District of Columbia Proposed amendment to Bylaws regarding director and officer indemnification with copy of amendment

Description

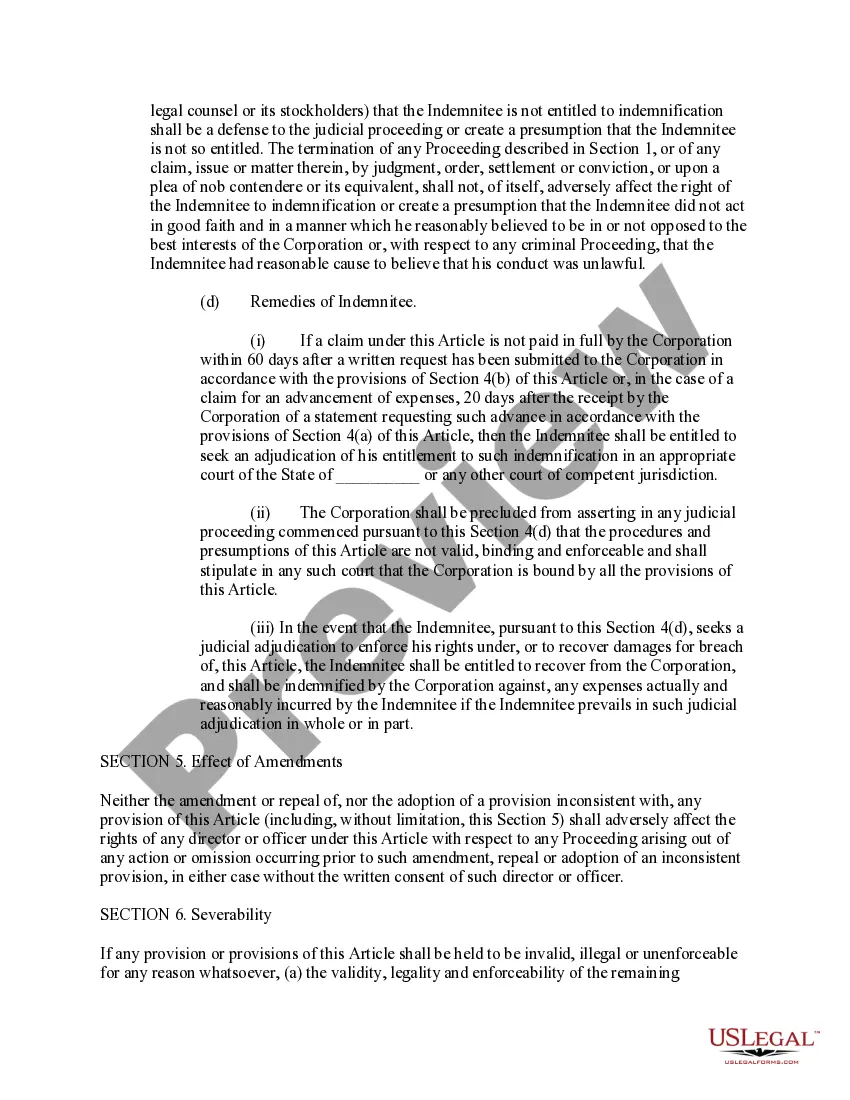

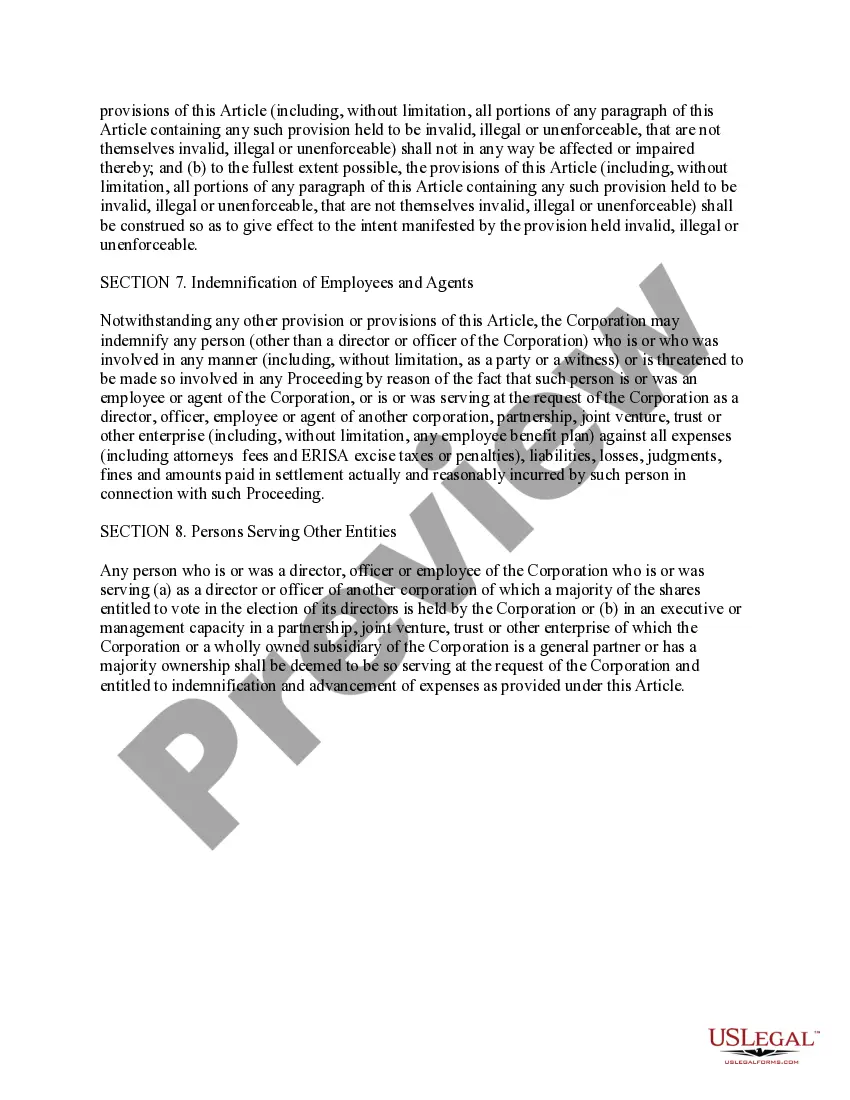

How to fill out Proposed Amendment To Bylaws Regarding Director And Officer Indemnification With Copy Of Amendment?

Are you currently in the place that you require files for either company or individual purposes just about every day? There are a variety of legitimate file layouts available online, but discovering ones you can depend on isn`t straightforward. US Legal Forms provides 1000s of form layouts, such as the District of Columbia Proposed amendment to Bylaws regarding director and officer indemnification with copy of amendment, which are written to meet state and federal requirements.

When you are presently familiar with US Legal Forms internet site and also have an account, basically log in. After that, it is possible to acquire the District of Columbia Proposed amendment to Bylaws regarding director and officer indemnification with copy of amendment template.

If you do not offer an bank account and wish to start using US Legal Forms, follow these steps:

- Discover the form you want and ensure it is for the correct area/county.

- Take advantage of the Review button to examine the shape.

- See the information to actually have selected the appropriate form.

- If the form isn`t what you`re searching for, use the Lookup discipline to find the form that meets your requirements and requirements.

- If you obtain the correct form, simply click Acquire now.

- Choose the prices strategy you need, submit the necessary information to produce your money, and pay for the transaction using your PayPal or Visa or Mastercard.

- Select a practical document file format and acquire your version.

Locate every one of the file layouts you might have purchased in the My Forms food selection. You can obtain a further version of District of Columbia Proposed amendment to Bylaws regarding director and officer indemnification with copy of amendment anytime, if needed. Just click on the needed form to acquire or printing the file template.

