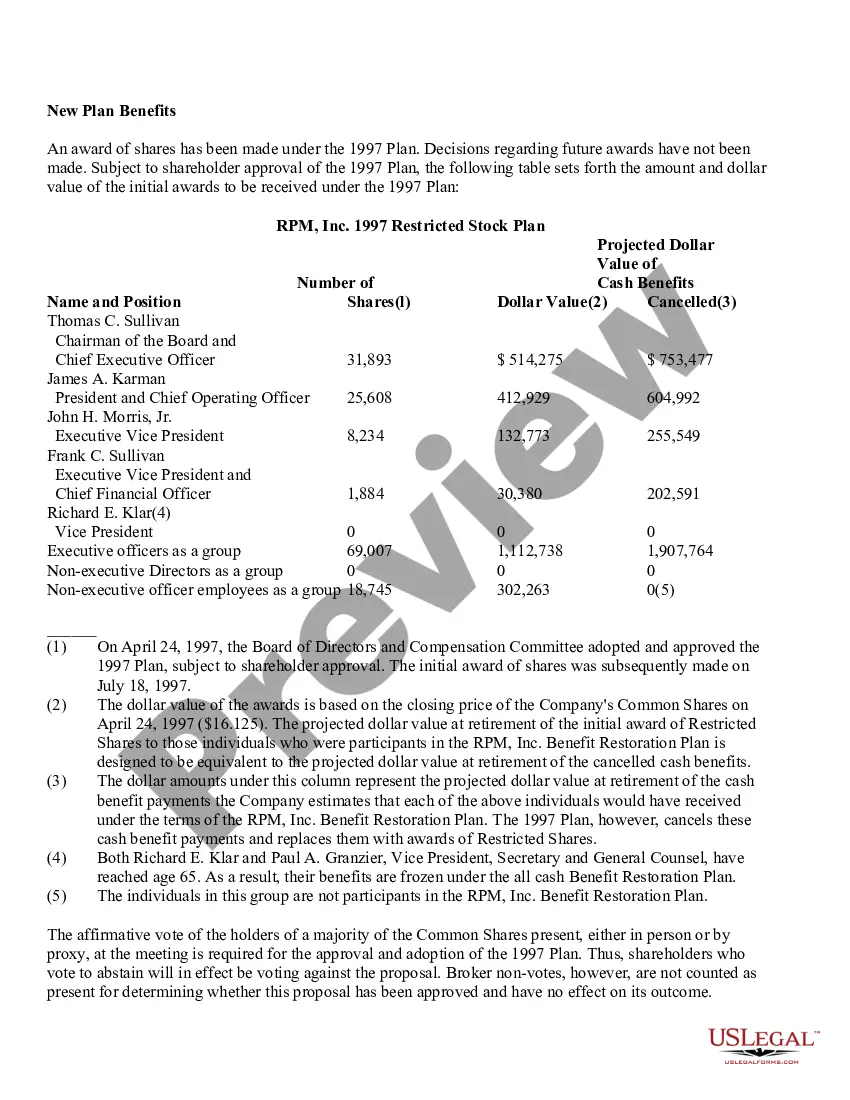

The District of Columbia Adoption of Restricted Stock Plan refers to the implementation of a specific type of employee benefit plan by RPM, Inc. in the District of Columbia jurisdiction. This adoption allows RPM, Inc. to offer restricted stock to its employees as a form of compensation and incentive. The District of Columbia Adoption of Restricted Stock Plan of RPM, Inc. is designed to retain, motivate, and reward employees by granting them restricted stock units or shares. These restricted stock units represent a form of ownership in the company, subject to certain restrictions and conditions. Under this plan, eligible employees of RPM, Inc. may be granted restricted stock as part of their overall compensation package. The specific terms and conditions of the restricted stock, including the vesting schedule, may vary depending on the company's policies and goals. The adoption of the District of Columbia Adoption of Restricted Stock Plan allows RPM, Inc. to align the interests of its employees with those of the company's shareholders. By granting employees a stake in the company's success, RPM, Inc. promotes increased engagement, loyalty, and commitment to achieving long-term business objectives. Different types of District of Columbia Adoption of Restricted Stock Plans may exist within RPM, Inc., depending on factors such as job positions, seniority, or performance metrics. For example, there may be a Senior Executive Restricted Stock Plan, designed specifically for high-level executives, and a General Employee Restricted Stock Plan, applicable to employees at various levels within the organization. The District of Columbia Adoption of Restricted Stock Plan ensures compliance with applicable laws, regulations, and tax requirements in the District of Columbia jurisdiction. RPM, Inc. must adhere to the specific guidelines and reporting obligations mandated by the District of Columbia's securities and labor laws when implementing and managing this adoption. In summary, the District of Columbia Adoption of Restricted Stock Plan of RPM, Inc. allows the company to offer restricted stock units or shares to eligible employees in order to incentivize and reward their contributions to the company's success. This adoption aligns employee interests with those of RPM, Inc., fostering a more engaged and motivated workforce. Various types of plans may exist within RPM, Inc., tailored to different employee groups or levels. Compliance with District of Columbia's legal and regulatory framework is a crucial aspect of implementing this adoption.

District of Columbia Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out District Of Columbia Adoption Of Restricted Stock Plan Of RPM, Inc.?

If you have to total, acquire, or print out authorized file web templates, use US Legal Forms, the greatest selection of authorized kinds, that can be found on-line. Make use of the site`s simple and practical lookup to find the files you need. Numerous web templates for company and personal uses are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to find the District of Columbia Adoption of Restricted Stock Plan of RPM, Inc. with a couple of mouse clicks.

If you are presently a US Legal Forms customer, log in in your bank account and click on the Download key to get the District of Columbia Adoption of Restricted Stock Plan of RPM, Inc.. You can even access kinds you formerly delivered electronically in the My Forms tab of the bank account.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have selected the form to the correct area/region.

- Step 2. Take advantage of the Review solution to look over the form`s content. Never forget about to read the description.

- Step 3. If you are unsatisfied with the form, make use of the Research field at the top of the display to get other variations from the authorized form design.

- Step 4. After you have discovered the form you need, click the Buy now key. Choose the costs plan you like and include your references to sign up for an bank account.

- Step 5. Approach the deal. You can utilize your credit card or PayPal bank account to perform the deal.

- Step 6. Choose the formatting from the authorized form and acquire it on your own system.

- Step 7. Full, revise and print out or sign the District of Columbia Adoption of Restricted Stock Plan of RPM, Inc..

Each and every authorized file design you acquire is your own property for a long time. You may have acces to each and every form you delivered electronically with your acccount. Click the My Forms segment and select a form to print out or acquire again.

Compete and acquire, and print out the District of Columbia Adoption of Restricted Stock Plan of RPM, Inc. with US Legal Forms. There are many skilled and status-distinct kinds you can utilize to your company or personal requires.