The District of Columbia Stock Option Plan is a comprehensive program that allows companies to grant various types of stock options and stock appreciation rights to their employees. This plan is designed to incentivize and reward employees by providing them with the opportunity to acquire company stock, aligning their interests with the company's success. The plan encompasses three types of stock options: Incentive Stock Options (SOS), Nonqualified Stock Options (SOS), and Stock Appreciation Rights (SARS). Each of these options offers different benefits and features to the employees participating in the plan. Incentive Stock Options (SOS) are a type of stock option that provides special tax advantages to employees. They are typically granted to key employees and are subject to certain rules outlined by the Internal Revenue Code. SOS allow employees to purchase company stock at a predetermined price, known as the exercise price or strike price, within a specified period of time. If the employee holds the SOS for at least two years after the grant date and one year after exercising them, any potential gains on the stock are taxed at the favorable capital gains tax rate upon sale. Nonqualified Stock Options (SOS) are another type of stock option that is not subject to the same tax advantages as SOS. SOS are granted to a broader group of employees, including consultants and non-executive employees. These options allow employees to purchase company stock at the exercise price, similar to SOS, but they do not have to meet specific holding periods to receive favorable tax treatment. Any gains from SOS are taxed as ordinary income in the year of exercise. Stock Appreciation Rights (SARS) offer employees the opportunity to benefit from the increase in the company's stock price without actually purchasing the stock. SARS are granted at a specific base price, and when exercised, the employee receives the appreciation in value as either cash or additional company stock. Unlike stock options, SARS do not require the employee to pay an exercise price upfront. The District of Columbia Stock Option Plan provides flexibility for companies to choose the types of stock options and stock appreciation rights that best suit their business needs. By offering these diverse options, companies can tailor their incentive programs to attract and retain top talent while aligning employee interests with the company's long-term success.

District of Columbia Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out District Of Columbia Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

