Title: District of Columbia Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank — Explained in Detail Introduction: This article aims to provide a comprehensive understanding of the District of Columbia Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank. We will delve into the purpose, procedure, and various types of these resolutions, shedding light on their importance and implications. The keywords relevant to this topic are District of Columbia Resolution, Meeting of LLC Members, Borrow Capital, Designated Bank, and Types. 1. Understanding the District of Columbia Resolution of Meeting of LLC Members: The District of Columbia Resolution of Meeting of LLC Members is a legal document that allows a Limited Liability Company (LLC) registered in the District of Columbia (D.C.) to borrow capital from a designated bank. This resolution serves as a formal agreement among the LLC members to authorize and regulate the borrowing process. 2. Purpose of the Resolution: The primary purpose of this resolution is to provide LLC members with a standardized procedure to obtain capital from a designated bank. It ensures that the decision to borrow capital is made collectively, protecting the best interests of the LLC and its members. 3. Procedure for Implementing the Resolution: The implementation of the Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank generally involves the following steps: a. Notice of Meeting: The LLC members must be given prior notice for the meeting to discuss and decide on borrowing capital. The notice must include the date, time, location, and purpose of the meeting. b. Meeting Conduction: The LLC members convene at the designated place and hold discussions regarding the capital borrowing. The resolution is proposed, debated, and put to a vote among the members. c. Adoption of the Resolution: Once the resolution is passed in the meeting by a majority vote, it becomes an official agreement among the members. The resolution sets forth the conditions, terms, and amount of borrowed capital, along with any additional provisions, if applicable. d. Documenting and Filing: The approved resolution must be appropriately documented, signed by all members, and kept in the company's records. It is advisable to file the resolution with the appropriate District of Columbia agencies for record-keeping purposes. 4. Types of District of Columbia Resolution of Meeting of LLC Members to Borrow Capital: a. Initial Capital Borrowing Resolution: This type of resolution is adopted when an LLC is borrowing capital for the first time. It establishes the process and guidelines for future capital borrowings that may occur during the LLC's existence. b. Additional Capital Borrowing Resolution: If an LLC has previously borrowed capital and intends to secure further financial resources, an additional capital borrowing resolution is required. It outlines the terms and conditions for the subsequent borrowing. c. Modification or Amendment Resolution: In situations where an existing capital borrowing resolution needs to be modified or amended due to changing circumstances, an LLC can adopt a modification or amendment resolution. This type of resolution clearly states the modifications made to the original resolution and its impact on borrowing capital. Conclusion: The District of Columbia Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is a vital document that ensures a structured and legally compliant approach to borrowing capital for LCS within the District of Columbia. By following the specified procedure and adopting relevant resolutions, LCS can effectively utilize available financing options to meet their capital needs. Remember that seeking legal advice and referring to the appropriate District of Columbia laws and regulations is essential during this process.

District of Columbia Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out District Of Columbia Resolution Of Meeting Of LLC Members To Borrow Capital From Designated Bank?

Are you presently inside a situation that you need to have documents for possibly organization or individual reasons nearly every working day? There are plenty of authorized papers templates available online, but discovering versions you can trust is not effortless. US Legal Forms offers a huge number of form templates, like the District of Columbia Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank, that happen to be published in order to meet state and federal requirements.

In case you are currently knowledgeable about US Legal Forms internet site and get a free account, merely log in. After that, it is possible to down load the District of Columbia Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank design.

If you do not have an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Find the form you need and make sure it is for that right area/region.

