District of Columbia Letter to Shareholders

Description

How to fill out Letter To Shareholders?

Are you currently in a place where you require files for either company or person functions just about every working day? There are a lot of lawful papers layouts available on the net, but discovering types you can trust is not simple. US Legal Forms provides thousands of develop layouts, much like the District of Columbia Letter to Shareholders, which can be published to satisfy state and federal requirements.

In case you are previously acquainted with US Legal Forms website and possess an account, merely log in. After that, you can obtain the District of Columbia Letter to Shareholders design.

If you do not have an accounts and would like to begin using US Legal Forms, follow these steps:

- Get the develop you will need and ensure it is for that correct city/state.

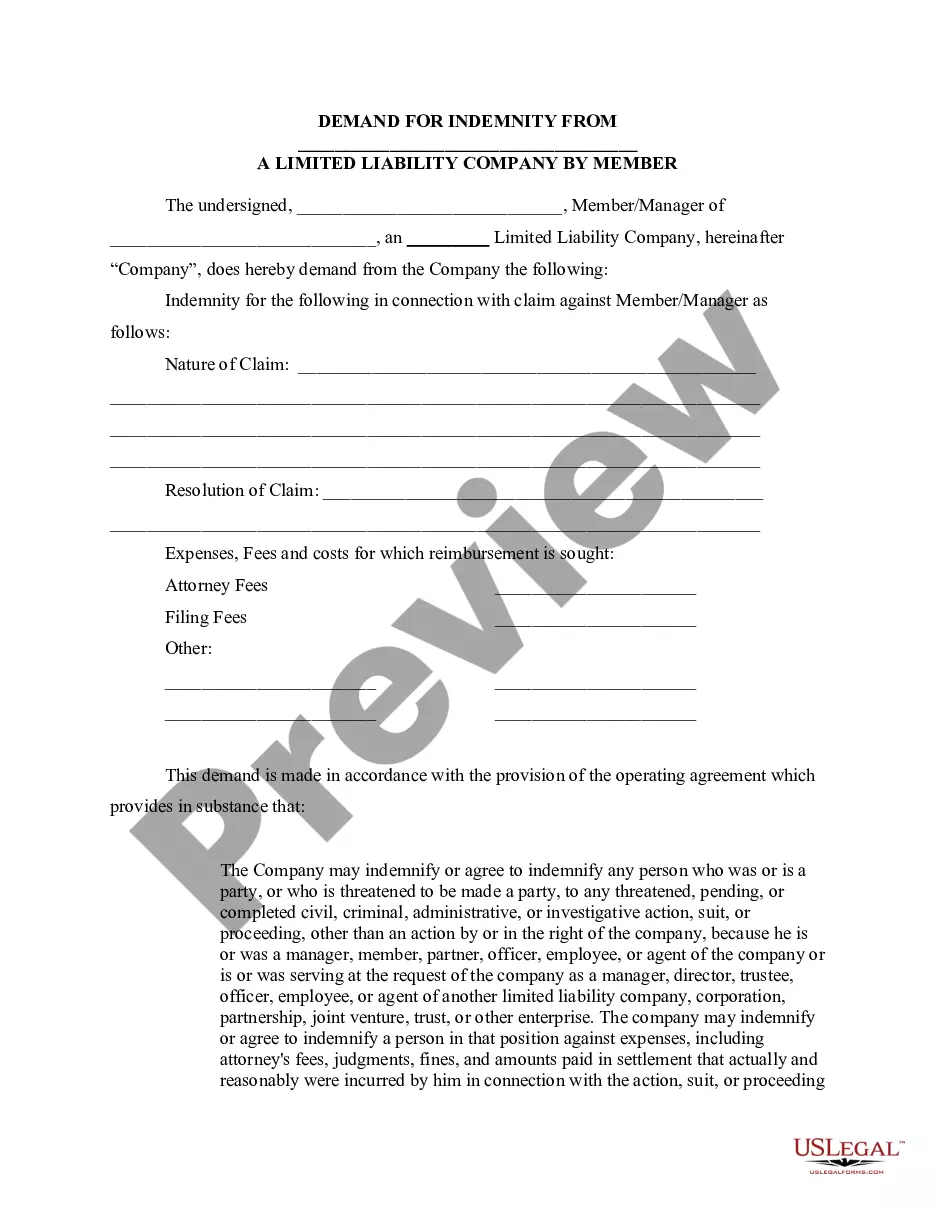

- Utilize the Review button to analyze the form.

- Read the explanation to ensure that you have chosen the right develop.

- When the develop is not what you`re trying to find, make use of the Lookup discipline to obtain the develop that meets your needs and requirements.

- Once you find the correct develop, click on Get now.

- Pick the costs strategy you desire, fill in the necessary information and facts to generate your account, and purchase the order making use of your PayPal or charge card.

- Decide on a hassle-free document formatting and obtain your copy.

Locate every one of the papers layouts you have bought in the My Forms food list. You can aquire a more copy of District of Columbia Letter to Shareholders whenever, if possible. Just go through the necessary develop to obtain or print the papers design.

Use US Legal Forms, probably the most substantial assortment of lawful types, to save time as well as avoid errors. The service provides appropriately made lawful papers layouts which can be used for a range of functions. Generate an account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

To apply for recognition of exemption from District of Columbia taxation, please visit MyTax.DC.gov. For questions, please contact OTR's Customer Service Administration at (202) 727-4TAX (4829).

You do not need to file a DC return if: You were not required to file a 2022 federal income tax return. You were not considered a resident of DC during 2022. You were an elected member of the US government who was not domiciled in DC.

FR-500 New Business Registration (new registrations only)

¶16-825, Other Taxes--Credit for Taxes Paid Another State ( Sec. 47-1806.04(a), D.C. Code ) To claim the credit, a resident must submit a copy of the income tax return required to be filed by the appropriate jurisdiction along with District Form D-40. Proof of payment, if requested, must also be provided.

If you have an out-of-state resale certificate but try to buy an item tax-free in Washington DC, your DC vendor will be unable to accept your out-of-state resale certificate. To receive a sales tax exemption on an item in DC, you must register for a sales tax permit there.

DC does not recognize the federal S corporation election and does not require a state-level S corporation election. You can still have an S corporation in DC. The S corporation will only be an S corporation for federal tax purposes and not for state tax purposes.

Section 47-1801.04(17) of the DC Official Code describes a statutory resident as any individual who maintains a place of abode within the District for an aggregate of 183 days or more during the taxable year, whether or not such individual is domiciled in the District.

D.C. franchise tax exemption occurs when a company is not required to pay franchise tax. This is a status given to certain businesses registered in Washington, D.C. Tax-exempt status is given to different types of businesses depending on what kinds of work or services they provide.