Use US Legal Forms, probably the most extensive collection of legitimate varieties, in order to save some time and steer clear of blunders. The services provides professionally manufactured legitimate file layouts that can be used for a selection of purposes. Make an account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

Shareholders invest in a corporation by buying its stock and receive economic benefits in return. Shareholders are not involved in the day-to-day management of business operations, but they have the right to elect representatives (directors) and to receive information material to investment and voting decisions.

A nonprofit corporation is an organization formed to serve the public good, such as for charitable, religious, educational, or other public service reasons, rather than purely for the creation of profit itself, as businesses aim to do.

Every business in D.C., including nonprofit organizations, must have a Basic Business License. You must first complete the prerequisites for the license, including registration with the Office of Tax and Revenue. You may submit your application online or submit a paper application.

The new statutes provide for email notifications, updated electronic meeting rules, and other changes to reflect current best practices in our sector. Most nonprofits don't have to do anything at all. The new law helps to set defaults and standards that many nonprofits have already put in place.

General Information. A Not-for-Profit Corporation is a special type of corporation where there are no owners. A Not-for-Profit gives no income, except salaries/ expenses, to members, directors, or officers. This corporation provides for personal liability protection.

The D.C. Nonprofit Corporation Act of 2010 (the ?Nonprofit Code?) overhauled laws regarding the formation and operation of nonprofits organized under D.C. law. It was the first substantial change to the D.C. Nonprofit Code since 1962. The new law became effective January 1, 2012.