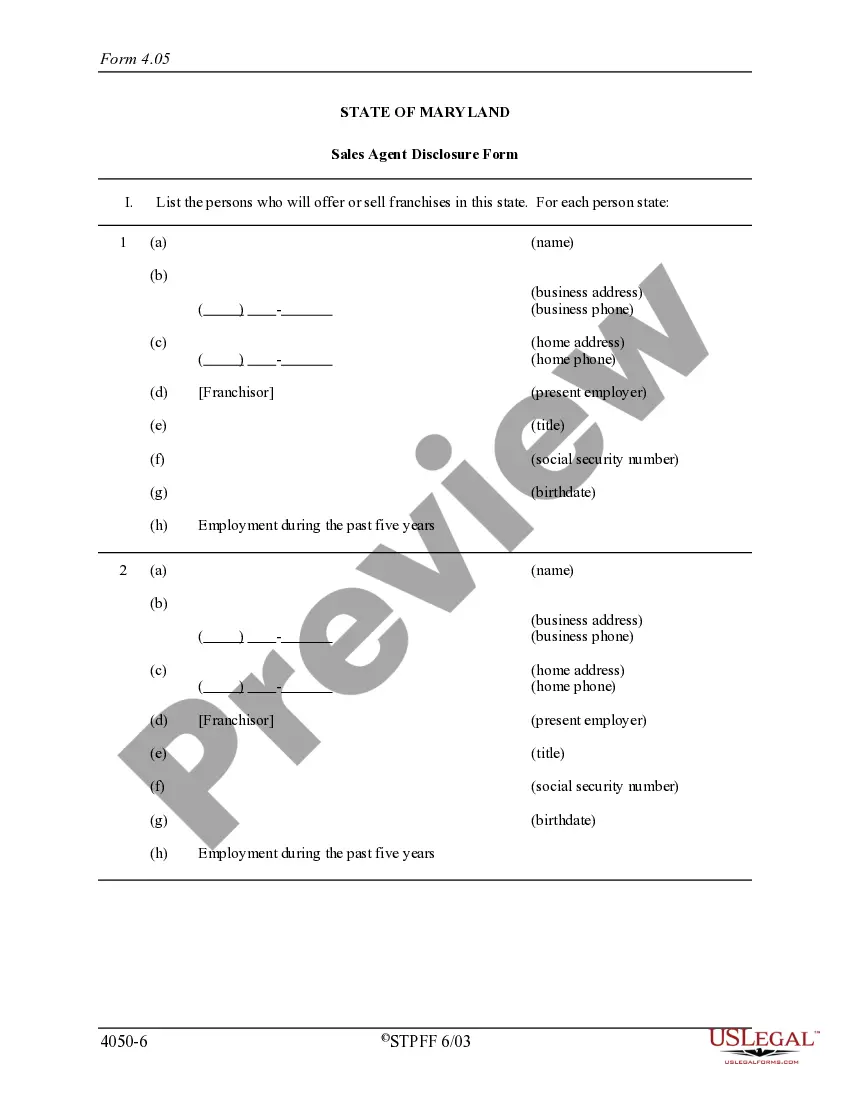

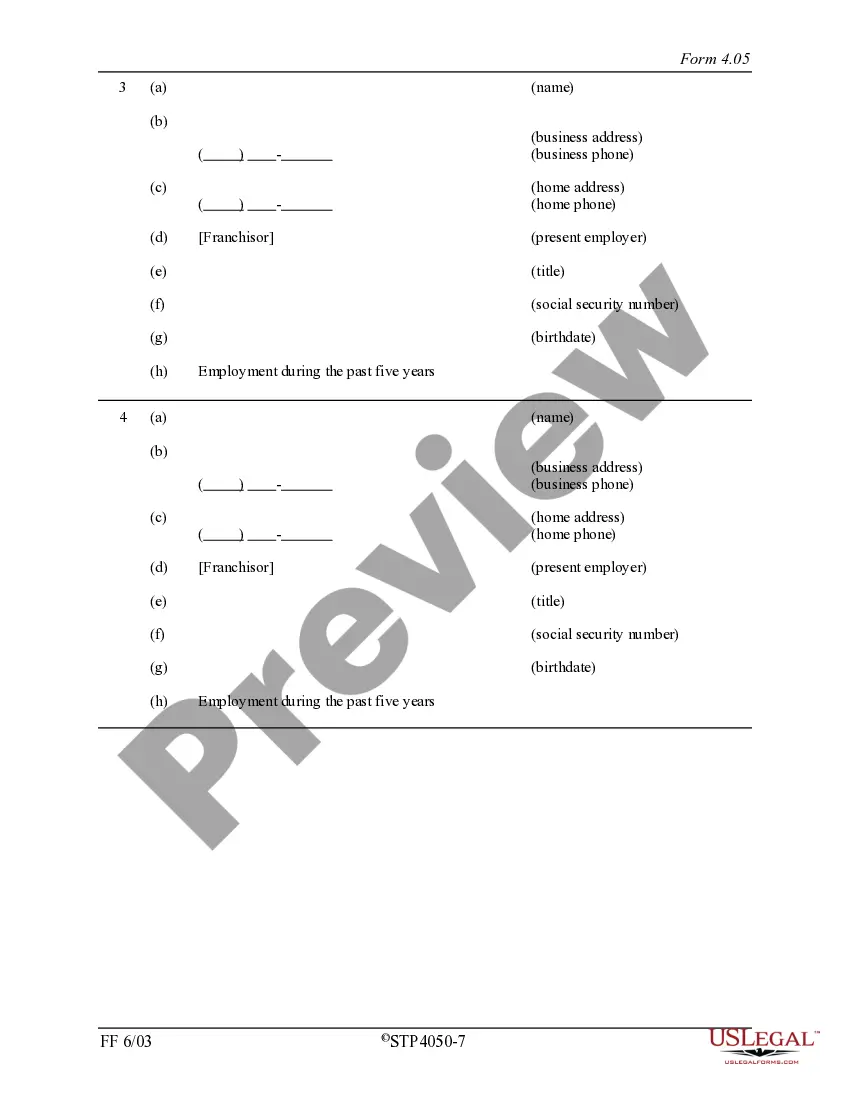

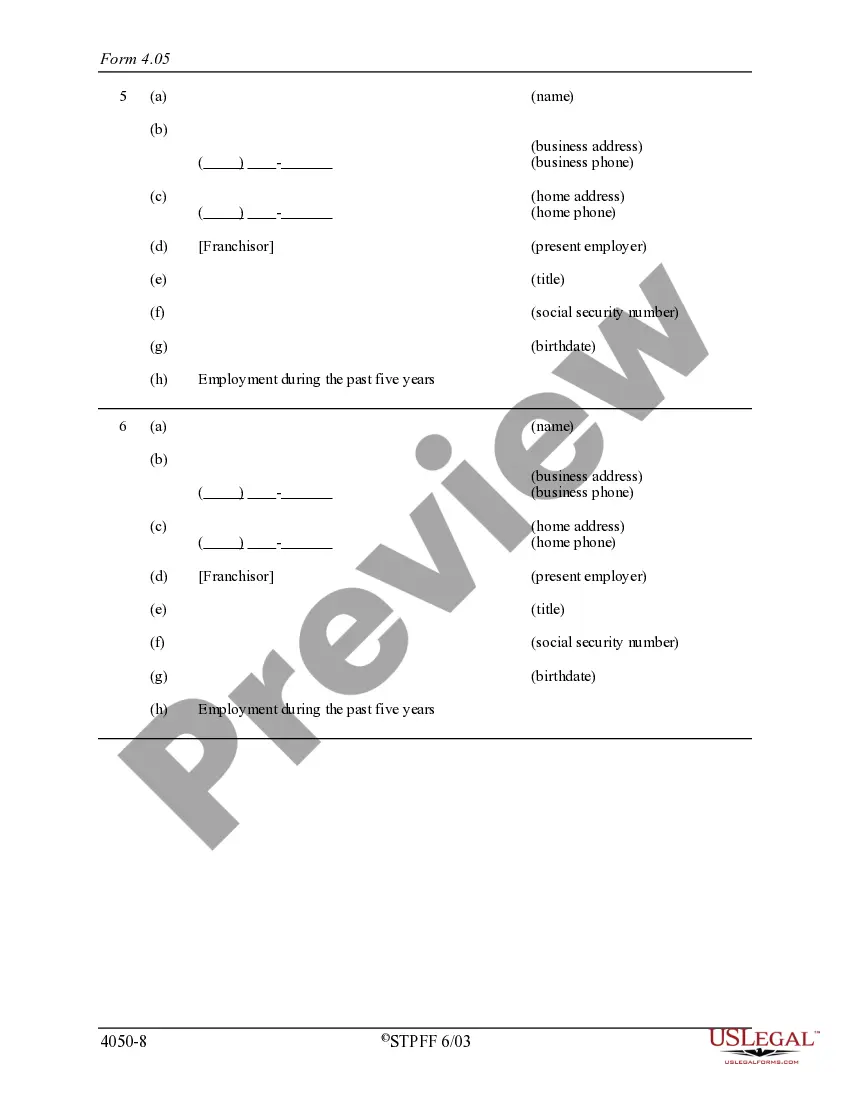

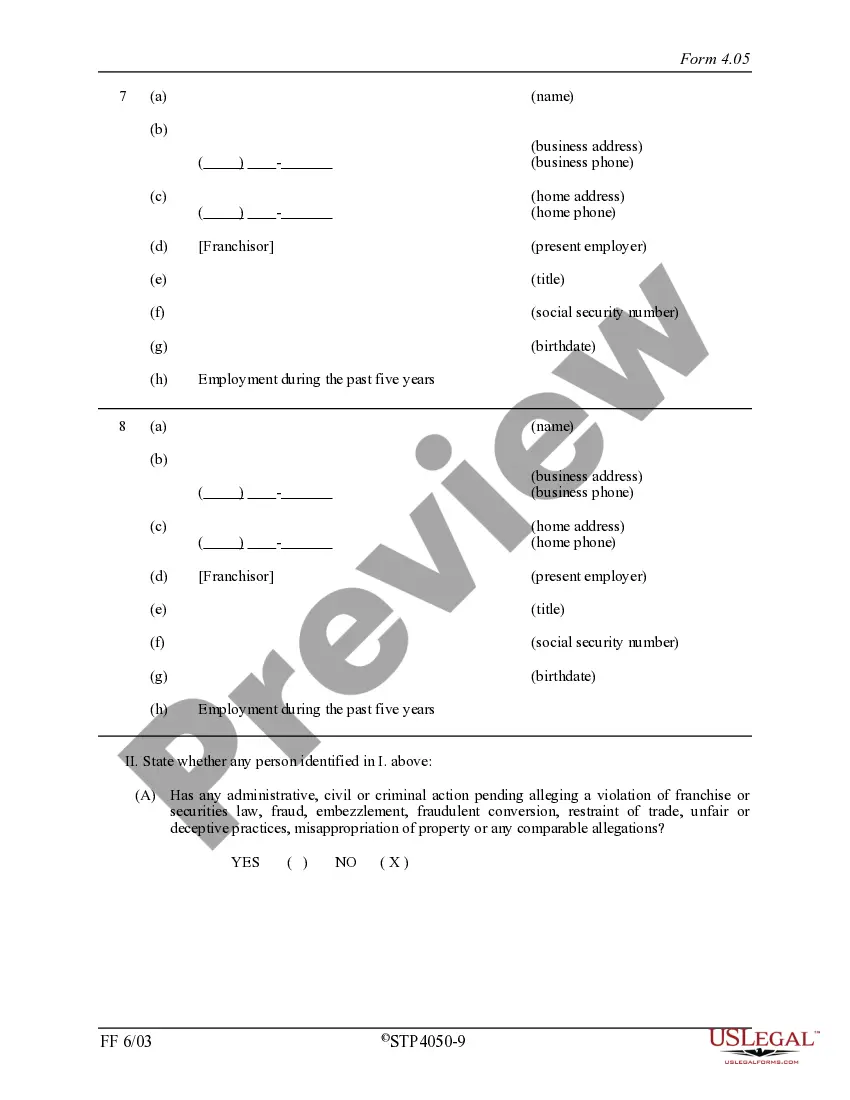

District of Columbia Maryland Franchise Registration Application

Description

How to fill out Maryland Franchise Registration Application?

US Legal Forms - among the biggest libraries of authorized kinds in the USA - delivers a wide range of authorized papers themes you can obtain or print. While using website, you can get 1000s of kinds for business and individual functions, categorized by types, states, or key phrases.You can get the most up-to-date variations of kinds much like the District of Columbia Maryland Franchise Registration Application in seconds.

If you currently have a monthly subscription, log in and obtain District of Columbia Maryland Franchise Registration Application from the US Legal Forms library. The Download switch will show up on each form you view. You get access to all earlier delivered electronically kinds inside the My Forms tab of your respective bank account.

In order to use US Legal Forms the first time, allow me to share straightforward instructions to help you get started off:

