District of Columbia Petty Cash Form

Description

How to fill out Petty Cash Form?

Selecting the ideal legal document template can be challenging. Indeed, numerous designs are accessible online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers a wide array of templates, including the District of Columbia Petty Cash Form, suitable for both business and personal purposes.

All forms are reviewed by professionals and comply with federal and state regulations.

If the form does not fulfill your needs, use the Search box to find the appropriate form. Once you are sure the form is suitable, click the Purchase now option to obtain it. Select the pricing plan you prefer and enter the required information. Create your account and complete the payment using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained District of Columbia Petty Cash Form. US Legal Forms is the largest collection of legal documents where you can find various paper templates. Use the service to acquire properly crafted documents that adhere to state regulations.

- If you are already registered, sign in to your account and click on the Acquire button to obtain the District of Columbia Petty Cash Form.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account and retrieve another copy of the documents you require.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state.

- You can explore the form using the Preview feature and review the form description to confirm it is the right one for you.

Form popularity

FAQ

You can file your DC tax return through the Office of Tax and Revenue's website. They provide clear instructions and online forms to make the process easier. Furthermore, using the District of Columbia Petty Cash Form can help you keep track of expenses to ensure your tax return is complete. Proper records can assist you in meeting all your filing obligations.

Yes, you can electronically file your DC tax return, which can save you time and hassle. The online process is user-friendly, allowing for quick submission and confirmation of your return. By utilizing resources such as the District of Columbia Petty Cash Form, you can ensure accurate financial reporting and streamline your filings. Embrace technology to make your tax experience smoother.

Filing your DC taxes late can lead to penalties and additional interest on any unpaid amount. The District of Columbia takes tax compliance seriously, and delays can cause unnecessary stress. To avoid this, consider organizing your finances early and using tools like the District of Columbia Petty Cash Form for better cash management. This way, you stay on track and potentially avoid costly mistakes.

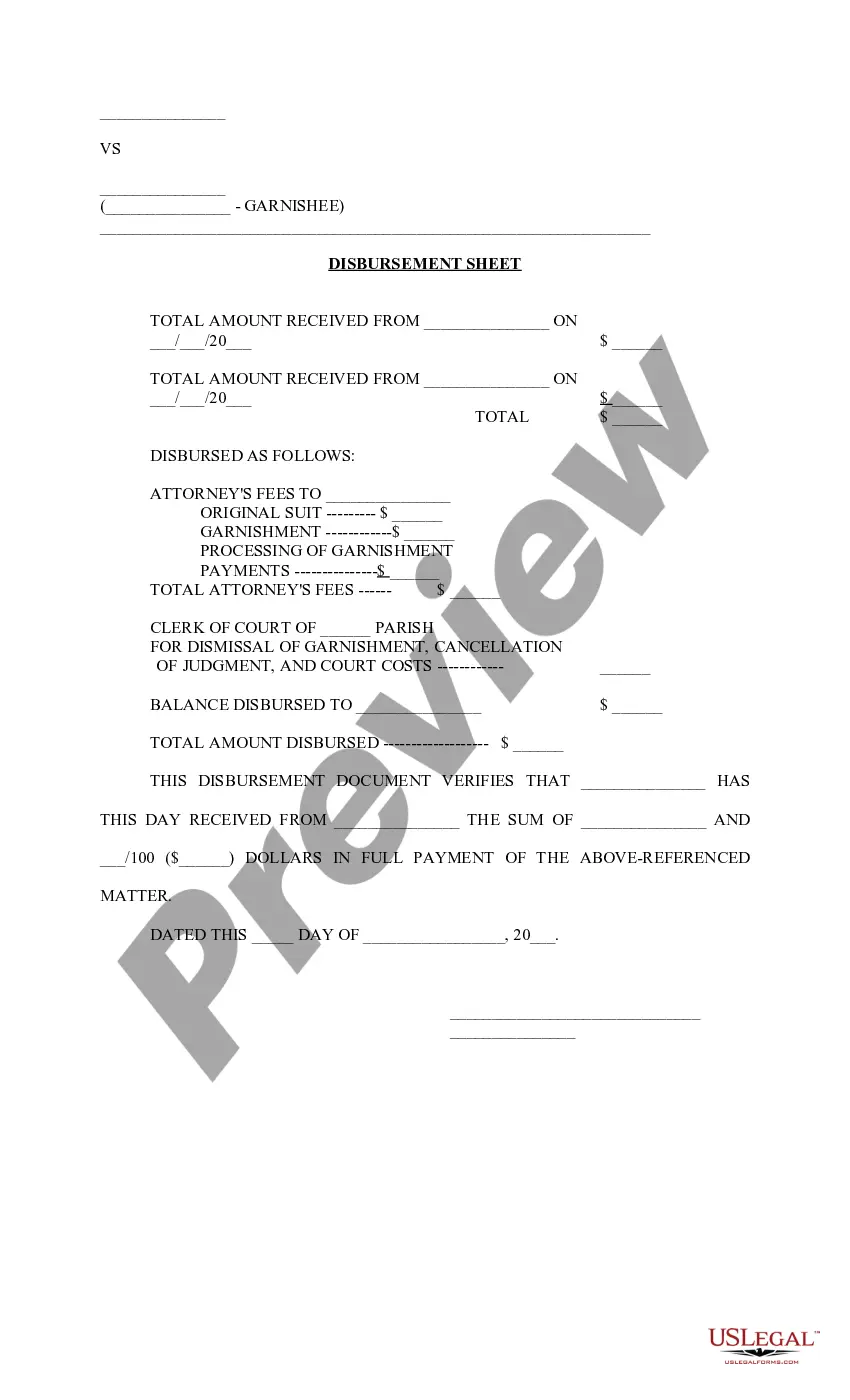

Filling out a petty cash form involves detailing each transaction, including the date, amount spent, and purpose of the expenditure. Make sure to include your name, signature, and the approval of a supervisor if required. Using the District of Columbia Petty Cash Form simplifies this process, ensuring accurate financial tracking for all small cash transactions.

Locally, you can find tax forms at public libraries, government offices, or community centers that provide tax assistance. Many of these locations will also have the District of Columbia Petty Cash Form available for those who need it. Be proactive in visiting these local resources to ensure you have all the necessary forms for your tax needs.

Generally, the post office does not carry tax forms for the District of Columbia or any other state. Instead, tax forms are often available online or at local government offices. You can find the necessary documentation, including the District of Columbia Petty Cash Form, to manage your petty cash efficiently as you prepare your tax filings.

You can obtain DC tax forms online through the Office of Tax and Revenue website or at designated government offices. These resources provide essential forms, including the District of Columbia Petty Cash Form, which is useful for managing small cash transactions. Always ensure that you have the latest versions of the forms to avoid complications during filing.

Petty cash should typically be prepared by a designated employee or financial officer within an organization. This person ensures that the District of Columbia Petty Cash Form is filled out correctly to document all cash transactions. Proper preparation helps maintain financial accuracy and accountability for small expenditures that arise during daily operations.

The DC form D-40 is the individual income tax return used to report personal income in the District of Columbia. It is important to understand that this form must be completed and submitted annually by residents who earn income within the District. For anyone needing to accurately track their financial activities, using the District of Columbia Petty Cash Form can streamline the process of managing small cash expenditures related to business or personal needs.

Basic petty cash procedures include establishing a petty cash fund, defining the spending limits, and regularly reconciling the fund to ensure accuracy. Develop a consistent method for tracking expenses using the District of Columbia Petty Cash Form to streamline this process. Regular review and reconciliation will help you maintain control over your petty cash.