Title: District of Columbia Qualifying Event Notice Information for Employer to Plan Administrator Introduction: As an employer operating within the District of Columbia, it is crucial to understand the various qualifying events that trigger changes to an employee's benefits plan. This detailed description aims to provide essential information and relevant keywords regarding District of Columbia Qualifying Event Notice Information for the Employer to Plan Administrator. Additionally, we will explore different types of qualifying events that employers may encounter. 1. What is a Qualifying Event Notice? A qualifying event notice is an important communication triggered by specific events that require an employer to update an employee's benefits coverage. It serves as a legal requirement under the District of Columbia law to inform Plan Administrators promptly. 2. Key Regulatory Framework: Employers operating in the District of Columbia must comply with specific provisions within the DC Health Benefits Exchange Authority (HBO) and the District of Columbia Health Benefit Exchange Authority (DCB). These provisions ensure that employees receive timely information regarding qualifying events. 3. Relevant Keywords: — District of Columbia Qualifying Event Notice — DC Health Benefits ExchangAuthorityit— - District of Columbia Health Benefit Exchange Authority — Employee BenefitPLAla— - Plan Administrator — Compliance Requirement— - DC Qualified Beneficiary — HIPAA Administrative Simplification Rules — Health Insurance Marketplace 4. Types of Qualifying Events: Employers in the District of Columbia must be aware of different qualifying events to fulfill their obligations as Plan Administrators. Below are a few types of common qualifying events: a. Loss of Coverage: When an employee or dependent loses their health coverage due to termination of employment, reduction in work hours, or other factors, a qualifying event notice must be sent to the Plan Administrator. b. Marriage, Birth, or Adoption: If an employee gets married, has a child, or adopts a child, the employer should communicate this change to the Plan Administrator. Additional coverage considerations may be required for the newly acquired family member. c. Divorce, Legal Separation, or Death: In the event of a divorce, legal separation, or the death of a spouse or dependent, the employer must notify the Plan Administrator of the changes required in benefits coverage. d. Change in Dependent's Eligibility: If a dependent no longer meets the eligibility criteria for coverage, such as reaching the maximum age or losing student status, the employer should inform the Plan Administrator of the change. e. COBRA Continuation Coverage: When an employee experiences a qualifying event that triggers COBRA (Consolidated Omnibus Budget Reconciliation Act) continuation coverage, the employer must provide the appropriate notices to the Plan Administrator. Conclusion: Understanding and complying with the District of Columbia's qualifying event notice requirements is crucial for employers to maintain compliance and ensure that employees receive necessary benefits coverage during significant life events. By promptly notifying the Plan Administrator of qualifying events, employers demonstrate their commitment to fulfilling legal obligations and promoting the overall well-being of their workforce.

District of Columbia Qualifying Event Notice Information for Employer to Plan Administrator

Description

How to fill out District Of Columbia Qualifying Event Notice Information For Employer To Plan Administrator?

Have you been within a placement where you need to have files for either organization or personal functions virtually every day time? There are tons of authorized document layouts available online, but discovering ones you can trust is not effortless. US Legal Forms provides thousands of type layouts, like the District of Columbia Qualifying Event Notice Information for Employer to Plan Administrator, which are written to meet federal and state specifications.

If you are currently informed about US Legal Forms internet site and also have a merchant account, merely log in. Afterward, it is possible to obtain the District of Columbia Qualifying Event Notice Information for Employer to Plan Administrator template.

Unless you provide an profile and would like to begin using US Legal Forms, abide by these steps:

- Obtain the type you require and make sure it is to the correct city/region.

- Make use of the Preview key to review the shape.

- Read the outline to ensure that you have selected the proper type.

- In case the type is not what you`re searching for, take advantage of the Search discipline to find the type that meets your needs and specifications.

- If you find the correct type, simply click Purchase now.

- Choose the rates strategy you would like, fill in the specified information to make your bank account, and pay for the transaction utilizing your PayPal or Visa or Mastercard.

- Pick a convenient paper structure and obtain your backup.

Find all of the document layouts you possess bought in the My Forms menu. You can aquire a more backup of District of Columbia Qualifying Event Notice Information for Employer to Plan Administrator any time, if needed. Just go through the needed type to obtain or print out the document template.

Use US Legal Forms, the most extensive collection of authorized types, to save time as well as stay away from faults. The assistance provides appropriately produced authorized document layouts which can be used for a variety of functions. Produce a merchant account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

In a contributory group plan, the employer pays part of the premium. Most states require that at least 75% of the eligible employees participate in the contributory plan. When an employer establishes a group insurance plan, what evidence of insurance may each participating employee receive?