- Be sure you have picked the proper form for your personal city/county. Go through the Preview switch to review the form`s articles. Browse the form outline to actually have chosen the correct form.

- When the form doesn`t fit your requirements, take advantage of the Research field at the top of the display to discover the one who does.

- When you are satisfied with the form, confirm your selection by clicking on the Purchase now switch. Then, pick the rates plan you prefer and offer your qualifications to register to have an bank account.

- Process the purchase. Utilize your credit card or PayPal bank account to perform the purchase.

- Choose the file format and obtain the form on the product.

- Make adjustments. Fill out, modify and print and sign the delivered electronically District of Columbia Maryland Franchise Registration Application.

Each template you put into your bank account does not have an expiration day and is your own property forever. So, in order to obtain or print another backup, just visit the My Forms section and then click in the form you need.

Gain access to the District of Columbia Maryland Franchise Registration Application with US Legal Forms, one of the most extensive library of authorized papers themes. Use 1000s of specialist and condition-particular themes that fulfill your business or individual requires and requirements.

Form popularity

FAQ

A home occupation is a business, profession or other economic activity conducted full- or part-time in the principal residence of the person conducting the business. This permit is required for operating a business from your home.

DC Franchise Tax Overview Unincorporated businesses (Partnership and Sole Proprietors), with gross incomes of more than $12,000 from District sources, must file Form D-30 (whether or not it has net income).

Note: All business entities in the District of Columbia need some kind of business license (see next section). Tax Registration. ... EIN. ... Basic Business License (BBL). ... Regulatory licenses and permits. ... Professional and occupational licenses. ... Sole proprietorships. ... Partnerships.

All EINs are issued by the federal government through the IRS, regardless of your state. You can apply for a federal employer identification number on the IRS website. Keep in mind that you will also have to get a state tax ID number from the DC Office of Tax and Revenue.

New Business Registration Your Federal Employer Identification Number and/or Social Security Number. Your legal form of business (e.g. partnership, corporation, sole proprietor) Your business address. The names, titles, home address, and Social Security number of the proprietor, partners, or principal officers (mandatory)

The fee for a General Business License is $99. You can apply for your Basic Business License online through My DC Business Center or in person at the DLCP Business License Center. Basic Business Licenses must be renewed every two or four years, depending on license type.

D.C. Franchise Taxes The tax applies to certain LLC, Partnership and Individuals and is filed on Form D-30. Taxpayers are subject to tax at a rate of 8.25% on net profits, with a minimum tax due of $250.

On the MyTax.DC.gov homepage, locate the Business section. Click ?Register a New Business ? Form FR-500?. You will be navigated to our FR-500 New Business Registration Form.