A District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant is a legally binding document that outlines the terms and conditions between a corporation and a consultant. This agreement serves as a guarantee from the corporation's officers or shareholders (referred to as the "guarantors") to personally guarantee the payment obligations of the corporation to the consultant. The purpose of this agreement is to provide the consultant with assurance that they will receive their agreed-upon compensation for the services rendered to the corporation. In many cases, consultants work on specific projects or provide specialized expertise to the corporation, and ensuring their payment becomes crucial to maintain a positive working relationship. In the District of Columbia, several variations of Personal Guaranty of Corporation Agreement to Pay Consultant may exist, depending on the specific circumstances or requirements of the parties involved. Some common variations might include: 1. District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant for Independent Contractors: This type of agreement pertains to consultants who are considered independent contractors, providing their services to the corporation on a temporary or project-specific basis. It outlines the payment terms, duration of the agreement, and other relevant details. 2. District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant for Professional Services: This variant applies to consultants who offer professional expertise or specialized services such as legal advice, accounting, marketing, or IT consulting. It provides the terms and conditions for compensation, confidentiality, non-disclosure, and intellectual property rights. 3. District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant for Advisory Services: This type of agreement is used when a consultant is engaged to offer advisory services to the corporation. It may cover areas such as strategic planning, business development, financial analysis, or market research. This agreement ensures the consultant's payment is guaranteed, even if the corporation experiences financial challenges. Regardless of the specific type of District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant, some essential components that are typically included are: — Identification of the parties involved: This section includes the names and addresses of the corporation, the guarantors, and the consultant. It may also specify the capacity in which the guarantors act on behalf of the corporation. — Scope of services: The agreement should clearly define the services the consultant is expected to provide, including any deliverables, milestones, or deadlines. — Payment terms: This section outlines the agreed-upon compensation, payment schedule, invoicing procedures, and any additional expenses or reimbursements. It may also specify any late payment penalties or interest charges. — Indemnification and liability: The agreement should address issues related to liability, indemnification, and insurance coverage. It may outline the consultant's responsibility for any damages resulting from their services and the corporation's obligation to protect the consultant against any claims or lawsuits arising from their work. — Confidentiality and non-disclosure: If applicable, the agreement should include provisions to protect the confidentiality of any proprietary or sensitive information shared between the parties during the engagement. — Termination clause: This section defines the circumstances under which either party can terminate the agreement, such as breach of contract, failure to perform, or completion of the services. — Governing law and jurisdiction: The agreement should specify that it is governed by the laws of the District of Columbia and indicate the applicable jurisdiction for any legal disputes. In summary, a District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant is a crucial legal document that ensures the consultant's payment for their services. By clearly outlining the terms and conditions of the engagement, it helps protect the rights and interests of both the corporation and the consultant.

