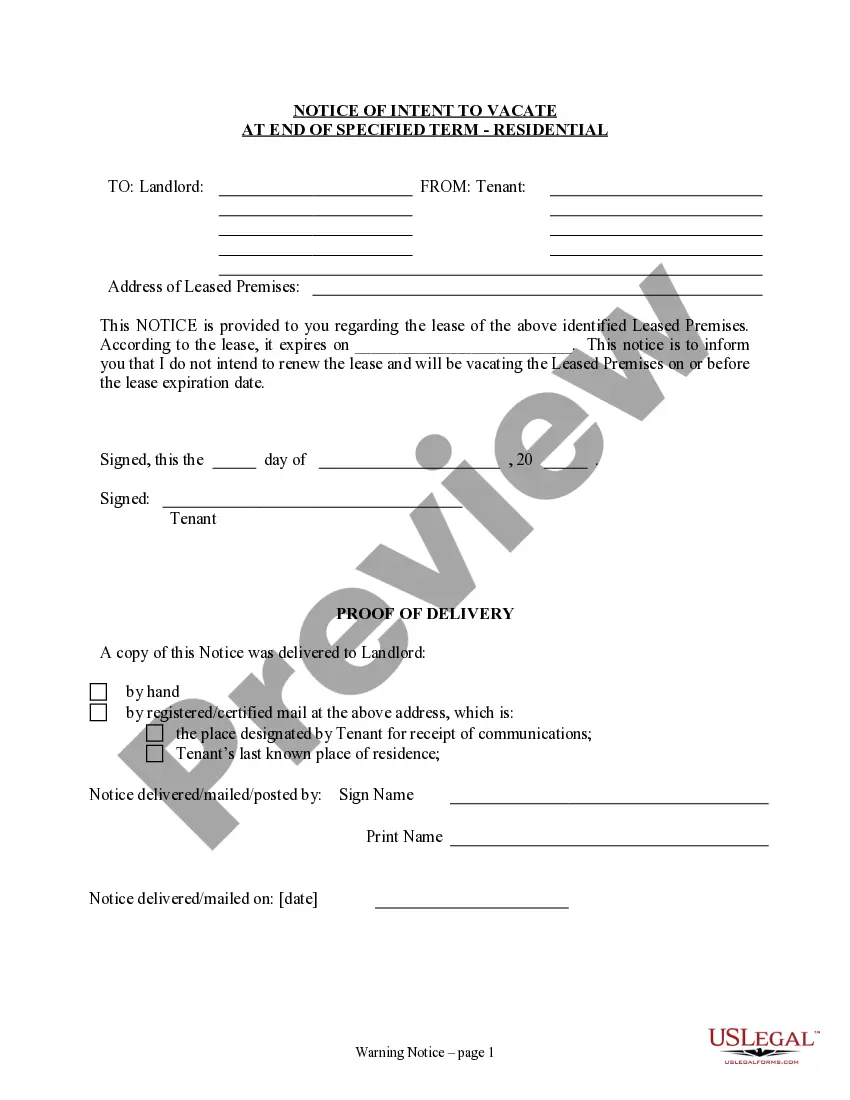

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

The District of Columbia Yearly Expenses by Quarter refers to the breakdown of the financial outlays incurred by the government of the District of Columbia over the course of a year, categorized into four quarters. This comprehensive expenditure report provides a detailed overview of the city's budget allocation and spending patterns throughout each fiscal quarter. The District of Columbia's Yearly Expenses by Quarter encompasses various categories such as education, healthcare, infrastructure, transportation, public safety, social welfare, and administrative costs. These expense categories enable a comprehensive analysis of the utilization of public funds, highlighting the government's priorities and areas of focus. The breakdown of District of Columbia Yearly Expenses by Quarter helps in monitoring the efficiency and effectiveness of government spending policies. This data is often utilized by policymakers, financial analysts, researchers, and concerned citizens for budget planning, performance evaluation, and forecasting purposes. Different types of District of Columbia Yearly Expenses by Quarter include: 1. Operating Expenses: This segment comprises day-to-day costs required to keep the government running smoothly. This includes salaries of government employees, utility bills, office supplies, legal and consulting services, and other necessary operational expenditures. 2. Capital Expenditures: Capital expenses involve long-term investments in infrastructure development, such as construction and maintenance of roads, bridges, schools, hospitals, parks, and government buildings. These investments are aimed at enhancing the quality of life for residents and improving the city's overall infrastructure. 3. Public Safety Expenditures: This category covers expenses related to law enforcement, fire protection, emergency services, and crime prevention. It includes the funding of police departments, fire stations, emergency medical services, and investments in technologies and equipment to ensure the safety of the residents. 4. Education and Social Welfare Expenses: This type of expense includes funding for public schools, colleges, universities, and vocational training institutions. It also covers expenditures related to social welfare programs, such as healthcare subsidies, affordable housing initiatives, food assistance programs, and support for vulnerable populations. 5. Healthcare Expenditures: This category involves the funding allocated to healthcare services, including hospitals, clinics, public health departments, and other medical facilities. It covers costs associated with providing healthcare to residents, ensuring access to quality medical services, and addressing public health concerns. 6. Transportation Expenses: This segment represents the funds allocated for the development, maintenance, and improvement of transportation infrastructure, such as roads, bridges, public transportation systems, cycling lanes, and pedestrian walkways. It also includes investments in transit systems, traffic management, and initiatives to promote green and sustainable transportation options. 7. Environmental and Sustainability Expenses: This type of expenditure focuses on creating a greener and more sustainable city. It includes expenses related to waste management, recycling programs, renewable energy initiatives, environmental protection measures, and other sustainability projects. The District of Columbia Yearly Expenses by Quarter report is crucial to understanding the financial landscape of the city government, ensuring transparency, accountability, and effective resource allocation. It serves as a vital tool for decision-making, policy formulation, and measuring the overall economic health and well-being of the District of Columbia.