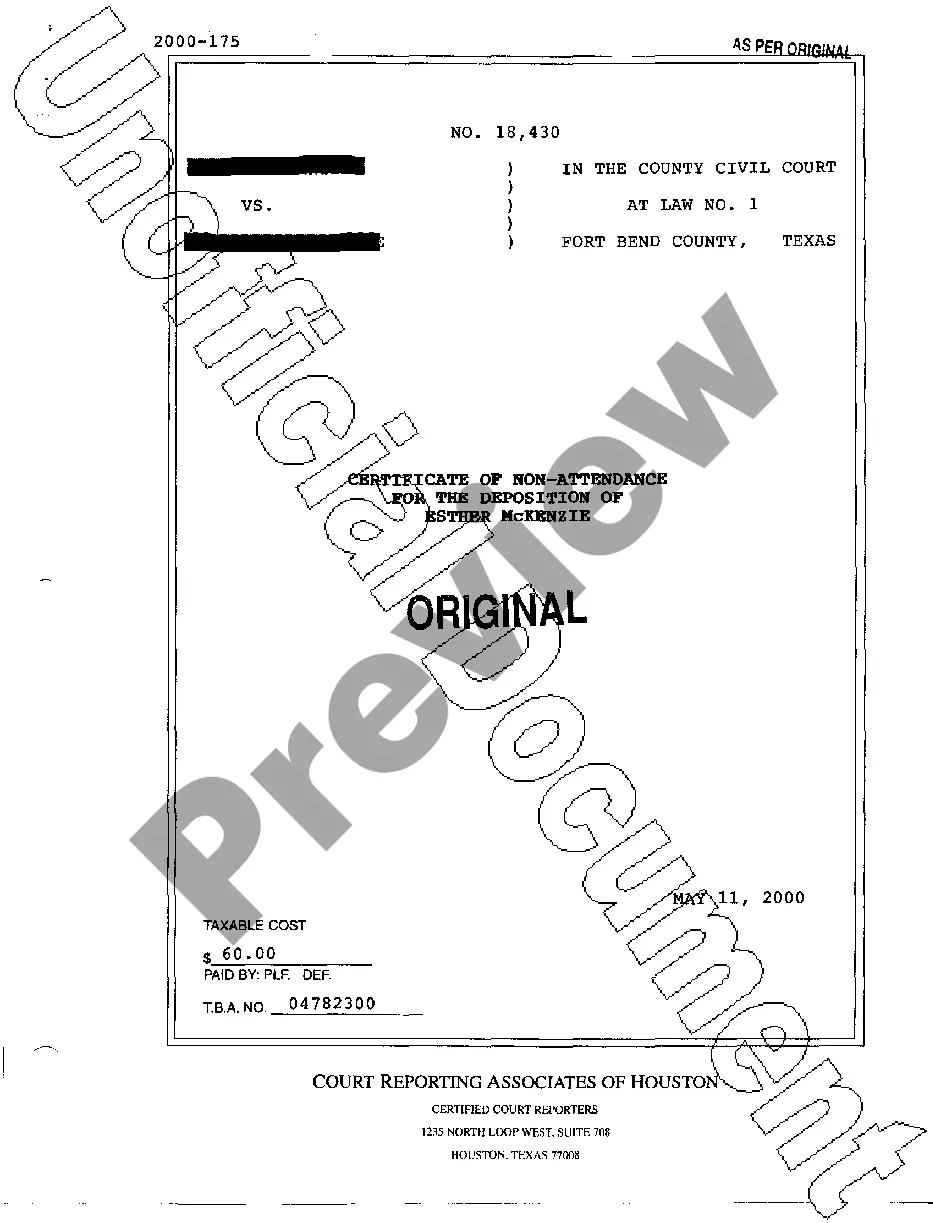

- Make use of the Review button to analyze the form.

- Read the description to actually have selected the right form.

- In case the form is not what you`re seeking, utilize the Look for area to discover the form that suits you and requirements.

- If you discover the right form, click on Purchase now.

- Select the pricing plan you need, fill in the desired information to make your bank account, and buy an order utilizing your PayPal or credit card.

- Choose a handy document file format and down load your version.

Get all of the papers templates you may have purchased in the My Forms food selection. You can aquire a more version of District of Columbia Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank anytime, if needed. Just click on the essential form to down load or produce the papers design.

Use US Legal Forms, by far the most substantial collection of authorized varieties, to conserve efforts and stay away from errors. The assistance offers skillfully manufactured authorized papers templates which you can use for a range of reasons. Generate a free account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

When you create a resolution to open a bank account, you need to include the following information:The legal name of the corporation.The name of the bank where the account will be created.The state where the business is formed.Information about the directors/members.More items...

A Board Resolution is a formal document that helps to identify the roles of corporate offices and the result of any votes or decisions the board makes regarding the company. Usually, they are written when a new member is voted into the board.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

What Is an LLC Banking Resolution? An LLC Banking Resolution is a formal document needed for an LLC to establish a bank relationship. It defines the representatives who are authorized to manage the company's bank account, including their roles and privileges.

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.

The properly filled-out form must contain the following information:The name of the organization;The maximum and minimum loan amounts;The names, titles, and signatures of four officers referred to this Resolution;The place of the meeting during which the Resolution was adopted;The exact date of that meeting;More items...?

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?16-Jun-2021

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.