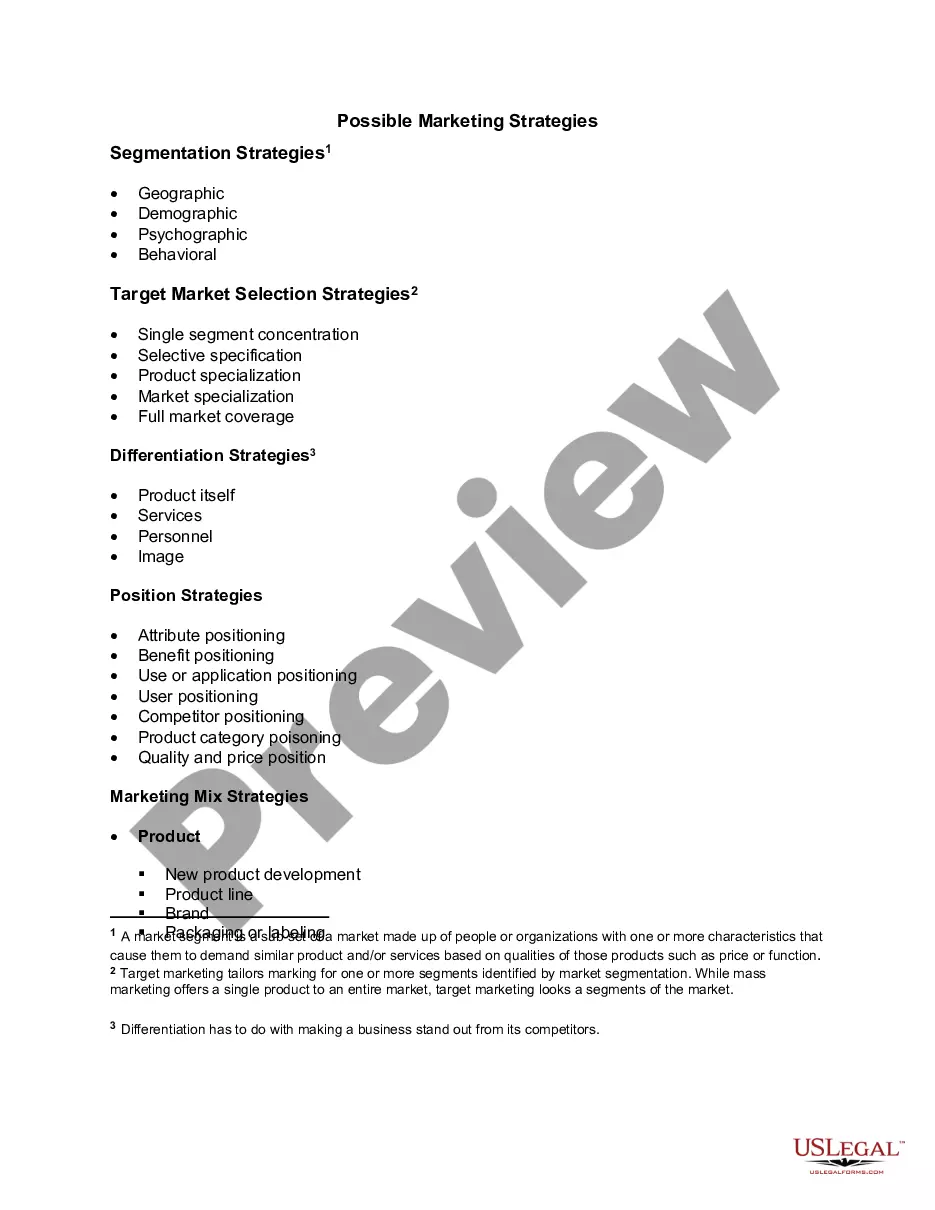

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

How to fill out Daily Accounts Receivable?

Finding the appropriate valid document format can be quite a challenge.

Of course, there are numerous templates available online, but how can you acquire the genuine form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the District of Columbia Daily Accounts Receivable, which can be utilized for both business and personal needs.

- All forms are reviewed by professionals and meet state and federal requirements.

- If you are already registered, Log In to your account and click the Download button to retrieve the District of Columbia Daily Accounts Receivable.

- Use your account to browse the legal documents you have purchased previously.

- Navigate to the My documents tab of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, make sure you have selected the correct form for your city/county. You can review the form using the Review button and check the form description to confirm it is suitable for you.