District of Columbia Commercial Lease Agreement for Tenant

Description

How to fill out Commercial Lease Agreement For Tenant?

Are you in a location where you frequently need documentation for either business or personal purposes.

There are numerous authentic document templates accessible online, but finding versions that you can trust is challenging.

US Legal Forms offers thousands of form templates, like the District of Columbia Commercial Lease Agreement for Tenant, which can be customized to comply with federal and state regulations.

Upon finding the appropriate form, click Get now.

Select the pricing plan you desire, fill in the necessary information to create your account, and pay for the transaction with your PayPal or Visa or Mastercard. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can retrieve another copy of the District of Columbia Commercial Lease Agreement for Tenant whenever necessary. Just click on the desired form to download or print the document template. Use US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the District of Columbia Commercial Lease Agreement for Tenant template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific city/state.

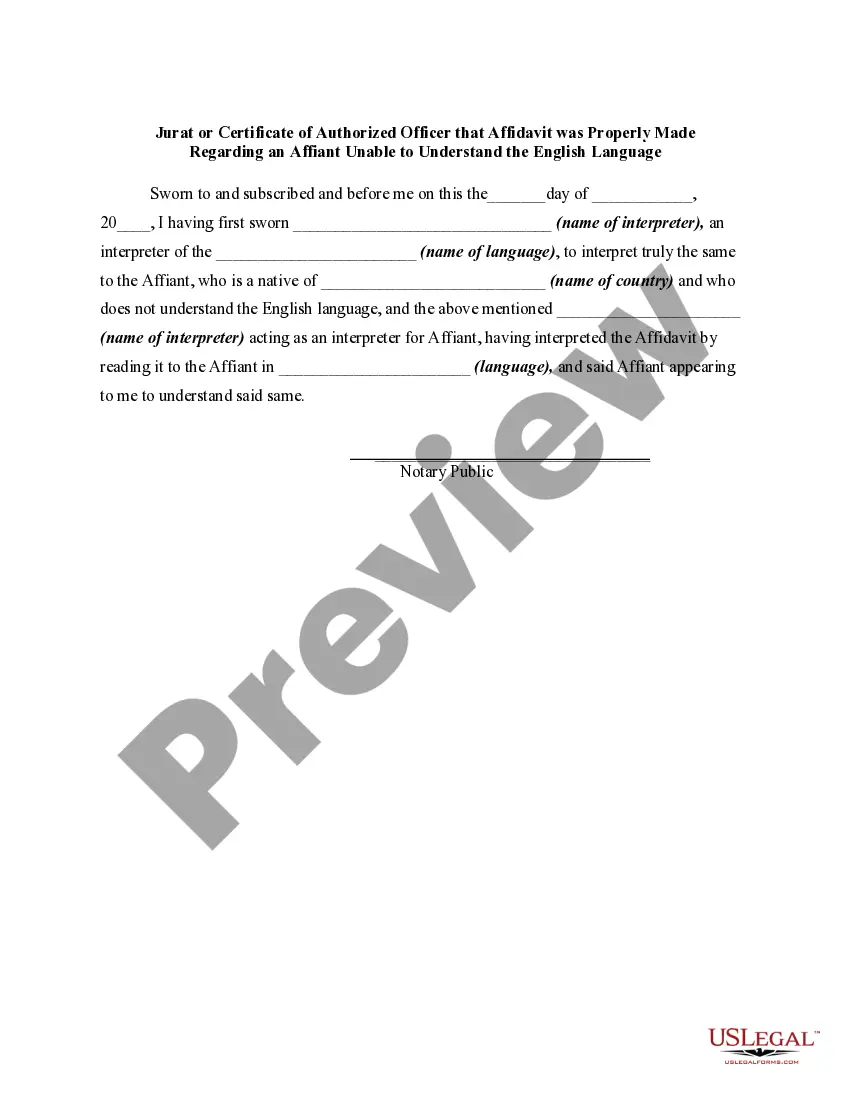

- Utilize the Review option to evaluate the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Your landlord is responsible for any aspects of health and safety written in the lease (eg in communal areas). You must take reasonable steps to make sure your landlord fulfils these responsibilities. If you get into a dispute with your landlord, you need to keep paying rent - otherwise you may be evicted.

Commercial tenants may have the protection of the Landlord and Tenant Act 1954. The Act grants Security of Tenure to tenants who occupy premises for business purposes. The tenancy will continue after the contractual termination date until it is ended in one of the ways specified by the Act.

Commercial Tenants:Tenants must pay their rent on the due date agreed on in the lease with the landlord. Tenants cannot hold back rent because a landlord has failed to fulfill their obligations as outlined in the lease. Tenants must fulfill their obligations as outlined by the lease agreement.

A Commercial Tenancy Agreement, also known as a Business Lease or a Commercial Lease, is used when the owner of a business property wishes to rent space to another business owner. Both parties may either be individuals or corporations.

A lease is surrendered when the tenant's interest is transferred back to the landlord and both parties accept that it will be extinguished. This can be done formally, by deed, but this is not always necessary.

A Commercial Tenancy Agreement, also known as a Business Lease or a Commercial Lease, is used when the owner of a business property wishes to rent space to another business owner. Both parties may either be individuals or corporations.

A commercial lease is a contract made between a business tenant and a landlord. This commercial lease contract grants you the right to use the property for commercial or business purposes. Money is paid to the landlord for the use of the property.

Landlords are normally responsible for any structural repairs needed to maintain commercial properties. This includes exterior walls, foundations, flooring structure and the roof.

The responsibilities of landlord and tenant will be clearly set out in the lease. Normally commercial landlords are responsible for any structural repairs such as foundations, flooring, roof and exterior walls, and tenants are responsible for non-structural repairs such as air conditioning or plumbing.

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.