District of Columbia Agreement and Plan of Merger for Conversion of Corporation into Maryland Real Estate Investment Trust The District of Columbia Agreement and Plan of Merger for Conversion of Corporation into Maryland Real Estate Investment Trust is a legal document that outlines the process and terms of converting a corporation based in the District of Columbia into a Maryland Real Estate Investment Trust (REIT). This strategic conversion allows a corporation to take advantage of the tax benefits and flexible regulatory framework offered by Maryland's REIT laws. The agreement typically includes the following key provisions: 1. Parties Involved: The agreement identifies the merging corporation, along with its current legal structure and location, as well as the target entity, which will become the new Maryland REIT. 2. Purpose: The purpose of the agreement is to formalize the corporation's intention to convert into a Maryland REIT, facilitating a smooth transition while complying with relevant legal requirements. 3. Conversion Process: The agreement specifies the steps and procedures to be followed during the conversion process. This may include obtaining necessary approvals from shareholders, filing appropriate forms with government agencies, and complying with all relevant regulations and laws. 4. Terms and Conditions: The agreement outlines the terms and conditions of the merger, such as the exchange ratio of the corporation's shares for shares in the Maryland REIT. It may specify any cash or stock considerations, if applicable. 5. Rights and Liabilities: The agreement addresses the transfer of rights, assets, and liabilities of the merging corporation to the new Maryland REIT. It ensures a smooth transfer of ownership and accountability, avoiding any undue burden on either party. 6. Governance and Management: The agreement may detail the composition of the new Maryland REIT's board of directors, the roles and responsibilities of key executives, and any changes to the corporation's bylaws or operating agreements. 7. Regulatory Compliance: The agreement includes provisions ensuring compliance with all applicable federal, state, and local laws, including securities regulations, taxation requirements, and reporting obligations. Different types of District of Columbia Agreement and Plan of Merger for Conversion of Corporation into Maryland Real Estate Investment Trust may be categorized based on specific industries or sectors involved in the merger. For example, there could be variations for technology corporations, healthcare organizations, or financial institutions. Each type may have unique considerations and provisions tailored to the specific needs of those industries. To ensure the successful conversion of a corporation into a Maryland REIT, it is highly advisable to engage experienced legal and financial professionals who are knowledgeable in mergers and real estate investment trusts. They can help navigate the complexities of the agreement and ensure compliance with all relevant laws and regulations.

District of Columbia Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust

Description

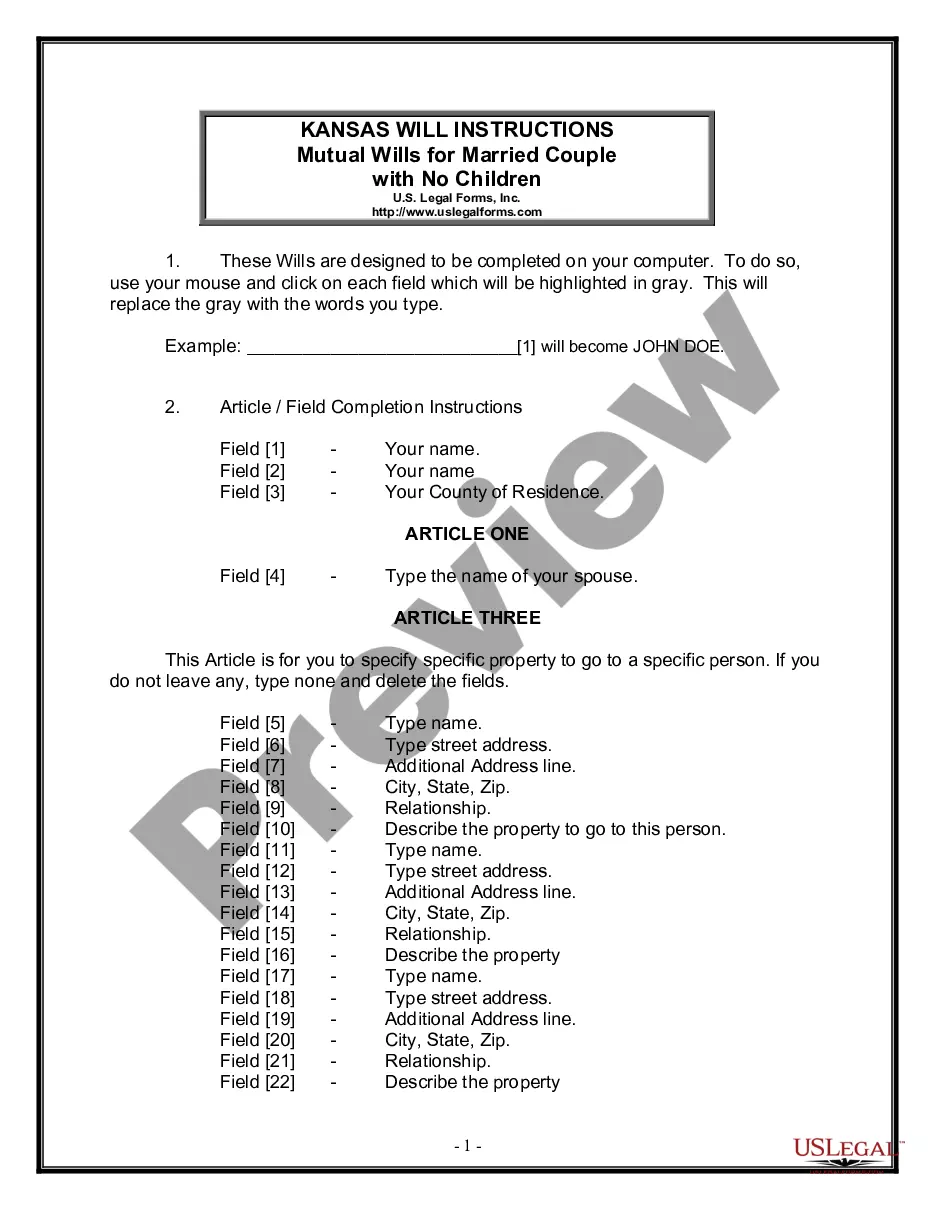

How to fill out District Of Columbia Agreement And Plan Of Merger For Conversion Of Corporation Into Maryland Real Estate Investment Trust?

Choosing the best legitimate record web template could be a have a problem. Naturally, there are plenty of themes available online, but how can you obtain the legitimate form you will need? Make use of the US Legal Forms site. The assistance gives a large number of themes, for example the District of Columbia Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust, that can be used for organization and private requirements. Every one of the types are examined by specialists and fulfill federal and state requirements.

In case you are already signed up, log in in your profile and click the Obtain key to find the District of Columbia Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust. Make use of profile to look through the legitimate types you might have purchased formerly. Proceed to the My Forms tab of your own profile and have another copy from the record you will need.

In case you are a new customer of US Legal Forms, allow me to share straightforward directions so that you can follow:

- First, be sure you have selected the right form to your town/state. You may look over the shape while using Review key and study the shape outline to ensure it is the best for you.

- When the form will not fulfill your expectations, make use of the Seach area to discover the right form.

- When you are sure that the shape would work, click on the Buy now key to find the form.

- Select the prices program you want and enter in the needed information. Make your profile and purchase the order making use of your PayPal profile or Visa or Mastercard.

- Opt for the document format and download the legitimate record web template in your gadget.

- Full, edit and printing and sign the acquired District of Columbia Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust.

US Legal Forms is the greatest collection of legitimate types where you can find a variety of record themes. Make use of the company to download professionally-manufactured papers that follow status requirements.