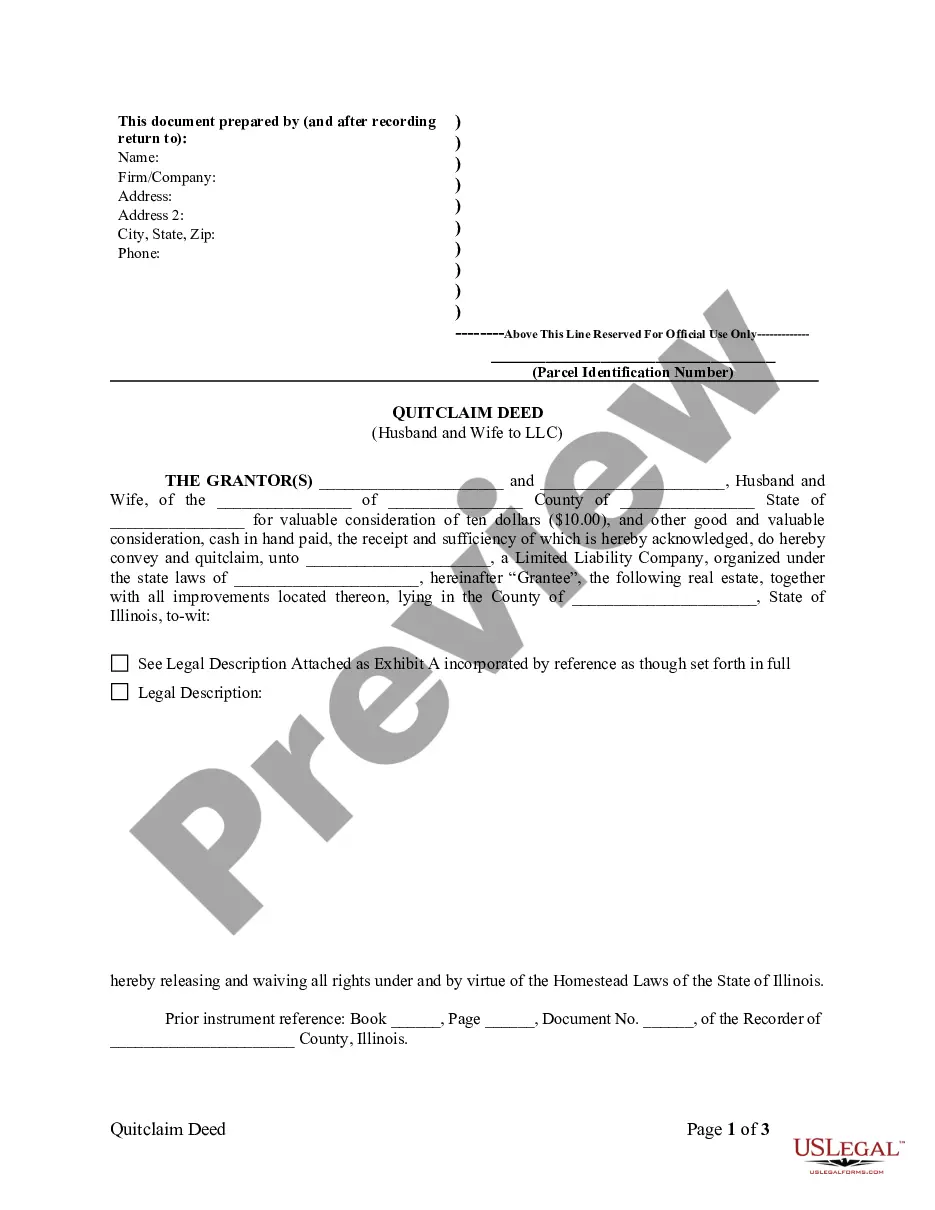

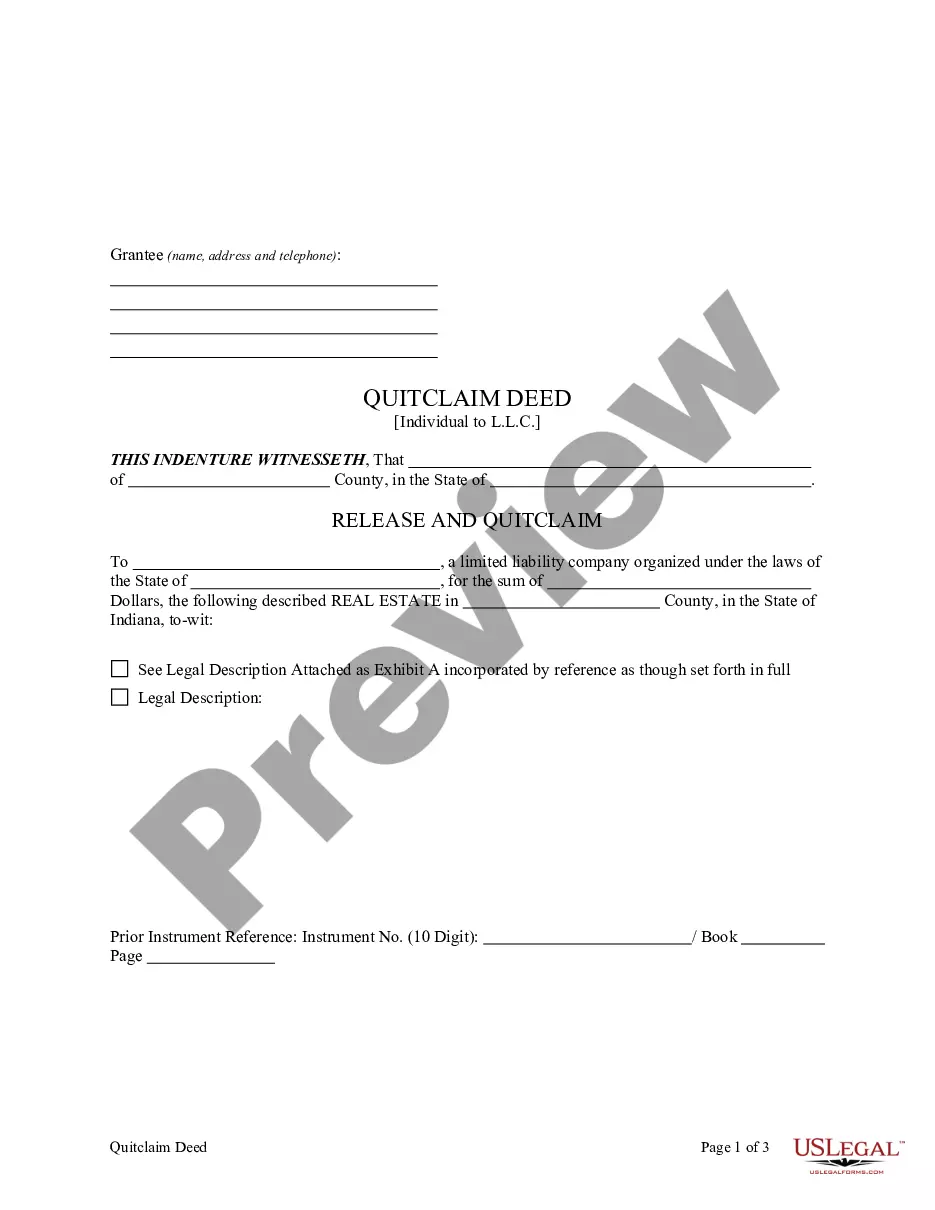

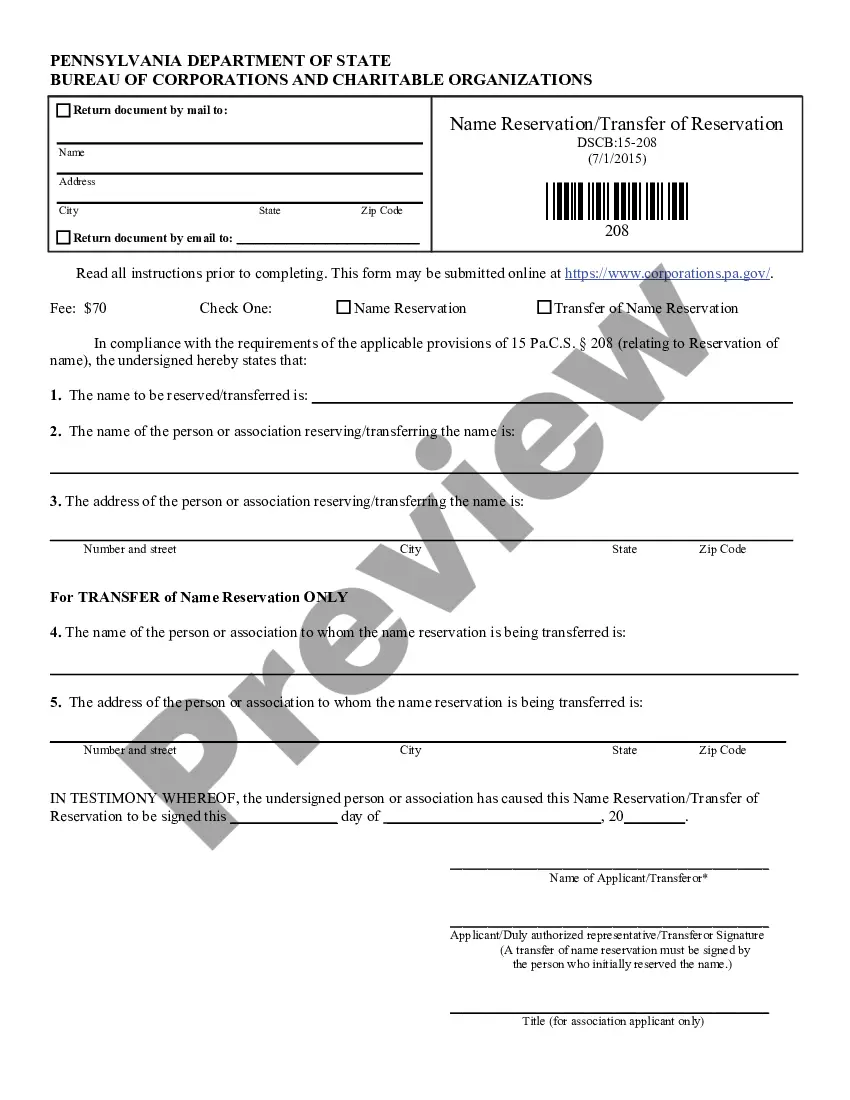

You may commit time on the Internet trying to find the lawful document design that meets the federal and state needs you will need. US Legal Forms offers a large number of lawful forms that happen to be reviewed by professionals. You can easily down load or print the District of Columbia Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights from your services.

If you have a US Legal Forms account, you are able to log in and click on the Down load button. Afterward, you are able to complete, modify, print, or indicator the District of Columbia Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights. Every single lawful document design you get is your own property permanently. To get yet another version of the acquired develop, check out the My Forms tab and click on the related button.

Should you use the US Legal Forms site initially, stick to the straightforward instructions under:

- First, be sure that you have chosen the correct document design for the area/area of your choosing. Look at the develop outline to ensure you have picked the correct develop. If readily available, take advantage of the Review button to search through the document design also.

- If you want to get yet another variation of your develop, take advantage of the Search field to find the design that suits you and needs.

- After you have discovered the design you want, just click Get now to continue.

- Select the costs strategy you want, type your qualifications, and register for an account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal account to pay for the lawful develop.

- Select the format of your document and down load it to the system.

- Make changes to the document if required. You may complete, modify and indicator and print District of Columbia Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

Down load and print a large number of document templates while using US Legal Forms web site, which offers the greatest collection of lawful forms. Use specialist and express-distinct templates to handle your company or person needs.