The District of Columbia Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation is a financial benefit provided to individuals who hold non-exercisable stock options in a company that undergoes a merger or consolidation. This award is specific to the District of Columbia and is designed to compensate stock option holders for the potential loss of their options due to the merger or consolidation. This cash award serves as a form of recognition for the investment and loyalty of stock option holders, ensuring they receive a financial benefit even if their options cannot be exercised post-merger. It aims to provide some level of compensation for the potential dilution or loss in value of their stock options resulting from the corporate restructuring. In the District of Columbia, there are two primary types of cash awards paid to holders of non-exercisable stock options upon merger or consolidation: 1. Merger Cash Award: This type of cash award is granted to stock option holders when their company merges with another entity. The award amount is typically determined based on various factors such as the number of non-exercisable stock options held, the market value of the options at the time of the merger, and the terms specified in the merger agreement. 2. Consolidation Cash Award: This cash award is provided to stock option holders when their company participates in a consolidation process. In a consolidation, multiple companies merge together to form a new entity. Like the merger cash award, the consolidation cash award is determined based on factors such as the number of non-exercisable stock options held and the terms specified in the consolidation agreement. Both types of cash awards aim to mitigate the potential negative impact on stock option holders caused by the merger or consolidation process. By providing a monetary benefit, these awards acknowledge the contributions and efforts of stock option holders while safeguarding their financial interests. It is important to note that the specific details and eligibility criteria for receiving the District of Columbia Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation may vary depending on the company, the terms of the merger or consolidation, and applicable regulations in the District of Columbia. Therefore, it is advisable to consult legal or financial professionals to obtain accurate and up-to-date information regarding this cash award program.

District of Columbia Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

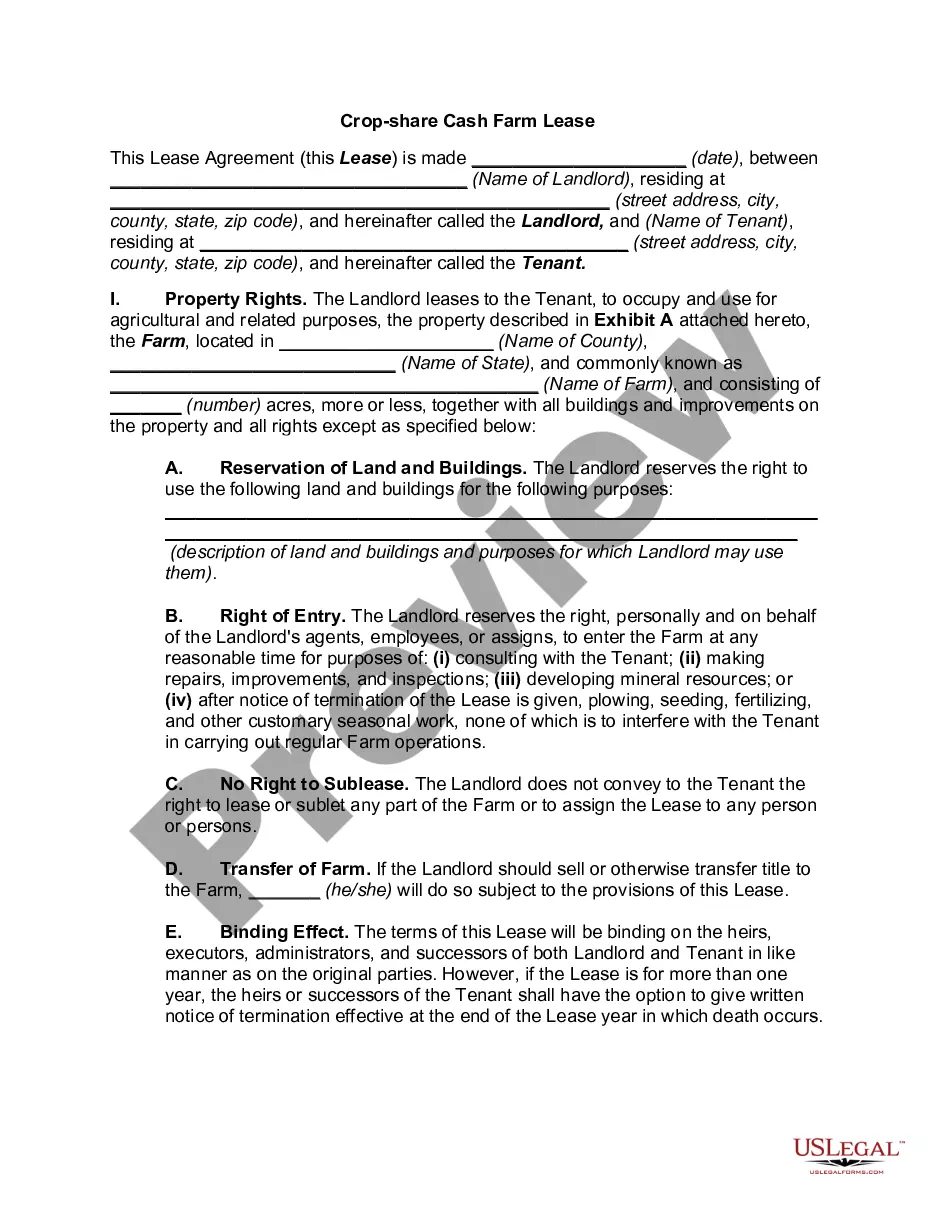

How to fill out District Of Columbia Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

You may invest time on the web trying to find the lawful record web template that meets the federal and state needs you need. US Legal Forms provides 1000s of lawful varieties that are reviewed by pros. You can easily acquire or printing the District of Columbia Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation from our support.

If you already possess a US Legal Forms accounts, you are able to log in and click on the Obtain option. After that, you are able to full, revise, printing, or sign the District of Columbia Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation. Every single lawful record web template you get is yours permanently. To obtain another copy associated with a bought kind, go to the My Forms tab and click on the related option.

If you use the US Legal Forms website the very first time, stick to the simple directions under:

- First, make certain you have selected the best record web template for your county/city of your liking. See the kind explanation to make sure you have picked the proper kind. If readily available, make use of the Review option to look with the record web template at the same time.

- If you wish to get another version of your kind, make use of the Lookup area to find the web template that meets your needs and needs.

- After you have found the web template you need, click on Get now to move forward.

- Select the costs plan you need, type your qualifications, and register for a merchant account on US Legal Forms.

- Total the deal. You may use your charge card or PayPal accounts to purchase the lawful kind.

- Select the formatting of your record and acquire it for your device.

- Make modifications for your record if required. You may full, revise and sign and printing District of Columbia Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation.

Obtain and printing 1000s of record layouts utilizing the US Legal Forms site, that provides the greatest selection of lawful varieties. Use skilled and express-distinct layouts to handle your company or personal requires.