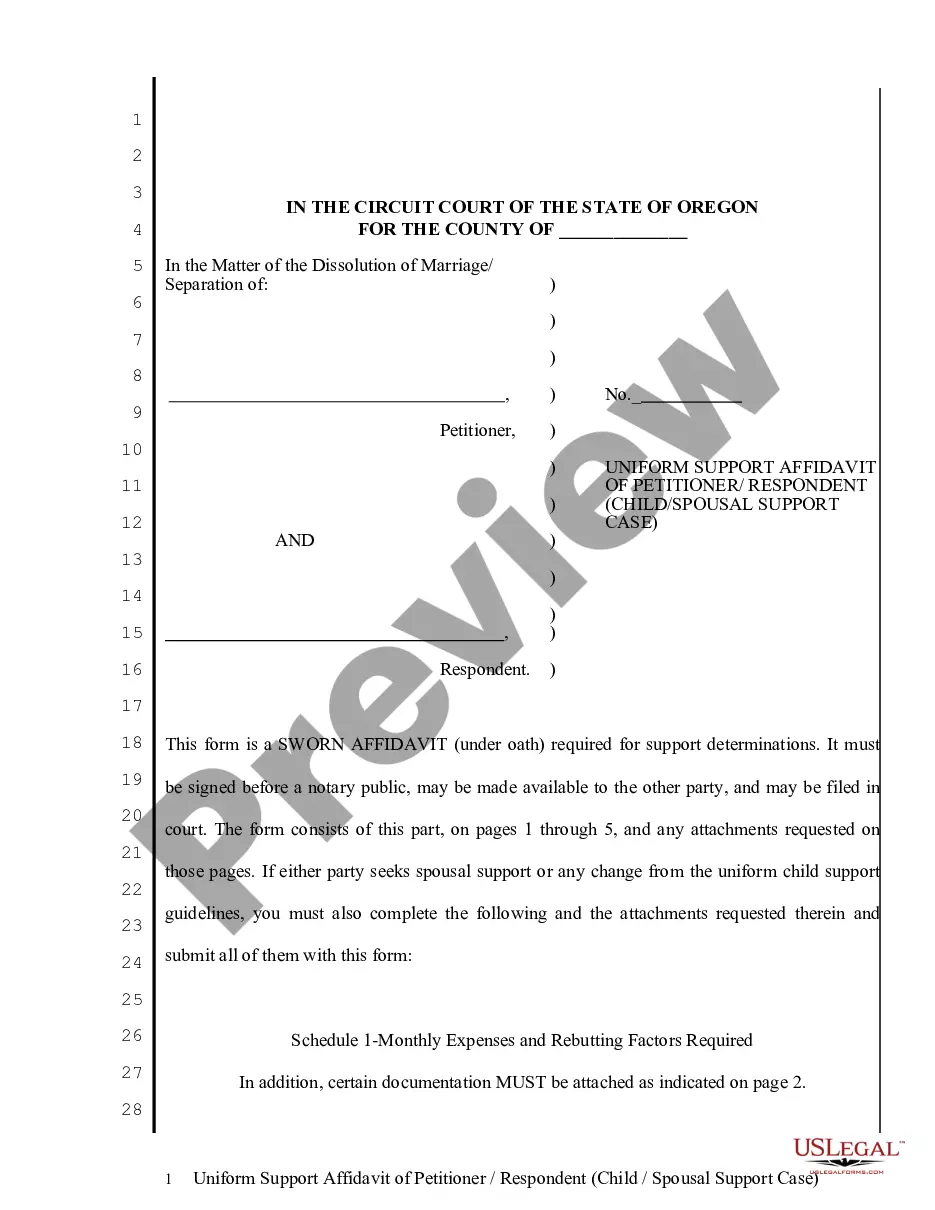

District of Columbia Fair Credit Act Disclosure Notice

State:

Multi-State

Control #:

US-171EM

Format:

Word;

Rich Text

Instant download

Description

Notice to potential employee that his/her credit history may be obtained for employment purposes.

How to fill out Fair Credit Act Disclosure Notice?

You might spend multiple hours online looking for the legal document template that meets both state and federal requirements you necessitate.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

You can download or print the District of Columbia Fair Credit Act Disclosure Notice from their service.

If available, use the Preview option to look through the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Download option.

- Then, you can fill out, alter, print, or sign the District of Columbia Fair Credit Act Disclosure Notice.

- Every legal document template you obtain is yours permanently.

- To get an additional copy of the purchased form, visit the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have selected the correct document template for the region/area you choose.

- Read the form description to make certain you have selected the correct form.