The District of Columbia Involuntary Petition and Memorandum — Form — - Post 2005 is a legal document used in the District of Columbia to initiate a bankruptcy case against an individual or business entity. This detailed description will provide an overview of the purpose and requirements of this form, while incorporating relevant keywords such as involuntary petition, memorandum, post-2005, and different types where applicable. The District of Columbia Involuntary Petition and Memorandum — Form — - Post 2005 serves as a means for creditors to join forces and request the court's intervention in collecting outstanding debts from a debtor who is unable to pay. By submitting this legally binding document, creditors can seek a court order that would force the debtor into bankruptcy proceedings. Form 5, utilized after 2005, is designed to comply with the updated bankruptcy laws and regulations implemented after the Bankruptcy Abuse Prevention and Consumer Protection Act (BAP CPA) came into effect. This revision aimed to prevent abuse and streamline the bankruptcy process. This specific form is divided into two parts: the involuntary petition and the accompanying memorandum. The petition section is where the creditors provide relevant information about the debtor, such as legal name, address, and taxpayer identification number. Creditors must ensure accuracy in this section as any errors might lead to delays or dismissals of the case. The memorandum, on the other hand, requires creditors to outline the reasons for initiating bankruptcy proceedings against the debtor. This section requires a comprehensive explanation, addressing the debtor's financial state, inability to repay debts, or signs of insolvency. Creditors may attach supporting documents, such as unpaid invoices, judgments, or collection letters, to strengthen their case. It is important to note that while Form 5 is the standard document used for involuntary petitions in the District of Columbia after 2005, there might be additional subcategories or variations that cater to specific circumstances or types of debtors. Examples of such variations could include Form 5A for corporate debtors or Form 5B for individual debtors. These distinctions aim to address the different legal and procedural requirements for varying debtor types. Overall, the District of Columbia Involuntary Petition and Memorandum — Form — - Post 2005 serves as a crucial tool for creditors seeking to protect their rights and recover outstanding debts through bankruptcy proceedings. By adhering to the specific requirements of this form and providing compelling evidence of the debtor's insolvency, creditors increase their chances of securing court intervention and finding resolution to their financial challenges.

District of Columbia Involuntary Petition and Memorandum - Form 5 - Post 2005

Description

How to fill out District Of Columbia Involuntary Petition And Memorandum - Form 5 - Post 2005?

US Legal Forms - one of several most significant libraries of authorized varieties in America - delivers a variety of authorized file themes you may acquire or print. Making use of the site, you will get a huge number of varieties for business and personal uses, categorized by types, claims, or keywords and phrases.You will find the newest variations of varieties such as the District of Columbia Involuntary Petition and Memorandum - Form 5 - Post 2005 in seconds.

If you already possess a monthly subscription, log in and acquire District of Columbia Involuntary Petition and Memorandum - Form 5 - Post 2005 from your US Legal Forms catalogue. The Down load button will appear on every form you perspective. You get access to all in the past saved varieties in the My Forms tab of your own accounts.

If you wish to use US Legal Forms for the first time, listed here are basic recommendations to help you get began:

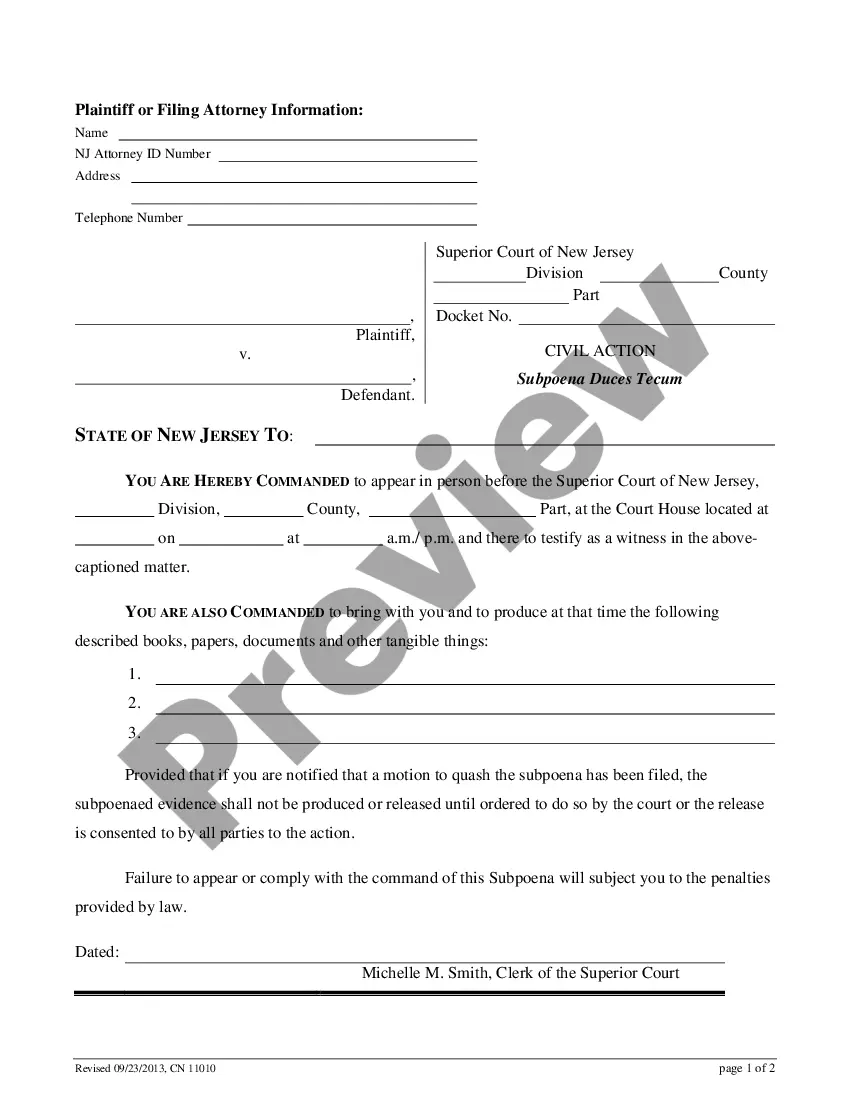

- Be sure to have picked out the right form to your metropolis/county. Select the Preview button to analyze the form`s articles. See the form outline to ensure that you have chosen the proper form.

- If the form does not satisfy your specifications, make use of the Research discipline on top of the display to get the one which does.

- Should you be satisfied with the shape, validate your option by clicking the Buy now button. Then, opt for the rates prepare you want and provide your qualifications to sign up to have an accounts.

- Approach the financial transaction. Make use of credit card or PayPal accounts to perform the financial transaction.

- Find the file format and acquire the shape on your own product.

- Make adjustments. Complete, modify and print and sign the saved District of Columbia Involuntary Petition and Memorandum - Form 5 - Post 2005.

Every single design you included in your money lacks an expiration time which is your own for a long time. So, if you would like acquire or print an additional copy, just check out the My Forms portion and click about the form you need.

Obtain access to the District of Columbia Involuntary Petition and Memorandum - Form 5 - Post 2005 with US Legal Forms, one of the most substantial catalogue of authorized file themes. Use a huge number of specialist and express-specific themes that satisfy your company or personal needs and specifications.