District of Columbia Tenant References Checklist to Check Tenant References

Description

How to fill out Tenant References Checklist To Check Tenant References?

Discovering the right authorized record web template can be a struggle. Obviously, there are tons of templates available on the Internet, but how do you find the authorized kind you require? Make use of the US Legal Forms web site. The services offers a large number of templates, like the District of Columbia Tenant References Checklist to Check Tenant References, which you can use for enterprise and personal requirements. All the kinds are checked out by pros and fulfill state and federal specifications.

Should you be currently signed up, log in for your accounts and click on the Down load switch to have the District of Columbia Tenant References Checklist to Check Tenant References. Utilize your accounts to appear through the authorized kinds you possess bought formerly. Check out the My Forms tab of your respective accounts and acquire another backup from the record you require.

Should you be a new customer of US Legal Forms, listed here are straightforward guidelines for you to adhere to:

- First, be sure you have selected the appropriate kind for your personal city/state. It is possible to look through the form utilizing the Preview switch and browse the form information to ensure this is basically the best for you.

- In the event the kind does not fulfill your needs, take advantage of the Seach discipline to discover the right kind.

- When you are positive that the form is proper, go through the Purchase now switch to have the kind.

- Opt for the prices strategy you need and enter the required information. Create your accounts and pay money for the transaction using your PayPal accounts or credit card.

- Pick the submit format and acquire the authorized record web template for your product.

- Comprehensive, modify and print and indication the received District of Columbia Tenant References Checklist to Check Tenant References.

US Legal Forms may be the greatest local library of authorized kinds in which you will find different record templates. Make use of the service to acquire skillfully-produced paperwork that adhere to express specifications.

Form popularity

FAQ

While it is dependent on certain situations, commonly a rental reference letter should aim to include the following;Your tenancy information, i.e. your name, current address, phone number, dates of occupancy when applicable, rental history, etc.Condition of prior rental properties, both before you moved in and after.More items...

If you paid rent on time in the past, show them your tenancy agreement and rent book or bank statements to prove this. You could also ask for a 'character reference' - a letter from an employer or someone who knows you well, to show that you're reliable.

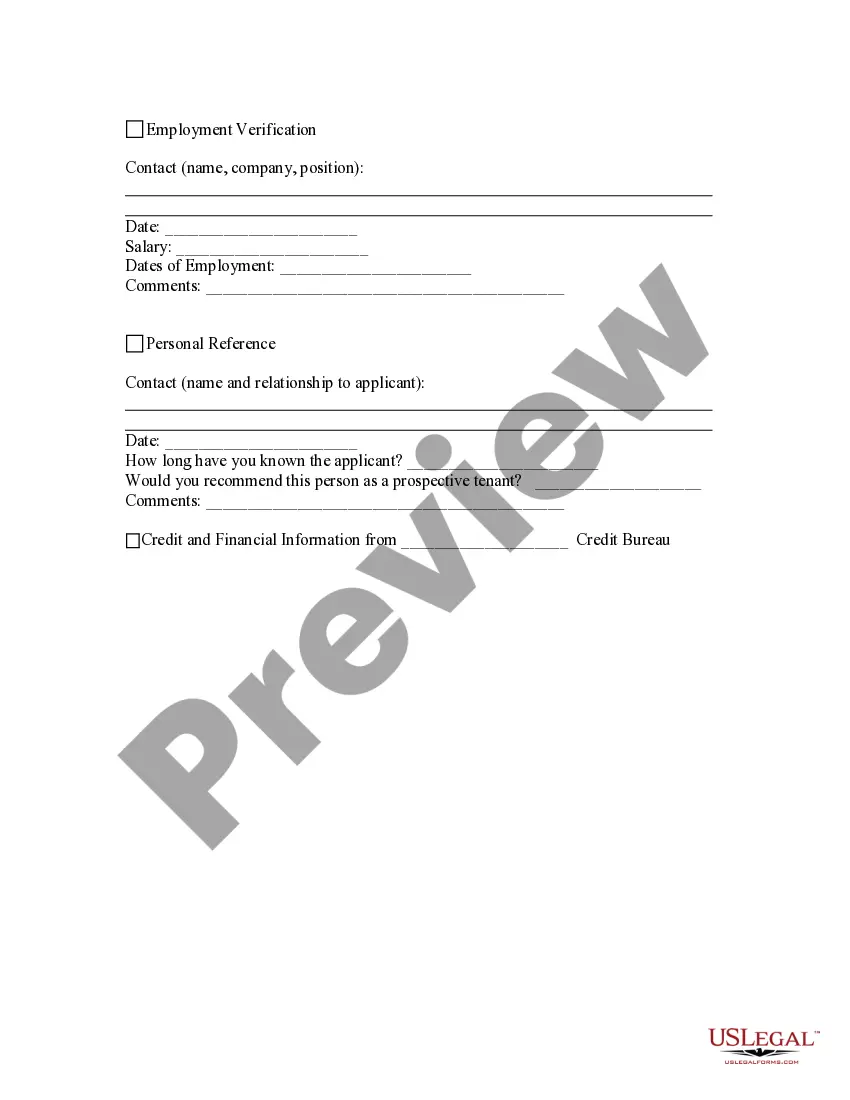

Other important questions to consider asking include Did the tenant have roommates that contributed to the monthly rent?Were they evicted from the property?Did they have any pets?Did neighboring tenants ever make complaints against the tenant?How long was the tenancy?Why did the tenant choose to leave?More items...?

Questions to Ask During a Landlord Reference CheckWill they keep my rental property in good condition?Are they likely to pay on-time?Will they cause trouble with the neighbors?What can I expect when communicating with this applicant?

Can landlords see references which were provided to the letting agents? The agent can pass this information to the landlord, as long as, when the reference is asked for, they make clear to the tenant and the referee that this will happen.

If you paid rent on time in the past, show them your tenancy agreement and rent book or bank statements to prove this. You could also ask for a 'character reference' - a letter from an employer or someone who knows you well, to show that you're reliable.

Fake landlord references can be given by tenants who know how to work the system. Tips for spotting a fake landlord reference include cross-checking the phone number, asking the reference for specific information about the tenant and the property, and checking out the tenant on social media sites.

Screening Questions for Tenant's Current or Past LandlordsWhat can you tell me about the tenant?Did the tenant pay on time or in the right amount?Did the tenant abide by the rules of the lease and any move-out rules?Did the tenant take care of your home and yard?Were there any complaints made against the tenant?More items...?

Landlords will collect rental references from interested renters via a rental application. One thing that is commonly found on rental applications is the request for personal, or character, references. As a landlord, you want to do a comprehensive background check on the tenant which includes calling tenant references.