District of Columbia Incentive Stock Plan of Chaparral Resources, Inc.

Description

How to fill out Incentive Stock Plan Of Chaparral Resources, Inc.?

Are you in a place that you will need paperwork for either organization or specific functions just about every time? There are a lot of legitimate record themes available on the Internet, but finding versions you can depend on isn`t straightforward. US Legal Forms offers thousands of kind themes, much like the District of Columbia Incentive Stock Plan of Chaparral Resources, Inc., that are composed in order to meet federal and state demands.

In case you are currently acquainted with US Legal Forms internet site and have your account, just log in. After that, you may obtain the District of Columbia Incentive Stock Plan of Chaparral Resources, Inc. design.

If you do not have an account and would like to begin using US Legal Forms, follow these steps:

- Obtain the kind you want and make sure it is for your correct town/area.

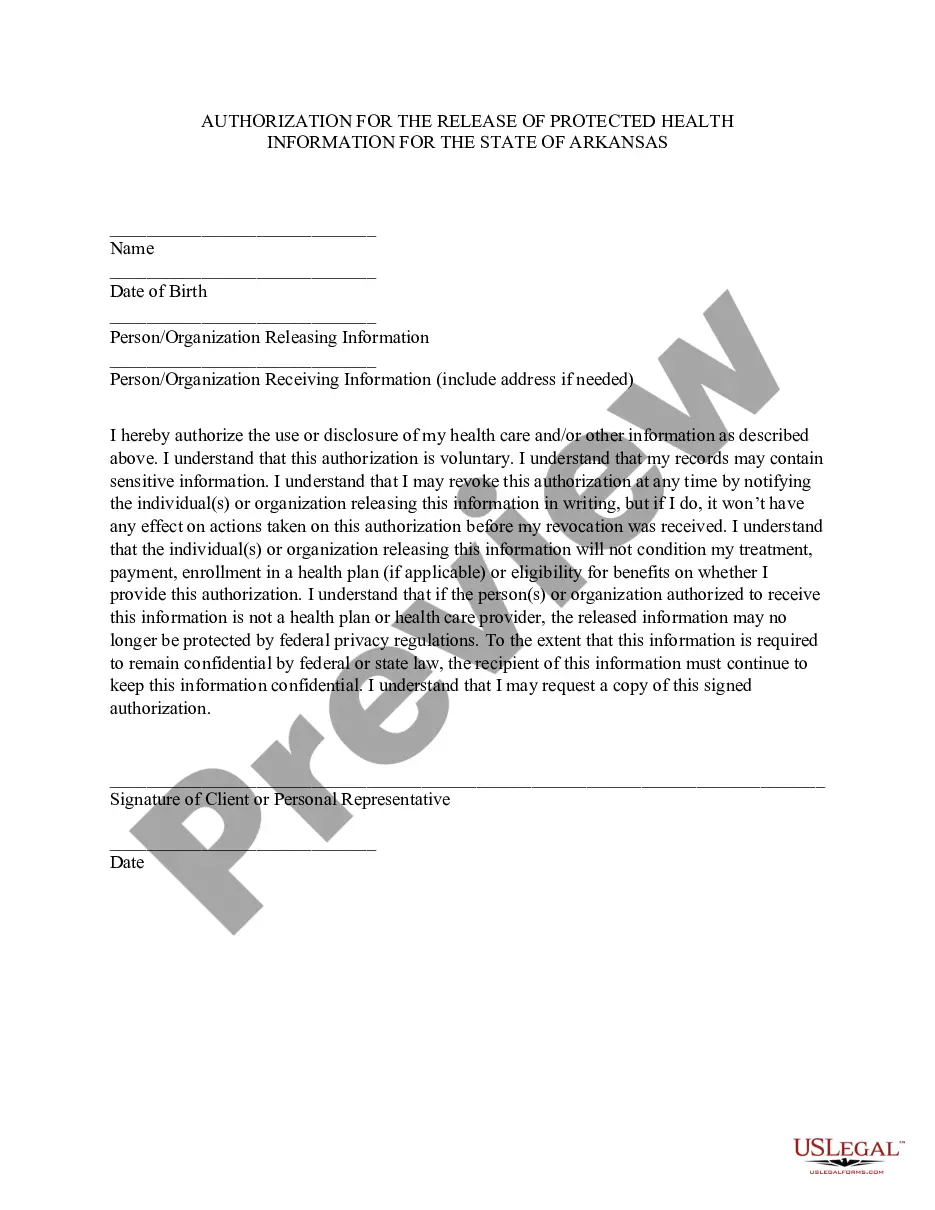

- Utilize the Preview option to check the shape.

- Read the outline to actually have selected the right kind.

- In the event the kind isn`t what you`re seeking, take advantage of the Search field to discover the kind that suits you and demands.

- Once you find the correct kind, simply click Purchase now.

- Choose the costs plan you desire, fill out the necessary information and facts to make your account, and pay for the transaction with your PayPal or charge card.

- Pick a hassle-free paper formatting and obtain your version.

Get each of the record themes you possess bought in the My Forms menu. You can obtain a additional version of District of Columbia Incentive Stock Plan of Chaparral Resources, Inc. anytime, if necessary. Just go through the necessary kind to obtain or produce the record design.

Use US Legal Forms, by far the most comprehensive selection of legitimate kinds, to save lots of efforts and prevent faults. The assistance offers expertly created legitimate record themes which you can use for an array of functions. Create your account on US Legal Forms and initiate generating your lifestyle a little easier.