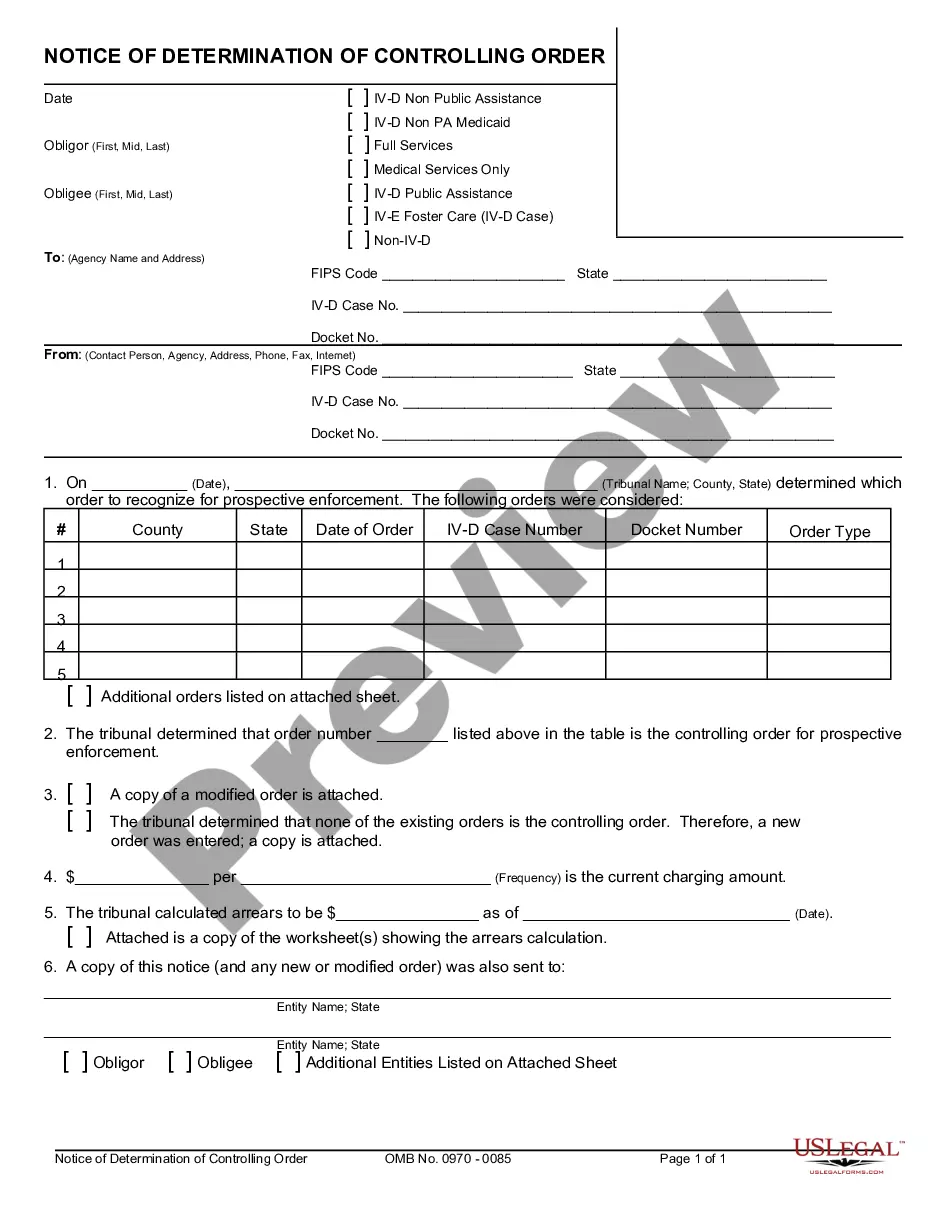

The following are qualifying events: the death of the covered employee; a covered employee's termination of employment or reduction of the hours of employment; the covered employee becoming entitled to Medicare; divorce or legal separation from the covered employee; or a dependent child ceasing to be a dependent under

Second qualifying events may include the death of the covered employee, divorce or legal separation from the covered employee, the covered employee becoming entitled to Medicare benefits (under Part A, Part B or both), or a dependent child ceasing to be eligible for coverage as a dependent under the group health plan.

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss,

States generally define true "group" insurance as having at least 10 people covered under one master contract.

Contributory plans require that the employer pay the premium with 100% participation. Contributory Plans require both the employee and employer contribute to the premium, and 75% participation is required. When a group is covered by a MET, who is issued the Master Policy?

Normally,100% of eligible employees must participate in a noncontributory group plan before the plan can be put in force. You just studied 15 terms!

Under a contributory group plan, you are expected to pay part of the premium for group life insurance. To avoid adverse selection, the insurer typically requires that at least 75 percent of eligible employees participate in the plan.

COBRA Qualifying Event Notice The employer must notify the plan if the qualifying event is: Termination or reduction in hours of employment of the covered employee, 2022 Death of the covered employee, 2022 Covered employee becoming entitled to Medicare, or 2022 Employer bankruptcy.