District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant

Description

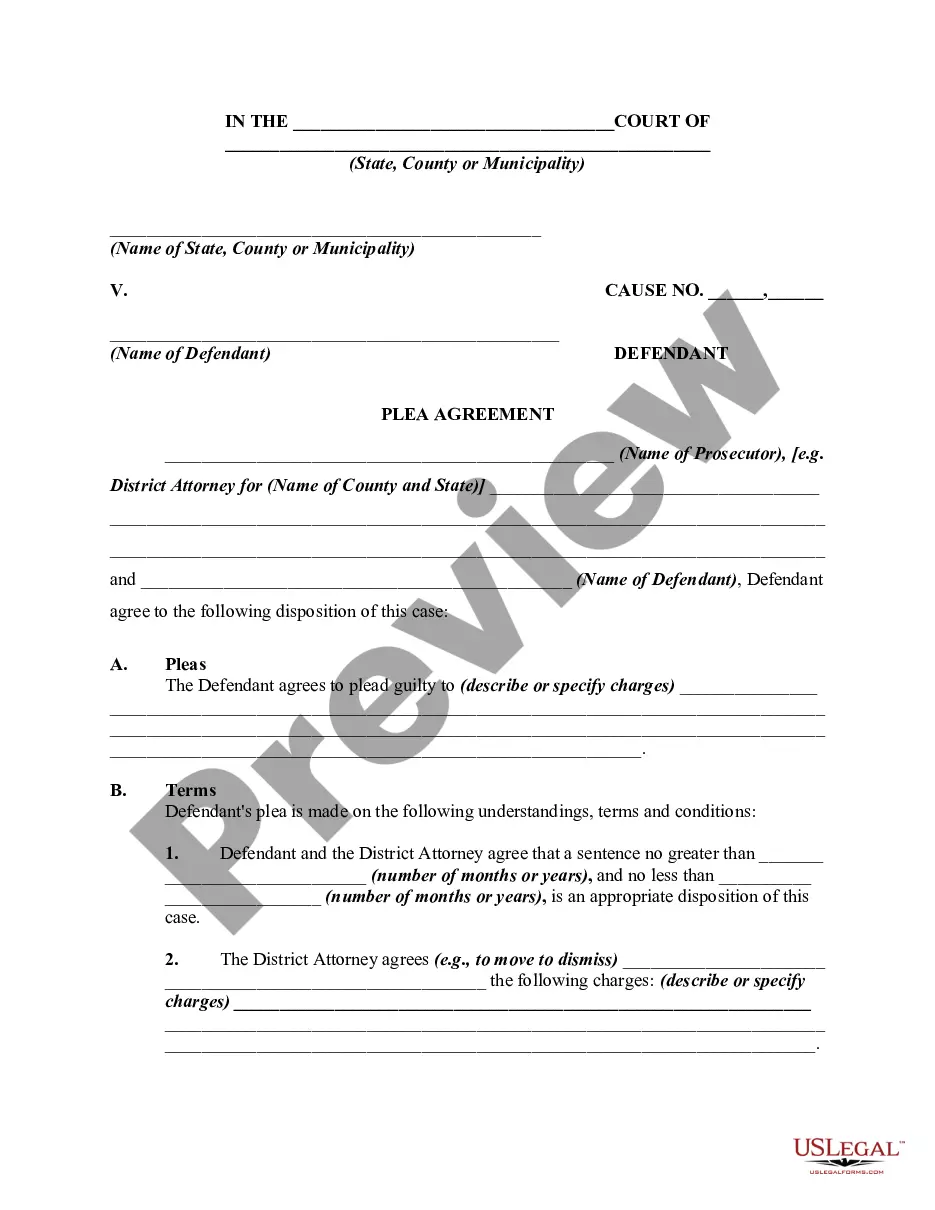

How to fill out District Of Columbia Personal Guaranty Of Corporation Agreement To Pay Consultant?

US Legal Forms - one of the most significant libraries of legal types in the States - gives an array of legal record themes you are able to down load or print out. While using web site, you may get 1000s of types for business and person functions, categorized by categories, claims, or key phrases.You will find the newest models of types such as the District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant in seconds.

If you already possess a registration, log in and down load District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant in the US Legal Forms catalogue. The Download button will show up on each kind you see. You gain access to all formerly acquired types from the My Forms tab of your own profile.

In order to use US Legal Forms initially, allow me to share straightforward recommendations to help you get started out:

- Be sure to have picked the right kind for the town/state. Click the Preview button to analyze the form`s content material. See the kind description to ensure that you have chosen the right kind.

- In case the kind does not match your needs, make use of the Lookup field near the top of the monitor to get the one which does.

- When you are satisfied with the form, affirm your option by clicking on the Buy now button. Then, opt for the rates program you want and offer your references to register for an profile.

- Process the transaction. Make use of your Visa or Mastercard or PayPal profile to accomplish the transaction.

- Find the file format and down load the form on your own device.

- Make changes. Complete, modify and print out and signal the acquired District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant.

Each and every design you included in your money does not have an expiry date and is also your own property for a long time. So, if you want to down load or print out an additional copy, just check out the My Forms section and click on around the kind you need.

Get access to the District of Columbia Personal Guaranty of Corporation Agreement to Pay Consultant with US Legal Forms, by far the most substantial catalogue of legal record themes. Use 1000s of expert and express-distinct themes that meet up with your organization or person requirements and needs.