District of Columbia Exempt Survey

Description

How to fill out Exempt Survey?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers an extensive selection of legal form templates that you can download or print.

By using the site, you can access thousands of forms for both business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the District of Columbia Exempt Survey in just minutes.

If you already possess a monthly subscription, Log In and download the District of Columbia Exempt Survey from your US Legal Forms library. The Download option will be available for every form you view. You can access all previously saved forms within the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make edits. Fill out, modify, and print & sign the saved District of Columbia Exempt Survey.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the appropriate form for your city/state.

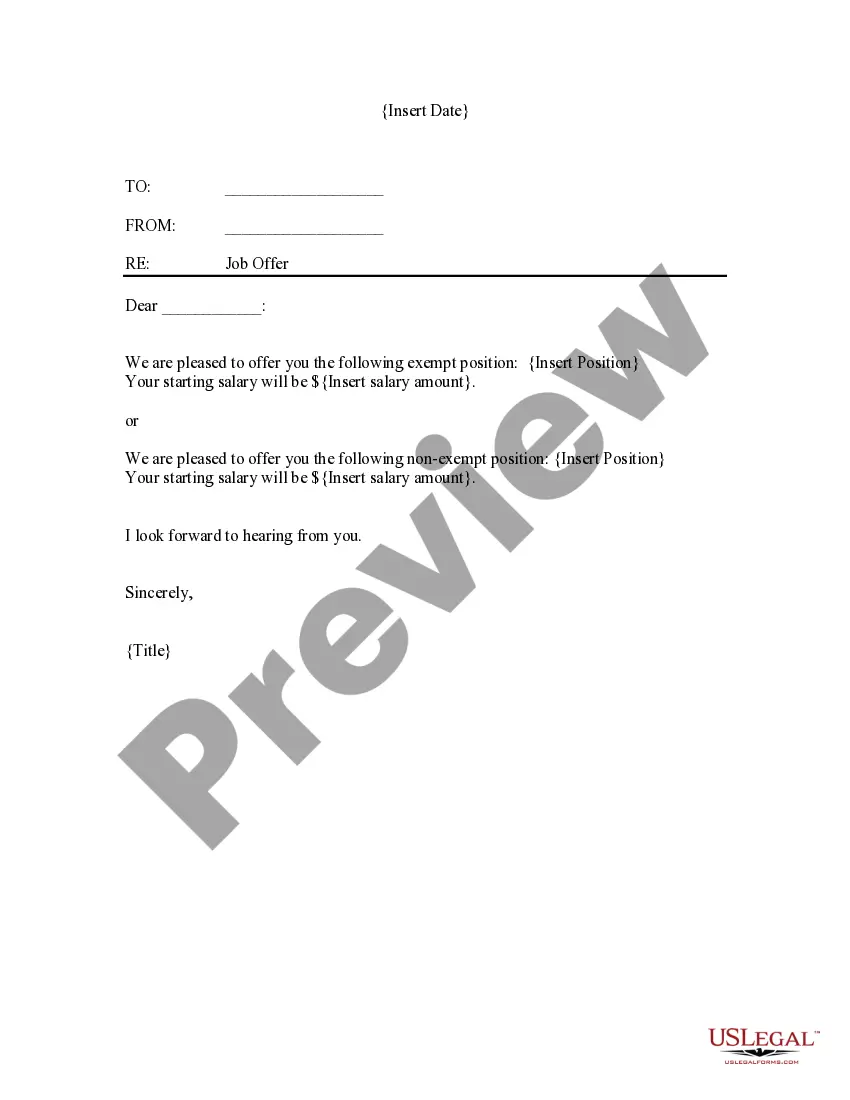

- Click the Preview button to review the content of the form.

- Read the form description to confirm you have the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

A 501(c)(3) nonprofit corporation is a charitable organization that the IRS recognizes as tax-exempt. This type of organization does not pay income tax on its earnings or on the donations it receives.

Being a 501(c)(3) nonprofit means your organization is exempt from paying most taxes at the federal level. However, being recognized as tax-exempt by the IRS does not automatically mean your organization is exempt from local D.C. taxes including income, franchise, sales, use, and personal property taxes.

Yes, even though the exempt organization is exempt from DC Sales and Use Tax on purchases of tangible personal property or services. What are the procedures for an individual to inspect applications and related financial documents of recognized exempt organizations by the District of Columbia?

As a reminder, effective November 1, business taxpayers can apply for exemption certificates electronically via the Office of Tax and Revenue's (OTR) tax portal, MyTax.DC.gov. If the exemption is approved, OTR will issue an official certificate which will include an expiration date.

Nonprofit organizations, even though they may be exempt from federal taxes, are not generally exempt from taxes in Washington. Unless a nonprofit organization has a specific exemption for either property or excise taxes, it is required to pay taxes in the same manner as other entities.

You must file a DC return if: You lived in the District of Columbia for 183 days or more during the taxable year, even if your permanent residence was outside the District of Columbia. You were a member of the armed forces and your home of record was the District of Columbia for either part of or the full taxable year.

Washington, D.C. sales tax details The Washington, DC sales tax rate is 6%, effective October 1, 2013. This is a single, district-wide general sales tax rate that applies to tangible personal property and selected services.

The District's standard deduction and personal exemption reduce income tax liability by reducing the amount of income that is subject to DC income taxes. The personal exemption is an amount that a tax filer can subtract from their taxable income for themselves and each of their dependents.

To apply for recognition of exemption from District of Columbia taxation, please visit MyTax.DC.gov. For questions, please contact OTR's Customer Service Administration at (202) 727-4TAX (4829).