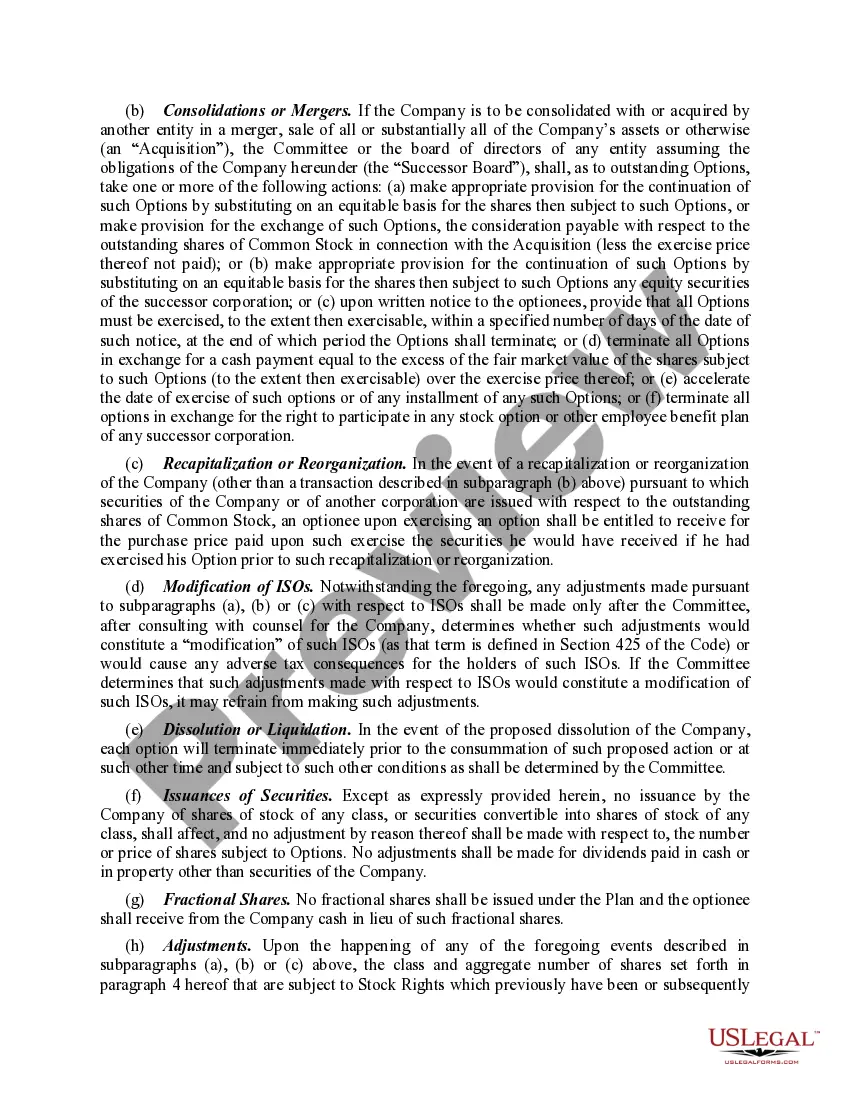

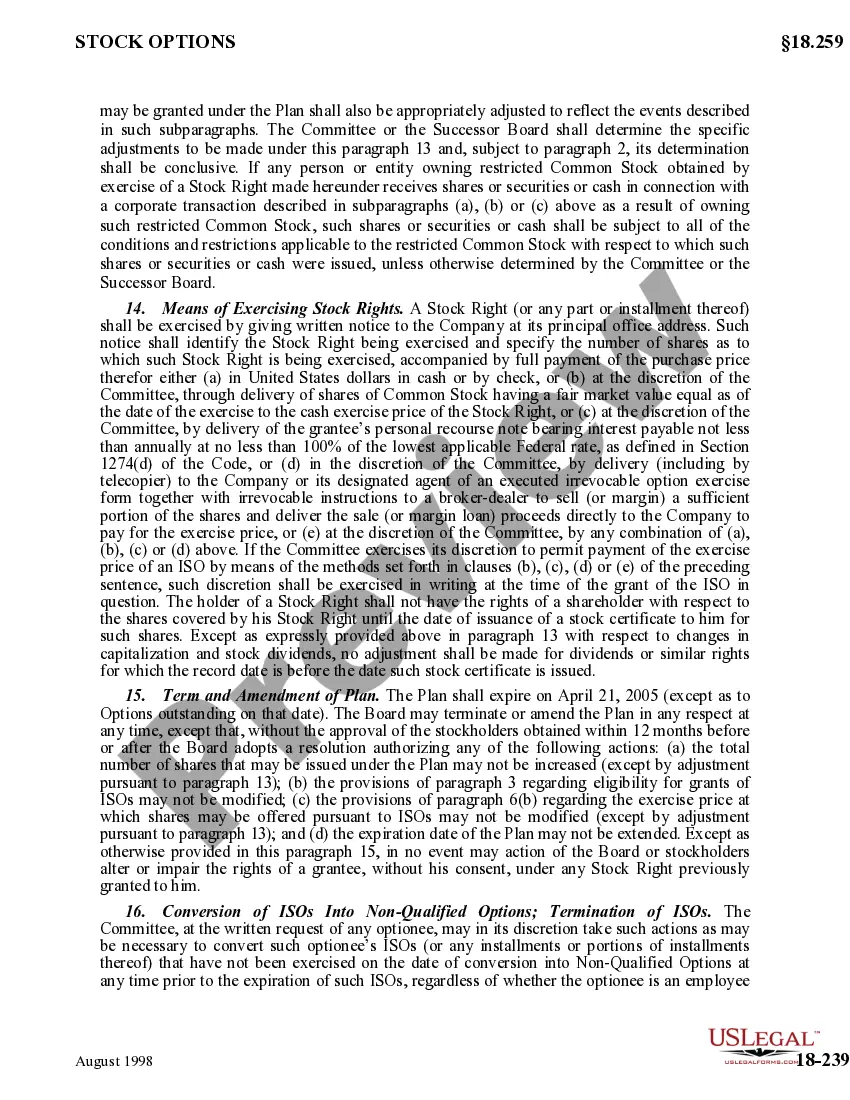

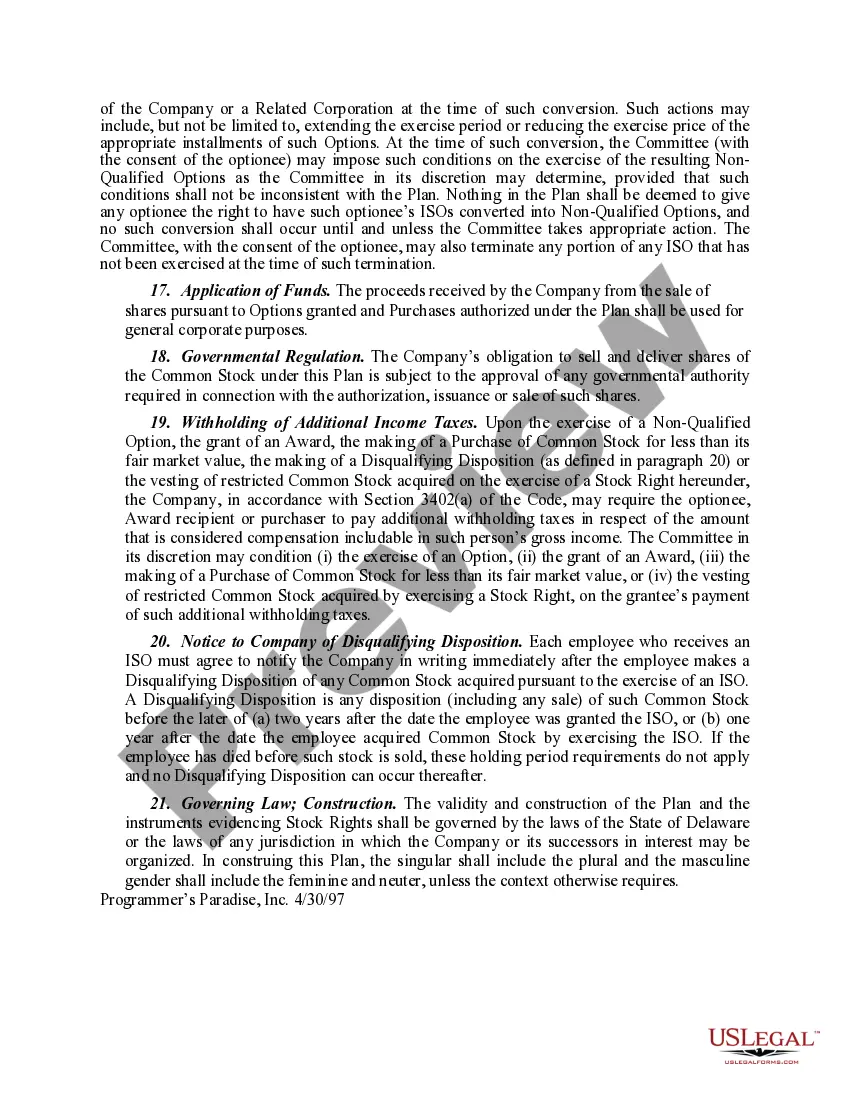

District of Columbia Stock Plan of Programmer's Paradise, Inc.

Description

How to fill out Stock Plan Of Programmer's Paradise, Inc.?

Are you in the situation the place you need paperwork for possibly organization or person reasons just about every day? There are a lot of lawful file web templates available on the net, but getting versions you can rely on is not easy. US Legal Forms provides a huge number of kind web templates, such as the District of Columbia Stock Plan of Programmer's Paradise, Inc., that are composed to satisfy federal and state requirements.

When you are previously knowledgeable about US Legal Forms web site and also have an account, just log in. After that, it is possible to acquire the District of Columbia Stock Plan of Programmer's Paradise, Inc. format.

Unless you provide an bank account and need to begin using US Legal Forms, adopt these measures:

- Get the kind you want and make sure it is for your appropriate area/region.

- Utilize the Preview switch to analyze the form.

- Browse the description to ensure that you have chosen the proper kind.

- When the kind is not what you`re looking for, make use of the Search field to obtain the kind that suits you and requirements.

- If you get the appropriate kind, just click Purchase now.

- Pick the costs program you want, submit the specified information and facts to create your money, and pay money for your order using your PayPal or bank card.

- Select a convenient document format and acquire your backup.

Locate all of the file web templates you have bought in the My Forms menus. You can aquire a more backup of District of Columbia Stock Plan of Programmer's Paradise, Inc. any time, if necessary. Just select the required kind to acquire or produce the file format.

Use US Legal Forms, one of the most considerable variety of lawful forms, to conserve efforts and avoid mistakes. The service provides expertly manufactured lawful file web templates which you can use for a selection of reasons. Create an account on US Legal Forms and initiate producing your way of life easier.