District of Columbia Approval of employee stock purchase plan for The American Annuity Group, Inc.

Description

How to fill out Approval Of Employee Stock Purchase Plan For The American Annuity Group, Inc.?

Are you presently in a situation the place you need papers for possibly company or personal functions virtually every time? There are a lot of legal file web templates accessible on the Internet, but getting versions you can rely on isn`t straightforward. US Legal Forms provides a large number of type web templates, just like the District of Columbia Approval of employee stock purchase plan for The American Annuity Group, Inc., which can be created to meet federal and state demands.

When you are currently acquainted with US Legal Forms website and possess your account, just log in. Next, you may download the District of Columbia Approval of employee stock purchase plan for The American Annuity Group, Inc. format.

Unless you have an bank account and wish to start using US Legal Forms, adopt these measures:

- Discover the type you will need and make sure it is for the correct city/state.

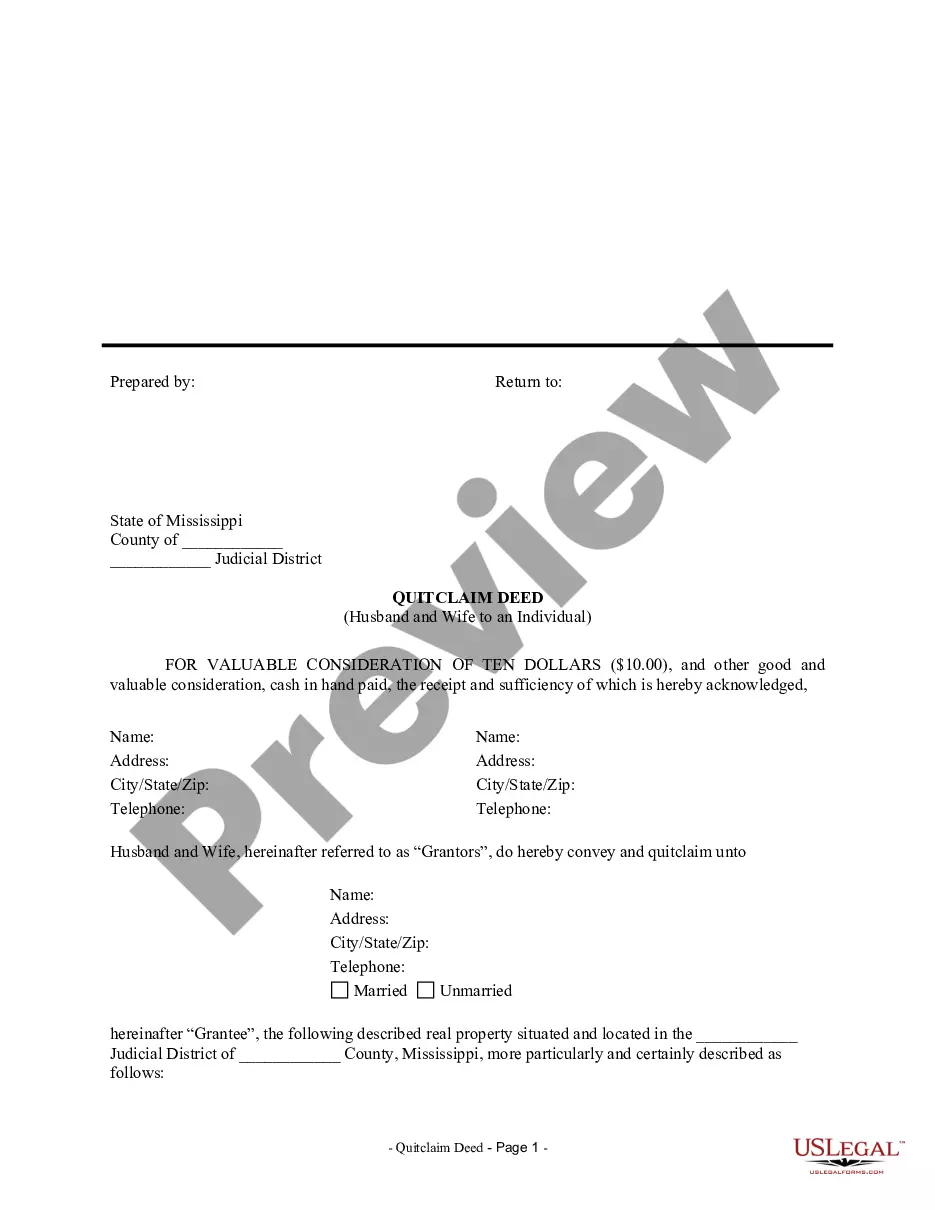

- Use the Review button to analyze the form.

- Read the description to actually have selected the appropriate type.

- In the event the type isn`t what you`re searching for, take advantage of the Lookup area to obtain the type that fits your needs and demands.

- If you find the correct type, click Buy now.

- Select the rates program you desire, fill out the required information and facts to produce your money, and purchase the order utilizing your PayPal or Visa or Mastercard.

- Pick a hassle-free file format and download your version.

Locate all the file web templates you may have purchased in the My Forms menus. You can obtain a more version of District of Columbia Approval of employee stock purchase plan for The American Annuity Group, Inc. whenever, if required. Just select the needed type to download or printing the file format.

Use US Legal Forms, by far the most substantial selection of legal kinds, to save time and steer clear of blunders. The support provides professionally made legal file web templates that you can use for an array of functions. Produce your account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

While the ESOP and the 401k are both qualified retirement plans, the 401k is funded by the employee and sometimes matched by the employer, whereas ESOPs are funded exclusively with contributions of company stock. This unique difference is what makes ESOPs a great option for employees.

Employee Stock Purchase Plans (ESPPs) are widely regarded as one of the most simple and straightforward equity compensation strategies available to businesses today. There are two major types of ESPP: 1) Qualified ESPP offering tax advantages and 2) Non-qualified ESPP offering flexibility.

How does a withdrawal work in an ESPP? With most employee stock purchase plans, you can withdraw from your plan at any time before the purchase. Withdrawals are made on Fidelity.com or through a representative. However, you should refer to your plan documents to determine your plan's rules governing withdrawals.

A 401(k) account is part of many employer-sponsored retirement plans. They offer immediate tax savings and, sometimes, employer matching of contributions. They also have notable restrictions. Investing in individual stocks offers no comparable tax benefits or employer matches.

If you have savings and 401(k).. If you have no debt and you're contributing up to the company match in your 401(k) PLUS saving money, you should definitely max out the amount you can contribute to your ESPP.

Stocks are riskier investments than 401(k) accounts or low-risk mutual funds. This means you could lose your entire investment if the stock market crashes. Time commitment You need to be willing to spend time monitoring your portfolio to make sure it stays on track.

The ESOP vs 401K Plan With a 401(k), the employer's contributions are tax-deferred, meaning that the money is taken out of each paycheck before taxes, and those wages are not taxed until withdrawal. Whereas with an ESOP, employees also do not pay taxes on the shares in their account until distribution.

THE INTERPUBLIC GROUP OF COMPANIES, INC. The purpose of the Plan is to provide employees an opportunity to purchase shares of IPG stock through offerings to be made from time to time during the ten-year period commencing January 1, 2016. 10,000,000 shares in the aggregate were reserved for this purpose.